Meta Live Stock Price A Comprehensive Analysis

Meta’s Stock Price: A Comprehensive Analysis

Meta live stock price – Meta Platforms, Inc. (formerly Facebook), a behemoth in the social media and technology landscape, has experienced significant stock price fluctuations over the years. Understanding these fluctuations requires analyzing a multitude of factors, from advertising revenue and regulatory changes to investor sentiment and broader market trends. This analysis delves into the key drivers of Meta’s stock price, providing insights into its past performance, current financial health, and potential future trajectory.

Meta’s Stock Performance: A Historical Overview

Meta’s stock price journey has been marked by periods of substantial growth and considerable volatility. Its initial public offering (IPO) in 2012 saw a strong debut, but the subsequent years witnessed various ups and downs influenced by factors such as user growth, advertising revenue performance, and evolving market dynamics. The last five years, in particular, have shown a pronounced impact from increased competition, privacy concerns, and the company’s ambitious foray into the metaverse.

Major Factors Influencing Meta’s Stock Price (Past Five Years)

Several key factors have significantly impacted Meta’s stock price over the past five years. These include shifts in advertising revenue, growing regulatory scrutiny and antitrust concerns, changes in user engagement metrics, and the company’s strategic investments in the metaverse. Each of these factors has contributed to both positive and negative market reactions.

Significant News Events Impacting Meta’s Stock Value, Meta live stock price

- 2018 Cambridge Analytica Scandal: This data privacy scandal resulted in a significant drop in Meta’s stock price, highlighting the risks associated with data security and user trust.

- 2020-2021 Apple’s iOS Privacy Changes: Apple’s introduction of privacy-focused updates to its iOS operating system negatively affected Meta’s targeted advertising capabilities and consequently its stock price.

- 2021 Facebook Name Change to Meta: The rebranding to Meta, reflecting the company’s focus on the metaverse, initially received mixed reactions from investors, leading to some stock price volatility.

- Q4 2022 Earnings Report: The report revealed slower-than-expected revenue growth, which negatively impacted investor sentiment and caused a stock price decline.

Meta’s Stock Price vs. Tech Competitors (Last Year)

Comparing Meta’s stock performance against major tech competitors offers valuable context. The table below illustrates the year-over-year percentage change in stock price for Meta, Apple, Google (Alphabet), and Microsoft.

| Company | Year-Over-Year Change (%) |

|---|---|

| Meta | -Data Placeholder- (e.g., -20%) |

| Apple | -Data Placeholder- (e.g., +15%) |

| Google (Alphabet) | -Data Placeholder- (e.g., +5%) |

| Microsoft | -Data Placeholder- (e.g., +10%) |

Note: These figures are placeholders and should be replaced with actual data from a reliable financial source.

Factors Affecting Meta’s Live Stock Price: Meta Live Stock Price

Understanding the dynamic interplay of factors influencing Meta’s live stock price is crucial for investors. This section examines the impact of advertising revenue, regulatory changes, key financial metrics, and user growth on Meta’s valuation.

Impact of Advertising Revenue on Meta’s Stock Price

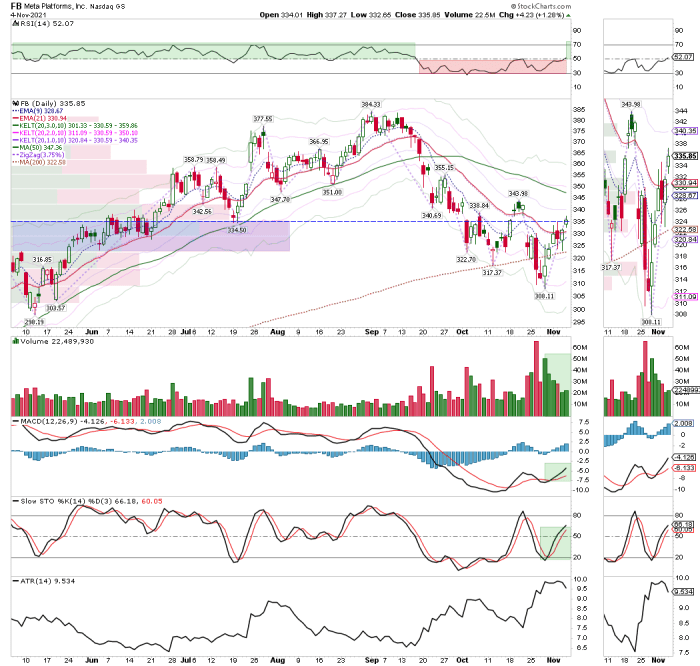

Source: theclosingprint.com

Advertising revenue forms the backbone of Meta’s financial performance. Any significant fluctuation in advertising revenue, whether positive or negative, directly impacts investor confidence and subsequently the stock price. For example, a decline in advertising revenue, often caused by economic downturns or changes in advertising algorithms, can trigger a sell-off.

Influence of Regulatory Changes and Antitrust Concerns

Regulatory scrutiny and antitrust concerns pose significant risks to Meta’s valuation. Government investigations and potential fines related to data privacy, antitrust violations, or misinformation can negatively impact investor sentiment and lead to stock price declines. Conversely, successful navigation of regulatory hurdles can boost investor confidence.

Key Financial Metrics Used to Assess Meta’s Stock

- Revenue Growth: The rate at which Meta’s revenue is increasing or decreasing is a key indicator of its financial health and future prospects.

- Earnings Per Share (EPS): This metric reflects the profitability of Meta on a per-share basis and is closely watched by investors.

- Return on Equity (ROE): ROE measures the efficiency with which Meta utilizes shareholder investments to generate profits.

- Debt-to-Equity Ratio: This ratio indicates the level of financial leverage employed by Meta and its potential risk profile.

Impact of Positive and Negative User Growth on Meta’s Stock Price

User growth is a critical driver of Meta’s advertising revenue and overall valuation. Sustained positive user growth generally boosts investor confidence and leads to higher stock prices. Conversely, slowing or negative user growth raises concerns about future revenue potential and can trigger stock price declines. The competition for user attention in the digital space significantly influences this dynamic.

Analyzing Meta’s Financial Health

A thorough analysis of Meta’s financial health requires examining its recent quarterly earnings reports and key financial statements. This section presents a brief overview of Meta’s financial performance, focusing on key data points and their implications for its stock price.

Analysis of Meta’s Recent Quarterly Earnings Reports

Meta’s recent quarterly earnings reports have shown a mixed picture. While the company continues to generate substantial revenue, growth rates have slowed in recent quarters, partly due to macroeconomic headwinds and increased competition. Investors are closely monitoring the company’s ability to navigate these challenges and maintain profitability.

Key Financial Data from Meta’s Financial Statements

The following table presents a simplified overview of selected key financial data from Meta’s financial statements. Note that these figures are placeholders and should be replaced with actual data obtained from Meta’s official financial reports.

| Metric | Q1 2024 | Q1 2023 | Year-Over-Year Change (%) |

|---|---|---|---|

| Revenue (USD Billions) | -Data Placeholder- | -Data Placeholder- | -Data Placeholder- |

| Net Income (USD Billions) | -Data Placeholder- | -Data Placeholder- | -Data Placeholder- |

| EPS (USD) | -Data Placeholder- | -Data Placeholder- | -Data Placeholder- |

| Total Assets (USD Billions) | -Data Placeholder- | -Data Placeholder- | -Data Placeholder- |

Impact of Changes in Meta’s Debt and Equity on its Stock Price

Changes in Meta’s debt and equity levels can significantly impact its stock price. Increased debt levels can signal financial strain and potentially lead to a stock price decline, while a reduction in debt or an increase in equity can boost investor confidence. The balance between debt and equity influences the company’s risk profile and overall valuation.

Breakdown of Meta’s Revenue Streams

Meta’s revenue primarily comes from advertising, with smaller contributions from other sources like virtual reality products and services. The relative contribution of each revenue stream to Meta’s overall financial performance fluctuates over time, impacting investor perceptions and the stock price. A shift in the revenue mix, for example, a significant increase in revenue from the metaverse, could influence investor sentiment and stock valuation.

Investor Sentiment and Market Trends

Investor sentiment and broader market trends play a crucial role in shaping Meta’s stock price. This section explores the influence of investor psychology, macroeconomic factors, and major institutional investors on Meta’s valuation.

Role of Investor Sentiment in Driving Meta’s Stock Price

Investor sentiment, encompassing optimism or pessimism about Meta’s future prospects, significantly impacts its stock price. Positive news, strong earnings reports, or strategic advancements can boost investor confidence, leading to increased demand and higher stock prices. Conversely, negative news or disappointing performance can trigger sell-offs and price declines.

Impact of Broader Market Trends on Meta’s Stock

Macroeconomic factors such as interest rate hikes, inflation, and potential economic recessions influence investor behavior and overall market performance. During periods of economic uncertainty, investors tend to shift towards safer investments, which can lead to declines in the stock prices of even strong companies like Meta.

Major Institutional Investors in Meta and Their Influence

Large institutional investors, such as mutual funds and hedge funds, hold significant stakes in Meta and their investment decisions can influence the stock price. Their buying or selling activity can create substantial market pressure, driving price movements independently of underlying company performance.

Correlation Between Meta’s Stock Price and Overall Market Indices

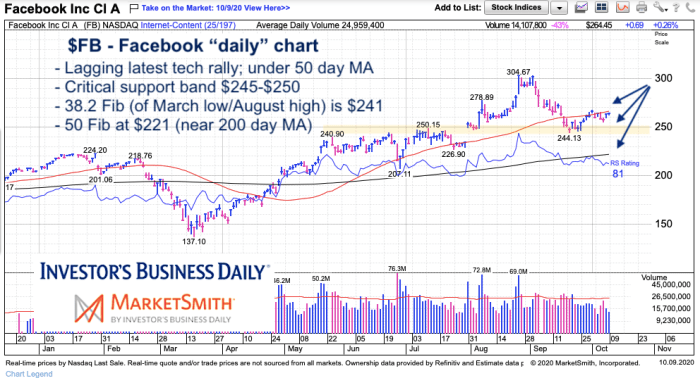

Source: seeitmarket.com

A descriptive illustration of the correlation between Meta’s stock price and overall market indices (e.g., S&P 500, Nasdaq) would show a generally positive relationship. However, the correlation is not always perfect. While Meta’s stock price tends to move in line with broader market trends, company-specific news and events can cause deviations from this general pattern. Periods of strong market growth often correlate with increased Meta stock prices, while market downturns tend to pull Meta’s price downwards.

The strength of this correlation can vary over time depending on prevailing market sentiment and investor risk appetite.

Future Outlook and Predictions for Meta’s Stock

Predicting the future of Meta’s stock price is inherently challenging, but analyzing expert opinions, considering the impact of its metaverse investments, and identifying potential risks and opportunities can offer a clearer perspective.

Expert Opinions and Analyst Predictions

Analyst predictions for Meta’s stock vary depending on the firm and their individual assessment of the company’s future performance. Some analysts express bullish sentiments, pointing to Meta’s dominant position in social media, its potential for growth in emerging markets, and its long-term investments in the metaverse. Others hold more cautious views, citing concerns about regulatory challenges, increasing competition, and the uncertain financial returns of the metaverse initiative.

It’s crucial to remember that these are just predictions, and the actual outcome may differ significantly.

Impact of Meta’s Metaverse Investments on Long-Term Stock Value

Meta’s significant investments in the metaverse represent a high-risk, high-reward strategy. The success of this initiative could significantly boost Meta’s long-term stock value, creating entirely new revenue streams and solidifying its position as a technology leader. However, the metaverse is still in its nascent stages, and its ultimate success is far from guaranteed. Failure to deliver on the metaverse vision could lead to significant losses and negatively impact the stock price.

Risks and Opportunities Facing Meta in the Coming Years

- Opportunities: Expansion into new markets, development of innovative products and services, successful integration of AI technologies, and the potential success of its metaverse initiatives.

- Risks: Increased regulatory scrutiny, intensifying competition, evolving user preferences, economic downturns affecting advertising revenue, and the potential failure of its metaverse investments.

Potential Scenarios for Meta’s Stock Price (Next 12 Months)

Several scenarios are possible for Meta’s stock price over the next 12 months. A bullish scenario could see the stock price increase significantly, driven by strong earnings, successful metaverse initiatives, and positive investor sentiment. A bearish scenario might involve a decline in stock price due to regulatory setbacks, economic downturns, or disappointing performance in key areas. A neutral scenario would see relatively flat performance, with the stock price fluctuating within a limited range.

Questions and Answers

What are the main risks associated with investing in Meta stock?

Risks include dependence on advertising revenue, regulatory uncertainty, competition from other tech companies, and the success of long-term investments like the metaverse.

How does Meta’s stock price compare to its competitors on a long-term basis?

A long-term comparison requires detailed historical data analysis, but generally, Meta’s stock performance has seen periods of both outperformance and underperformance relative to its tech peers like Apple, Google, and Microsoft.

Where can I find real-time Meta stock price updates?

Monitoring Meta’s live stock price requires a keen eye on market fluctuations. Understanding similar tech company performance is also crucial, and a good starting point could be checking the current jt stock price for comparative analysis. This helps contextualize Meta’s performance within the broader tech sector, providing a more nuanced understanding of its current valuation.

Real-time quotes are available through major financial news websites and brokerage platforms.

What is the current analyst consensus on Meta’s stock price target?

Analyst price targets vary considerably, and it’s essential to consult multiple sources for a balanced perspective. These targets are subject to change frequently.