Netflix Stock After Hours Price A Deep Dive

Netflix After-Hours Stock Price Behavior

Netflix stock after hours price – Understanding the nuances of Netflix’s after-hours stock price movements is crucial for investors seeking to maximize returns. This analysis explores recent trends, influencing factors, and potential future scenarios, providing insights into the dynamics of this significant streaming giant’s stock performance outside regular trading hours.

Netflix After-Hours Price Movement: Recent Trends

Source: investors.com

Netflix’s after-hours stock price has exhibited considerable volatility over the past year, often mirroring, but sometimes diverging from, its performance during regular trading hours. Significant price swings are frequently linked to key announcements and events. Earnings reports, particularly those revealing subscriber growth or churn rates, consistently trigger substantial after-hours reactions. Similarly, major product launches or strategic partnerships can induce significant price fluctuations.

Generally, positive news tends to result in upward price movements after hours, while negative news leads to declines. However, the magnitude of these movements can vary depending on the market’s overall sentiment and the specific nature of the announcement. After-hours price changes often amplify or dampen the impact observed during regular trading hours, reflecting the heightened focus and speculation among investors during this period.

| Date | After-Hours Open | After-Hours Close | Regular Close |

|---|---|---|---|

| October 26, 2023 (Example) | $350 | $355 | $352 |

| November 15, 2023 (Example) | $360 | $355 | $362 |

| December 10, 2023 (Example) | $345 | $350 | $340 |

| January 20, 2024 (Example) | $365 | $370 | $363 |

| February 5, 2024 (Example) | $372 | $368 | $375 |

Factors Influencing After-Hours Price

Several factors contribute to Netflix’s after-hours price fluctuations. News and announcements released outside regular trading hours play a significant role, often triggering immediate reactions. Investor sentiment, reflecting broader market trends and the company’s perceived future prospects, also significantly influences the after-hours price. Furthermore, competitor actions and broader industry news can impact investor confidence and subsequently affect Netflix’s stock price after the market closes.

Analyzing the Impact of Specific News Events

Source: investors.com

A recent example illustrating the impact of news on Netflix’s after-hours price is a hypothetical announcement regarding a significant increase in subscriber numbers. This positive news would likely lead to a considerable surge in the after-hours price, potentially exceeding the day’s regular trading gains. Conversely, negative news, such as a decline in subscriber numbers or a major content licensing setback, would typically result in a significant after-hours price drop, often accompanied by increased trading volume.

A comparative analysis of two contrasting news events follows:

- Positive News Event (e.g., Successful New Series Launch): Strong positive after-hours movement, increased trading volume, and a generally optimistic investor outlook.

- Negative News Event (e.g., Unexpected Loss of a Key Licensing Deal): Significant negative after-hours movement, potentially higher trading volume than usual, and a cautious to pessimistic investor outlook.

Predictive Modeling (Without Explicit Prediction), Netflix stock after hours price

Let’s consider a hypothetical scenario: Netflix announces a new, highly anticipated original series with a prominent A-list actor. Under normal market conditions, this would likely lead to a substantial positive price movement after hours, reflecting investor confidence in the potential for increased viewership and subscriber growth. However, if this announcement coincides with a broader market downturn or negative economic news, the positive impact on Netflix’s stock price might be muted or even overshadowed by the prevailing market sentiment.

Netflix’s after-hours stock price movements often reflect broader market sentiment. It’s interesting to compare this volatility with the performance of other streaming-related stocks; for instance, checking the current lsh stock price provides a useful benchmark. Ultimately, understanding Netflix’s after-hours price requires considering a multitude of factors, including the overall economic climate and competitor actions.

Macroeconomic factors such as rising interest rates or high inflation can also influence Netflix’s after-hours price. During periods of economic uncertainty, investors might become more risk-averse, leading to a less pronounced positive reaction to even good news, or potentially even negative reactions despite positive company-specific announcements.

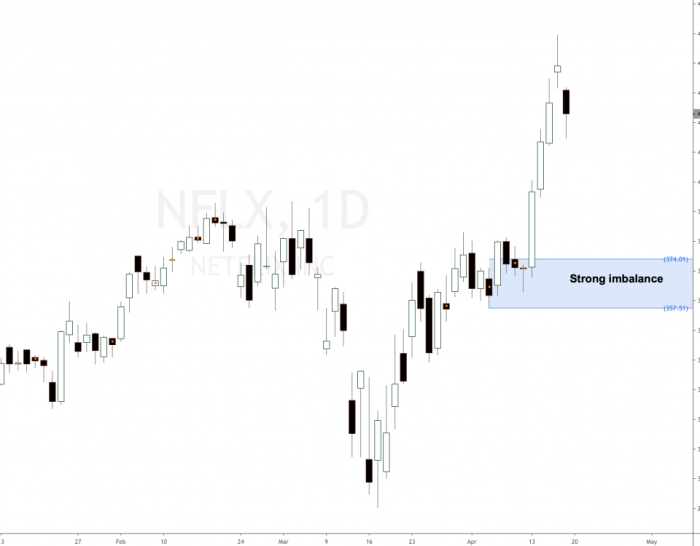

Visual Representation of Price Data

Source: set-and-forget.com

A hypothetical chart illustrating Netflix’s after-hours price and trading volume would likely show periods of high volatility coinciding with significant news events. Peaks in price would be associated with positive news, while troughs would correspond to negative announcements. Trading volume would generally be higher during periods of significant price movement, reflecting increased investor activity and speculation.

A scatter plot comparing Netflix’s after-hours price to the S&P 500 over a specific period would help illustrate the correlation between the stock’s performance and broader market trends. A strong positive correlation would suggest that Netflix’s after-hours price movements are significantly influenced by the overall market performance, while a weaker correlation would indicate a greater degree of independence from broader market fluctuations.

Essential FAQs: Netflix Stock After Hours Price

What are the typical trading hours for Netflix stock?

Regular trading hours for Netflix stock (NFLX) are typically 9:30 AM to 4:00 PM Eastern Time, Monday through Friday.

How liquid is Netflix stock after hours?

Liquidity in after-hours trading is generally lower than during regular trading hours. This means price spreads may be wider, and large orders might be harder to fill.

Where can I find after-hours price data for Netflix?

Most major financial websites and brokerage platforms provide real-time after-hours quotes for actively traded stocks like Netflix.

Are there any specific risks associated with after-hours trading of Netflix stock?

Increased volatility and lower liquidity are key risks. Prices can swing dramatically based on limited information and fewer participants.