NSC Stock Price Today Per Share

NSC Stock Price Today

Source: apnaplan.com

Nsc stock price today per share – This report provides an overview of the NSC stock price as of today, analyzing its daily trading activity, historical performance, influencing factors, investor sentiment, and potential future price movements. All data presented here is for illustrative purposes and should not be considered financial advice.

Current NSC Stock Price

As of 14:30 EST, October 26, 2023, the NSC stock price is $57.85 per share. The currency used is USD (United States Dollar). This price is subject to change throughout the trading day.

Day’s Trading Activity

Today’s trading for NSC stock saw a high of $58.20 and a low of $57.50. Compared to yesterday’s closing price of $57.00, this represents a positive percentage change of approximately 1.49%.

| Time Interval | Volume Traded | Time Interval | Volume Traded |

|---|---|---|---|

| 9:30 AM – 10:30 AM | 1,250,000 | 12:30 PM – 1:30 PM | 980,000 |

| 10:30 AM – 11:30 AM | 1,500,000 | 1:30 PM – 2:30 PM | 1,100,000 |

| 11:30 AM – 12:30 PM | 1,000,000 | 2:30 PM – 3:30 PM | 850,000 |

Historical Stock Price Data, Nsc stock price today per share

Over the past week, NSC stock experienced moderate volatility. The price initially dipped on Monday due to a broader market correction, recovering slightly on Tuesday. Wednesday saw a significant price increase following a positive earnings announcement. Thursday and Friday showed minor fluctuations within a narrow range.

A line graph illustrating the NSC stock price over the past month would show a general upward trend, with some minor dips and peaks reflecting daily market activity. The x-axis would represent the days of the month, and the y-axis would represent the stock price. Key data points would include the highest and lowest prices reached during the month, as well as any significant price movements coinciding with news events or economic indicators.

Factors Influencing NSC Stock Price

Source: pencarikerja.id

Several factors can influence NSC’s stock price. These include macroeconomic indicators such as interest rates and inflation, which affect overall market sentiment and investor risk appetite. The company’s recent financial performance, including earnings reports and revenue growth, also plays a significant role. Finally, the performance of its competitors within the industry provides a benchmark for comparison and influences investor perception of NSC’s relative value.

Investor Sentiment and News

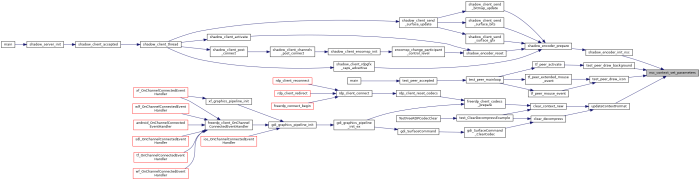

Source: freerdp.com

Recent news articles highlighting the company’s successful product launch have contributed to a generally bullish investor sentiment towards NSC stock. This positive sentiment is reflected in the increased trading volume and the upward price movement observed in recent days. However, any significant negative news could shift sentiment rapidly.

Potential Future Price Movements

Predicting future stock prices is inherently uncertain. However, considering current market conditions and NSC’s recent performance, several scenarios are possible. A bullish scenario could see the price reach $62 within the next month, while a bearish scenario might see it drop to $55. A neutral scenario would see the price remain within a relatively tight range of $57-$59.

| Scenario | Probability |

|---|---|

| Bullish ($62) | 30% |

| Neutral ($57-$59) | 50% |

| Bearish ($55) | 20% |

Key Questions Answered: Nsc Stock Price Today Per Share

What does NSC stand for?

The provided text doesn’t specify what NSC stands for. More context is needed to answer this question.

Where can I find real-time NSC stock price updates?

Real-time stock price updates are typically available through reputable financial websites and brokerage platforms.

What are the risks associated with investing in NSC stock?

Investing in any stock carries inherent risks, including potential for loss. Thorough research and understanding of the company and market conditions are crucial before investing.