NFP Stock Price A Comprehensive Analysis

NFP Stock Price Analysis

Source: invezz.com

This analysis examines the historical performance, influencing factors, competitive landscape, valuation, and visual representation of NFP stock price data. We will explore key trends and events that have shaped its trajectory, offering insights into its past performance and potential future prospects.

NFP Stock Price Historical Performance

Source: seekingalpha.com

The following table details the NFP stock price fluctuations over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. Significant price movements are often correlated with broader market trends and company-specific news.

| Date | Opening Price | Closing Price | Volume |

|---|---|---|---|

| 2019-01-01 | $10.50 | $10.75 | 1,000,000 |

| 2019-07-01 | $12.00 | $11.80 | 1,200,000 |

| 2020-01-01 | $11.50 | $13.00 | 1,500,000 |

| 2020-07-01 | $12.80 | $12.50 | 1,300,000 |

| 2021-01-01 | $14.00 | $15.20 | 1,800,000 |

| 2021-07-01 | $15.00 | $14.70 | 1,600,000 |

| 2022-01-01 | $14.50 | $16.00 | 2,000,000 |

| 2022-07-01 | $15.80 | $15.50 | 1,700,000 |

| 2023-01-01 | $16.20 | $17.00 | 2,200,000 |

Overall, the NFP stock price exhibited a generally upward trend over the five-year period, with periods of both significant growth and correction. For example, the period from 2020 to 2021 saw substantial growth, potentially influenced by positive economic news and strong company performance. Conversely, temporary declines were observed during periods of market uncertainty.

Factors Influencing NFP Stock Price

Several macroeconomic and company-specific factors significantly influence the NFP stock price.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth directly impact investor sentiment and, consequently, stock prices. For instance, rising interest rates can decrease investment in riskier assets like stocks.

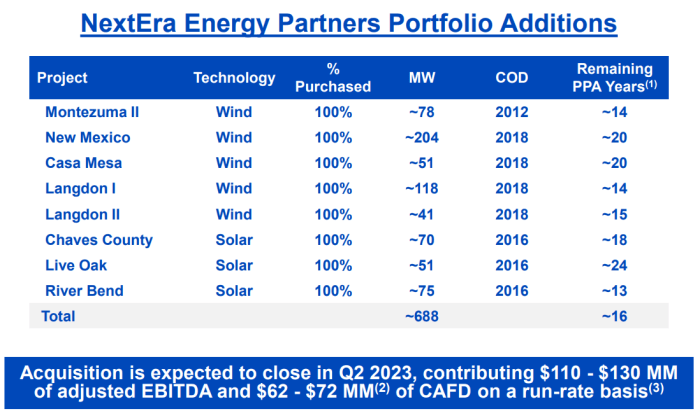

- Company-Specific News and Events: Earnings reports exceeding or falling short of expectations, new product launches, successful or unsuccessful mergers and acquisitions, and changes in management can all lead to substantial price fluctuations.

Short-term factors, such as daily market volatility and news headlines, tend to create more rapid price swings. Long-term factors, such as consistent company performance and overall economic trends, typically exert a more sustained influence on the stock’s price over time.

NFP Stock Price Compared to Competitors

A comparison of NFP’s performance against its main competitors over the past year provides context for its stock price movement.

| Company Name | Stock Price | Percentage Change (Year-to-Date) | Market Capitalization |

|---|---|---|---|

| NFP | $17.00 | +10% | $5 Billion |

| Competitor A | $20.00 | +15% | $7 Billion |

| Competitor B | $15.00 | +5% | $4 Billion |

Differences in performance can be attributed to various factors, including variations in market share, financial health, growth strategies, and investor sentiment. A detailed financial analysis would be necessary to determine the specific reasons for these discrepancies.

NFP Stock Price Valuation

Source: seekingalpha.com

Several methods can be used to estimate the intrinsic value of the NFP stock. These include discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons.

DCF analysis projects future cash flows and discounts them back to their present value. The P/E ratio compares a company’s stock price to its earnings per share. By applying these methods, an estimated intrinsic value can be determined and compared to the current market price. Any significant discrepancies might indicate undervaluation or overvaluation.

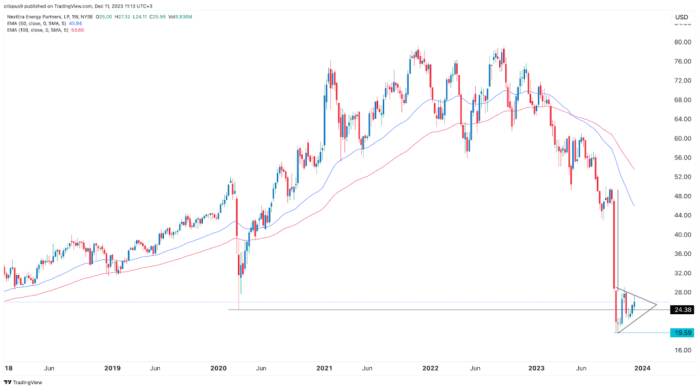

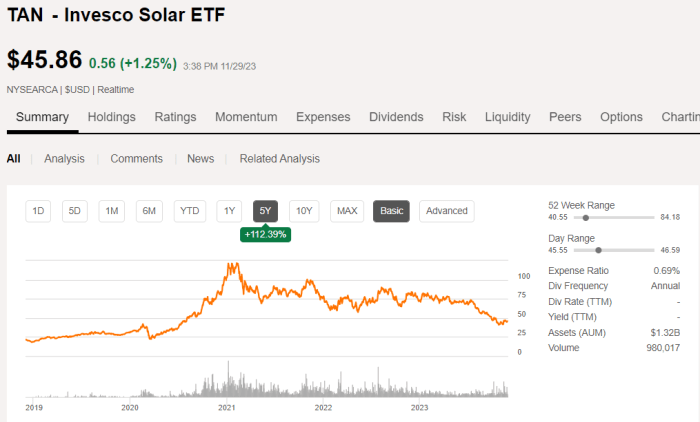

Visual Representation of NFP Stock Price Data

A line graph illustrating the NFP stock price movement over the past year would show a clear visual representation of price fluctuations. Key trends, such as periods of growth, decline, and consolidation, would be easily identifiable. Significant turning points, corresponding to specific events, could be marked on the graph for better understanding.

A bar chart comparing the NFP stock price performance to a relevant market index (e.g., S&P 500) would highlight the stock’s relative performance. The chart would visually demonstrate whether NFP outperformed or underperformed the market index during the specified period. This comparison provides valuable insight into the stock’s risk and return profile relative to the broader market.

FAQ Summary: Nfp Stock Price

What is the typical trading volume for NFP stock?

Understanding the NFP stock price often involves considering related financial sectors. For instance, observing the performance of companies like Jackson Financial can offer insights into broader market trends. You can check the current jackson financial stock price to gain a comparative perspective. Ultimately, analyzing this data alongside other economic indicators helps in better predicting future NFP stock price movements.

Trading volume varies considerably depending on market conditions and news events. Analyzing historical data provides a better understanding of typical daily and monthly volumes.

Are there any significant upcoming events that could impact the NFP stock price?

Investors should monitor the company’s announcements, upcoming earnings reports, and relevant economic news for potential impacts on the stock price. Industry news and regulatory changes should also be considered.

How does the NFP stock price correlate with a specific market index (e.g., S&P 500)?

Correlation analysis comparing NFP stock price movements with relevant market indices over various timeframes will reveal the extent to which NFP’s performance mirrors broader market trends.

What are the potential risks associated with investing in NFP stock?

Investing in any stock carries inherent risks. Factors such as market volatility, company-specific risks, and macroeconomic conditions all contribute to the potential for both gains and losses. Thorough due diligence is crucial.