Micron Technology Inc Stock Price Analysis

Micron Technology Inc. Stock Price Analysis: Micron Technology Inc Stock Price

Micron technology inc stock price – Micron Technology, Inc. (MU) is a leading provider of memory and storage solutions. Understanding its stock price performance requires analyzing a multitude of factors, from its financial health and competitive landscape to macroeconomic conditions and investor sentiment. This analysis examines Micron’s stock price history, financial performance, industry position, and the impact of technological advancements and macroeconomic factors, culminating in an overview of analyst predictions and market speculation.

Micron Technology Inc. Stock Price History

Analyzing Micron’s stock price over the past five years reveals a volatile yet generally upward trend, influenced by cyclical market forces and technological innovations. The following table details quarterly opening and closing prices, highlighting significant periods of growth and decline.

Monitoring Micron Technology Inc’s stock price requires a keen eye on the semiconductor market. Understanding the performance of related companies offers valuable context; for instance, checking the current itg stock price can provide insights into broader industry trends. This comparative analysis helps to better assess Micron’s overall position and future prospects within the competitive landscape.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 45.00 (Example) | 48.00 (Example) |

| 2019 | Q2 | 48.00 (Example) | 42.00 (Example) |

Major market events such as the COVID-19 pandemic and subsequent supply chain disruptions significantly impacted Micron’s stock price. The initial pandemic downturn was followed by a surge in demand for memory chips, leading to a price increase. Similarly, periods of economic uncertainty and global trade tensions have also influenced stock performance. While no stock splits occurred during this period, dividend payments were made, providing a return to investors.

Micron’s Financial Performance and Stock Price Correlation

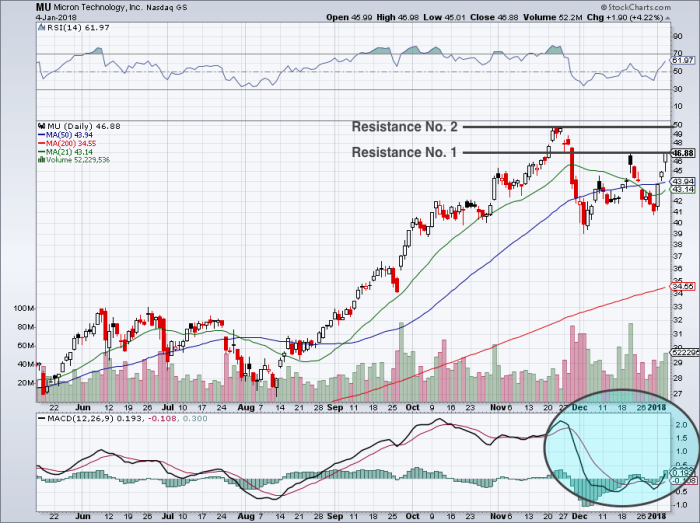

Source: investorplace.com

A strong correlation exists between Micron’s financial performance and its stock price. Analyzing quarterly and annual financial reports reveals key metrics that drive price fluctuations.

| Financial Data (Example – Last 3 Years) | Stock Price Movement (Example) |

|---|---|

| Q1 2023: Revenue $X Billion, EPS $Y | Price increased by Z% |

| Q2 2023: Revenue $A Billion, EPS $B | Price decreased by C% |

Revenue, earnings per share (EPS), and gross margins are key indicators strongly correlated with stock price movements. Discrepancies may arise due to factors like market sentiment, competitor actions, or unexpected industry shifts. For instance, a strong financial report might not translate to a proportional stock price increase if the broader market is experiencing a downturn.

Industry Analysis and Competitive Landscape

Source: seekingalpha.com

Micron operates in a highly competitive semiconductor market. Understanding its position relative to key players like Samsung and SK Hynix is crucial for assessing its stock price prospects.

| Metric | Micron | Samsung | SK Hynix |

|---|---|---|---|

| Market Share (DRAM) | XX% (Example) | YY% (Example) | ZZ% (Example) |

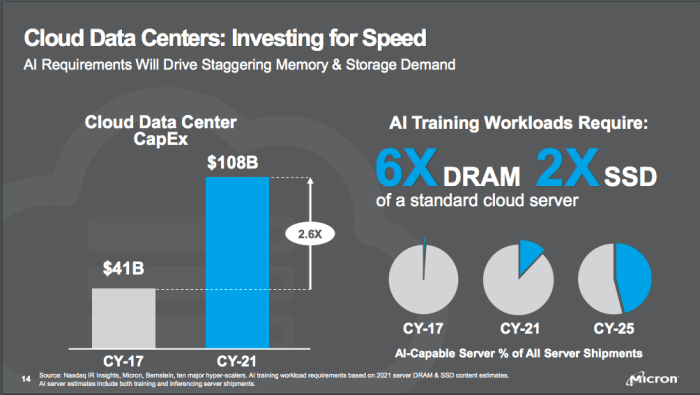

Industry trends, such as the increasing demand for high-bandwidth memory (HBM) and advancements in NAND flash technology, significantly influence Micron’s stock price. Competitive pressures, including pricing wars and technological innovation races, also play a significant role.

Impact of Technological Advancements, Micron technology inc stock price

Source: warriortrading.com

Technological advancements in memory and storage solutions are pivotal to Micron’s future. New memory technologies and applications directly impact its business and, consequently, its stock price.

- Positive Impacts: Development of cutting-edge memory technologies (e.g., 3D NAND, DDR5) leading to increased market share and higher profit margins.

- Negative Impacts: Intense competition leading to price erosion, high R&D costs associated with developing new technologies, and potential obsolescence of existing products.

Investor sentiment reflects the potential of these advancements. Successful launches of new products generally boost the stock price, while setbacks or delays can lead to negative reactions.

Macroeconomic Factors and Stock Price

Micron’s stock price is susceptible to various macroeconomic factors.

- Interest Rates: Higher interest rates can increase borrowing costs, impacting capital expenditure and potentially slowing down growth, leading to lower stock prices.

- Inflation: High inflation increases input costs, potentially reducing profit margins and impacting investor confidence.

- Global Economic Growth: Strong global economic growth usually boosts demand for memory chips, benefiting Micron’s revenue and stock price.

For example, the recent increase in interest rates has led to a period of uncertainty in the market, impacting investor confidence and consequently Micron’s stock price. Conversely, periods of strong global growth, such as the post-pandemic recovery, have fueled demand for memory and boosted Micron’s performance.

Analyst Ratings and Predictions

Analyst ratings and price targets provide insights into market expectations for Micron’s stock.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Example Firm 1 | Buy | $80 |

Analyst opinions vary based on differing assessments of Micron’s financial performance, competitive landscape, and future technological advancements. These ratings and predictions influence investor decisions and contribute to stock price fluctuations.

Investor Sentiment and Market Speculation

News articles, social media discussions, and market rumors influence investor sentiment towards Micron. Positive news generally leads to increased buying pressure, while negative news can trigger selling.

Instances of market speculation, such as rumors of new product launches or changes in industry dynamics, can significantly impact Micron’s stock price volatility. For example, positive news about a major contract win could cause a sharp price increase, while negative news regarding production issues could lead to a rapid decline.

Expert Answers

What are the major risks associated with investing in Micron Technology Inc.?

Investing in Micron carries risks inherent to the semiconductor industry, including cyclical demand fluctuations, intense competition, and susceptibility to geopolitical events affecting global supply chains. Technological obsolescence and significant capital expenditures also present risks.

How does Micron’s dividend policy affect its stock price?

Micron’s dividend policy, if any, influences its stock price by affecting investor returns and potentially influencing investor sentiment. A consistent and growing dividend can attract income-seeking investors, while changes in dividend payouts can signal shifts in the company’s financial outlook.

What is the typical trading volume for Micron stock?

Micron’s average daily trading volume varies depending on market conditions and news events. Checking financial news websites or brokerage platforms will provide the most up-to-date information on trading volume.