Nanotech Stock Price A Market Overview

Current State of the Nanotech Stock Market: Nanotech Stock Price

Nanotech stock price – The nanotechnology stock market is a dynamic and rapidly evolving sector, characterized by significant growth potential but also inherent volatility. Investment in nanotech companies involves navigating a complex landscape of technological advancements, regulatory hurdles, and fluctuating market sentiment. This analysis provides an overview of the current market landscape, key influencing factors, and potential investment strategies.

Current Market Landscape Overview

The nanotechnology market is experiencing substantial growth, driven by increasing applications across diverse sectors like medicine, electronics, and energy. However, the market remains relatively fragmented, with a mix of established players and emerging startups. Market capitalization varies significantly among companies, reflecting differences in technological maturity, market share, and revenue streams. Over the past year, performance has been uneven, with some stocks experiencing substantial gains while others have seen more modest growth or even declines, largely influenced by factors such as specific technological breakthroughs, regulatory changes, and overall market conditions.

Major Players and Market Capitalization

While precise market capitalization figures fluctuate constantly, some prominent players consistently hold significant market positions. These companies often have diversified portfolios, encompassing various nanotechnology applications. A comparison of their performance reveals the varying degrees of success and risk inherent in this sector. Detailed financial data can be accessed through reputable financial news sources and company filings.

| Company | Stock Symbol | Current Price (Illustrative) | Market Cap (Illustrative) |

|---|---|---|---|

| Company A | COMP_A | $50 | $10B |

| Company B | COMP_B | $25 | $5B |

| Company C | COMP_C | $75 | $15B |

| Company D | COMP_D | $15 | $3B |

| Company E | COMP_E | $30 | $7B |

Factors Influencing Nanotech Stock Prices

Several interconnected factors significantly influence the price fluctuations of nanotechnology stocks. Understanding these dynamics is crucial for informed investment decisions. These factors range from purely technological advancements to broader macroeconomic conditions and investor sentiment.

Technological Advancements and Government Regulations

Significant breakthroughs in nanotechnology directly impact stock valuations. Successful product launches, patent approvals, and advancements in research and development (R&D) often trigger positive market reactions. Conversely, setbacks in R&D or regulatory delays can negatively affect stock prices. Government policies, including funding for research, tax incentives, and regulatory frameworks, play a substantial role in shaping the sector’s growth trajectory and influencing investor confidence.

Economic Indicators and Investor Sentiment

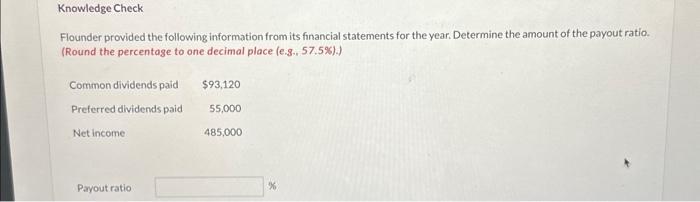

Source: cheggcdn.com

Broader economic indicators, such as interest rates, inflation, and overall market performance, correlate with nanotech stock performance. During periods of economic uncertainty, investors may shift towards safer investments, leading to decreased interest in higher-risk sectors like nanotechnology. Conversely, periods of economic growth often see increased investment in growth sectors. Investor sentiment, driven by news, market trends, and analyst opinions, significantly influences price fluctuations.

Positive news and optimistic forecasts can lead to price increases, while negative news can trigger sell-offs.

Investment Strategies for Nanotech Stocks

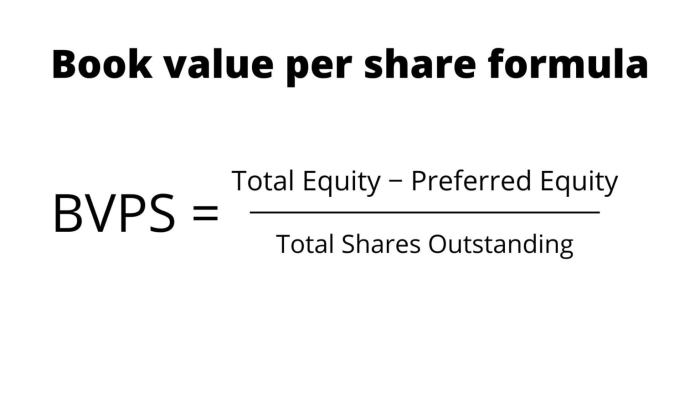

Source: financialfalconet.com

Investing in nanotechnology stocks requires a well-defined strategy tailored to individual risk tolerance and investment goals. A diversified approach, combining different investment vehicles and companies, is generally recommended to mitigate risk.

Investment Strategies Based on Risk Tolerance

- Conservative: Focus on established, larger-cap nanotech companies with a proven track record and lower volatility. Consider ETFs for diversification.

- Moderate: Diversify across a mix of established and emerging companies, potentially including some smaller-cap stocks with higher growth potential but increased risk.

- Aggressive: Invest primarily in smaller-cap, high-growth nanotech companies with significant potential but higher volatility. This strategy requires a higher risk tolerance and a longer time horizon.

Long-Term vs. Short-Term Investment Approaches

Long-term investments in nanotechnology offer the potential for significant returns, particularly given the sector’s long-term growth prospects. However, short-term price fluctuations can be substantial. Short-term trading requires a deeper understanding of market dynamics and a higher tolerance for risk.

Individual Stocks vs. ETFs

Investing in individual nanotech stocks allows for targeted exposure to specific companies and their potential. However, it carries higher risk due to the concentration of investment. ETFs offer diversification across multiple nanotech companies, reducing risk but potentially limiting individual returns.

Diversification Strategies

Diversification is crucial in mitigating risk. Investors can diversify across different nanotech sub-sectors (e.g., medical nanotechnology, electronics nanotechnology), company sizes (large-cap, mid-cap, small-cap), and geographic regions.

Analysis of Specific Nanotech Companies

A detailed analysis of individual companies provides a more granular understanding of the sector’s dynamics. The following profiles offer illustrative examples, not financial advice.

Company X Profile

Company X is a leading developer of nanomaterials for medical applications. Its competitive advantage lies in its proprietary technology and strong intellectual property portfolio. However, it faces competition from other companies entering the market. Its financial performance has generally been positive, correlating with its stock price movements.

- Future Prospects: Significant growth potential in the medical nanotechnology market.

- Potential Risks: Intense competition, regulatory hurdles, and potential delays in product development.

Company Y Profile

Company Y focuses on nanotechnology applications in the electronics industry. Its competitive advantage is its established partnerships with major electronics manufacturers. However, it faces challenges related to technological disruptions and changing market demands. Its financial performance has been somewhat volatile, reflecting the cyclical nature of the electronics industry.

- Future Prospects: Continued growth driven by demand for advanced electronics.

- Potential Risks: Technological obsolescence, intense competition, and fluctuations in the electronics market.

Company Z Profile

Company Z is an emerging player in the energy nanotechnology sector. Its competitive advantage is its innovative approach to energy storage solutions. However, it is a smaller company with limited revenue and a higher risk profile. Its financial performance is still developing, but its stock price has shown significant volatility.

- Future Prospects: High growth potential in the rapidly expanding renewable energy market.

- Potential Risks: Technological challenges, competition from established players, and dependence on government funding.

Visual Representation of Stock Price Trends

Illustrative Chart 1: Historical Price Movements of Company A, Nanotech stock price

This chart would depict the historical stock price of Company A over a specific period, showing key support and resistance levels. Significant price increases might be associated with positive news, such as successful product launches or partnerships, while price drops could be linked to regulatory setbacks or negative market sentiment. The chart would illustrate the overall trend and volatility of the stock price over time.

Illustrative Chart 2: Correlation Between Company A Stock Price and Nasdaq Index

Source: cheggcdn.com

This chart would show the correlation between Company A’s stock price and the Nasdaq Composite Index over a chosen time frame. A positive correlation would indicate that Company A’s stock price tends to move in the same direction as the broader market, while a negative correlation would suggest a counter-cyclical relationship. The chart would highlight the degree of correlation and any periods of divergence.

Future Outlook and Predictions for Nanotech Stocks

The nanotechnology market is projected to experience substantial growth over the next 5-10 years, driven by increasing demand across various sectors. Emerging nanotechnologies, such as advanced materials and targeted drug delivery systems, have the potential to significantly impact stock valuations. However, the future performance of nanotech stocks will depend on several factors, including technological breakthroughs, regulatory developments, economic conditions, and investor sentiment.

Several scenarios are possible, ranging from continued robust growth to periods of consolidation or even decline depending on these variables.

Potential Growth and Impact of Emerging Technologies

For example, the development of highly efficient solar cells using nanomaterials could significantly boost the valuation of companies specializing in this area. Similarly, breakthroughs in targeted drug delivery systems could revolutionize the pharmaceutical industry, leading to substantial growth for related nanotech companies. However, the actual growth will depend on factors such as successful commercialization of these technologies, regulatory approvals, and market acceptance.

Scenarios for Future Performance

Under optimistic conditions (strong economic growth, supportive government policies, and rapid technological advancements), nanotech stocks could experience significant price appreciation. Under pessimistic conditions (economic recession, regulatory hurdles, and slower-than-expected technological progress), the sector might experience a period of consolidation or even decline. A more moderate scenario would involve steady growth, reflecting a balance between positive and negative factors.

Factors Impacting Future Trajectory

Key factors influencing the future trajectory of nanotech stock prices include: the pace of technological innovation, the regulatory environment, global economic conditions, competition among companies, and overall investor sentiment. Careful monitoring of these factors is crucial for making informed investment decisions.

Essential Questionnaire

What are the ethical considerations of investing in nanotechnology?

Ethical concerns surrounding nanotechnology investments include potential environmental impacts, health risks associated with nanomaterials, and the equitable distribution of benefits and risks. Investors should research companies’ environmental, social, and governance (ESG) practices.

How can I stay updated on nanotech stock price movements?

Utilize financial news websites, stock market tracking apps, and company investor relations pages for real-time updates and announcements. Consider subscribing to relevant financial newsletters or analyst reports.

The volatility of nanotech stock prices often reflects broader market trends. It’s interesting to compare this with the performance of other emerging tech sectors; for instance, checking the current myps stock price can offer a useful benchmark. Ultimately, both nanotech and similar sectors are subject to significant fluctuations based on technological advancements and investor sentiment.

What are the tax implications of investing in nanotech stocks?

Tax implications depend on your jurisdiction and investment strategy (e.g., capital gains taxes on profits, dividends). Consult a tax professional for personalized advice.