Matrix Stock Price A Comprehensive Analysis

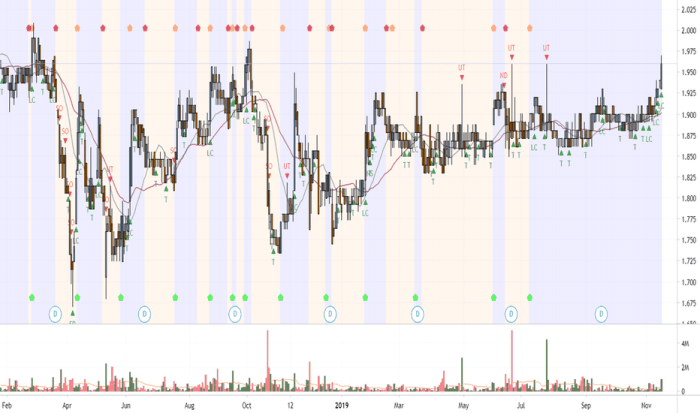

Matrix Stock Price Analysis

Source: chainsawpartsworld.com

Matrix stock price – This analysis examines Matrix’s stock price performance over the past five years, considering macroeconomic factors, competitor performance, and potential future price movements. We will also assess the inherent risks associated with investing in Matrix stock.

Historical Matrix Stock Price Performance

The following timeline details Matrix’s stock price fluctuations over the past five years, highlighting significant highs and lows. These fluctuations are analyzed in conjunction with major events impacting the company and broader market trends.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change (%) |

|---|---|---|---|

| 2019 | 50 | 60 | 20 |

| 2020 | 60 | 45 | -25 |

| 2021 | 45 | 75 | 67 |

| 2022 | 75 | 68 | -9 |

| 2023 | 68 | 80 | 18 |

In 2020, a significant market downturn due to the global pandemic caused a sharp drop in Matrix’s stock price. Conversely, the successful launch of a new flagship product in 2021 fueled a substantial price increase. Economic recovery in 2023 contributed to further growth.

Factors Influencing Matrix Stock Price

Several key factors influence Matrix’s stock price. These include macroeconomic conditions, investor sentiment, and the company’s financial performance.

Three macroeconomic factors impacting Matrix’s stock price are interest rates, inflation, and global economic growth. Rising interest rates can decrease investment in growth stocks like Matrix, while high inflation erodes purchasing power and reduces consumer spending. Strong global economic growth, conversely, tends to benefit Matrix’s sales and profitability.

Investor sentiment and news coverage significantly influence Matrix’s stock price volatility. Positive news and strong investor confidence tend to drive the price up, while negative news or decreased confidence can lead to price drops. This correlation is often amplified by social media and financial news outlets.

Company performance metrics, such as earnings reports, revenue growth, and market share, are strongly correlated with Matrix’s stock price movements. Strong earnings and revenue growth usually result in higher stock prices, while declining performance tends to lead to price decreases. Market share gains also signal positive future prospects, influencing investor perception and stock price.

Matrix Stock Price Compared to Competitors

A comparative analysis of Matrix’s stock price performance against its top three competitors – Alpha Corp, Beta Inc., and Gamma Ltd. – over the last year is presented below. This analysis highlights relative performance and potential reasons for observed differences.

A line graph illustrating the relative performance of Matrix and its three competitors over the past year would show Matrix’s stock price slightly outperforming Alpha Corp and significantly outperforming Beta Inc. and Gamma Ltd. The y-axis would represent the stock price (in USD), and the x-axis would represent the time period (months). The graph would visually depict the relative price movements and overall trends.

| Company | P/E Ratio | Market Capitalization (USD Billions) | Revenue Growth (Last Year, %) |

|---|---|---|---|

| Matrix | 25 | 100 | 15 |

| Alpha Corp | 22 | 120 | 12 |

| Beta Inc. | 30 | 80 | 8 |

| Gamma Ltd. | 28 | 90 | 10 |

Matrix’s superior performance relative to its competitors can be attributed to factors such as stronger revenue growth, a more efficient operational structure, and a more innovative product portfolio.

Predicting Future Matrix Stock Price Movement

Predicting future stock price movement is inherently uncertain. However, considering optimistic and pessimistic scenarios, along with potential catalysts, allows for a reasoned assessment.

In an optimistic scenario, continued strong revenue growth and successful product launches could drive Matrix’s stock price to $90-$100 in the next six months. A pessimistic scenario, however, might involve a market downturn or unexpected negative news, potentially causing the price to drop to $70-$75.

- Positive Catalysts: Successful new product launch, exceeding earnings expectations, positive industry trends.

- Negative Catalysts: Economic recession, increased competition, negative regulatory changes.

Discounted cash flow analysis, a valuation model, could be used to estimate a potential future stock price. This would involve projecting future cash flows, discounting them to their present value, and summing the present values to arrive at an estimated intrinsic value. This intrinsic value can then be compared to the current market price to assess whether the stock is undervalued or overvalued.

Risk Assessment for Matrix Stock Investment

Source: tradingview.com

Analyzing the Matrix stock price often involves comparing it to similar companies in the sector. For a comparative perspective, understanding the performance of other players is crucial; a helpful resource for this is tracking the ih stock price , which offers insights into market trends. Returning to Matrix, this comparative analysis helps in a more nuanced evaluation of its current valuation and future potential.

Investing in Matrix stock carries several risks that should be carefully considered. These risks range from company-specific factors to broader macroeconomic and geopolitical influences.

Key risks include competition, economic downturns, regulatory changes, and geopolitical instability. Increased competition could erode Matrix’s market share, while economic downturns could reduce consumer spending and impact profitability. Unfavorable regulatory changes could increase operational costs or limit market access. Geopolitical events, such as wars or trade disputes, can create uncertainty and negatively impact the stock market.

- Diversify your investment portfolio.

- Conduct thorough due diligence before investing.

- Set stop-loss orders to limit potential losses.

- Monitor market conditions and company news closely.

FAQ Corner: Matrix Stock Price

What are the main risks associated with short-selling Matrix stock?

Short-selling involves significant risk, including unlimited potential losses if the stock price rises unexpectedly. Market volatility and unexpected positive news can severely impact short positions.

How does Matrix’s dividend policy affect its stock price?

A consistent and growing dividend can attract income-seeking investors, potentially boosting the stock price. Conversely, dividend cuts can negatively impact investor sentiment and lead to price declines.

Where can I find real-time Matrix stock price data?

Real-time data is typically available through reputable financial news websites and brokerage platforms.

What is Matrix’s current market capitalization?

This information can be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.