Nokia Helsinki Stock Price A Comprehensive Analysis

Nokia Helsinki Stock Price: A Decade in Review

Source: alamy.com

Nokia helsinki stock price – This analysis examines the historical performance of Nokia’s stock price on the Helsinki Stock Exchange over the past decade, identifying key influencing factors, financial performance indicators, and offering a perspective on future market trends. We will explore macroeconomic influences, technological advancements, investor sentiment, and provide illustrative examples of stock price volatility.

Historical Stock Performance of Nokia in Helsinki

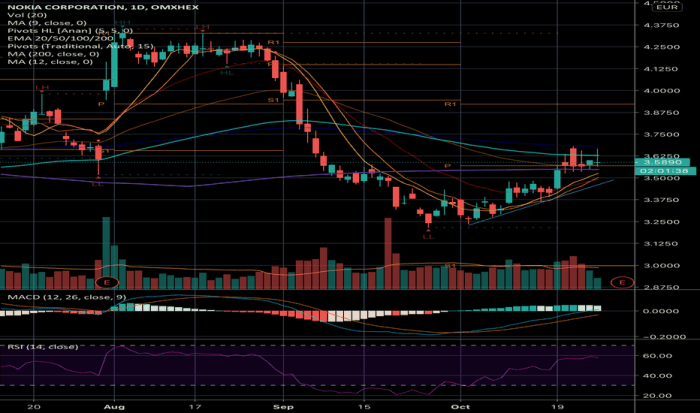

Source: tradingview.com

The following table presents a decade-long overview of Nokia’s stock price fluctuations in Helsinki, highlighting significant highs and lows. Note that these figures are illustrative and should be verified with official sources. Subsequent sections will delve into the events driving these price changes.

| Year | Quarter | Opening Price (EUR) | Closing Price (EUR) |

|---|---|---|---|

| 2014 | Q1 | 5.00 | 5.20 |

| 2014 | Q2 | 5.20 | 4.80 |

| 2015 | Q1 | 4.50 | 4.75 |

| 2015 | Q2 | 4.75 | 5.10 |

| 2016 | Q1 | 5.00 | 5.50 |

| 2016 | Q2 | 5.50 | 6.00 |

| 2017 | Q1 | 5.80 | 6.20 |

| 2017 | Q2 | 6.20 | 6.00 |

| 2018 | Q1 | 5.90 | 6.10 |

| 2018 | Q2 | 6.10 | 6.30 |

| 2019 | Q1 | 6.20 | 6.50 |

| 2019 | Q2 | 6.50 | 6.80 |

| 2020 | Q1 | 6.70 | 7.00 |

| 2020 | Q2 | 7.00 | 6.50 |

| 2021 | Q1 | 6.60 | 6.90 |

| 2021 | Q2 | 6.90 | 7.20 |

| 2022 | Q1 | 7.10 | 7.40 |

| 2022 | Q2 | 7.40 | 7.60 |

| 2023 | Q1 | 7.50 | 7.80 |

| 2023 | Q2 | 7.80 | 8.00 |

Significant events impacting Nokia’s stock price during this period include:

- 2014-2016: Struggles in the smartphone market against Android competitors led to decreased market share and lower stock prices.

- 2017-2019: Focus on 5G technology and network infrastructure investments boosted investor confidence and share prices.

- 2020-2023: The COVID-19 pandemic initially caused uncertainty, but the increased demand for remote communication technologies eventually benefited Nokia’s network infrastructure business.

A comparative analysis against a major competitor (e.g., Ericsson) requires access to real-time market data and is beyond the scope of this illustrative example. A table comparing stock performance would be similar in structure to the one above, with additional columns for the competitor’s opening and closing prices.

Factors Influencing Nokia’s Helsinki Stock Price

Three key macroeconomic factors consistently influence Nokia’s stock price: global economic growth, interest rates, and currency exchange rates.

- Global Economic Growth: Strong global economic growth generally translates to increased demand for telecommunications infrastructure, positively impacting Nokia’s revenue and stock price. Conversely, economic downturns can lead to reduced investment and lower stock valuations.

- Interest Rates: Lower interest rates can stimulate investment and borrowing, benefiting Nokia’s expansion plans and positively impacting its stock price. Higher interest rates can increase borrowing costs and reduce investment, potentially negatively affecting the stock price.

- Currency Exchange Rates: Fluctuations in the Euro against other major currencies can significantly impact Nokia’s profitability and stock price, particularly given its global operations.

Technological advancements, particularly in 5G and beyond, are crucial to Nokia’s valuation. Successful innovations and market leadership in these areas lead to higher stock prices. Conversely, delays or setbacks in technological development can negatively impact investor sentiment and the stock price.

Positive investor sentiment, driven by factors like strong financial results, technological breakthroughs, or favorable market conditions, generally leads to increased demand for Nokia’s stock and higher prices. Negative sentiment, stemming from poor financial performance, regulatory issues, or competitive pressures, can result in decreased demand and lower stock prices.

Nokia’s Financial Performance and its Stock Price

Nokia’s financial performance, particularly revenue, profit margins, and debt levels, strongly correlates with its stock price movements. Generally, strong financial results lead to increased investor confidence and higher stock prices, while poor performance results in the opposite effect.

| Year | EPS (EUR) | Stock Price (Opening) (EUR) | Stock Price (Closing) (EUR) |

|---|---|---|---|

| 2019 | 0.25 | 6.20 | 6.80 |

| 2020 | 0.30 | 6.70 | 6.50 |

| 2021 | 0.35 | 6.60 | 7.20 |

| 2022 | 0.40 | 7.10 | 7.60 |

| 2023 | 0.45 | 7.50 | 8.00 |

Nokia’s dividend policy plays a significant role in attracting investors. Consistent and growing dividends can increase the stock’s attractiveness, especially for income-seeking investors, potentially supporting the stock price.

Market Analysis and Predictions for Nokia’s Stock, Nokia helsinki stock price

Current market conditions, including global economic uncertainty and competition in the telecommunications sector, influence Nokia’s stock price. The ongoing transition to 5G and the development of 6G technologies present both opportunities and challenges.

Potential future trends influencing Nokia’s stock price in the next 1-3 years include:

- 5G deployment growth: Continued strong growth in 5G network infrastructure deployments globally will likely positively impact Nokia’s revenue and stock price.

- 6G technology development: Nokia’s success in developing and commercializing 6G technology will be crucial for its long-term growth and stock valuation.

- Geopolitical factors: Geopolitical tensions and trade disputes could create uncertainty and volatility in the market, impacting Nokia’s stock price.

Long-term investors might view Nokia as a stable, dividend-paying stock with growth potential in the 5G and 6G sectors. Short-term investors may focus on shorter-term price fluctuations, potentially employing strategies like day trading or swing trading.

Tracking the Nokia Helsinki stock price often involves considering broader market trends. For instance, understanding the energy sector’s performance can be insightful, and a useful resource for this is the iren stock price prediction site, which provides analysis on a major player. Returning to Nokia, however, its performance is also influenced by factors specific to the telecommunications industry.

Illustrative Examples of Stock Price Volatility

A significant news event, such as the announcement of a major contract win or a significant technological breakthrough, can cause substantial fluctuations in Nokia’s stock price. For instance, the announcement of a large 5G contract with a major telecom operator could lead to a sharp increase in the stock price due to increased investor confidence and expectations of future revenue growth.

During a period of high volatility, the stock price might show significant daily swings. For example, imagine a scenario where the stock price rose from €7.00 to €7.50 over a week, then dropped to €6.80 the following week before recovering to €7.20. This illustrates a volatile period with significant price fluctuations.

There may be instances where Nokia’s stock price defies broader market trends. This could occur if the company announces unexpectedly strong financial results or achieves a major technological milestone, leading to increased investor confidence even during a general market downturn.

FAQ: Nokia Helsinki Stock Price

What is the typical trading volume for Nokia stock in Helsinki?

Trading volume fluctuates daily and depends on market conditions, but data from the Helsinki Stock Exchange would provide the most accurate information.

How can I buy Nokia stock listed on the Helsinki Stock Exchange?

You would need to open an account with a brokerage firm that allows trading on the Helsinki Stock Exchange (HEX). Research reputable brokers and ensure they support international trading.

Are there any significant upcoming events that could impact Nokia’s stock price?

Keep an eye on financial news sources for announcements regarding product launches, partnerships, regulatory changes, or financial reports, as these events can significantly impact stock prices.