Magellanic Cloud Stock Price A Curious Exploration

The Curious Case of “Magellanic Cloud Stock Price”

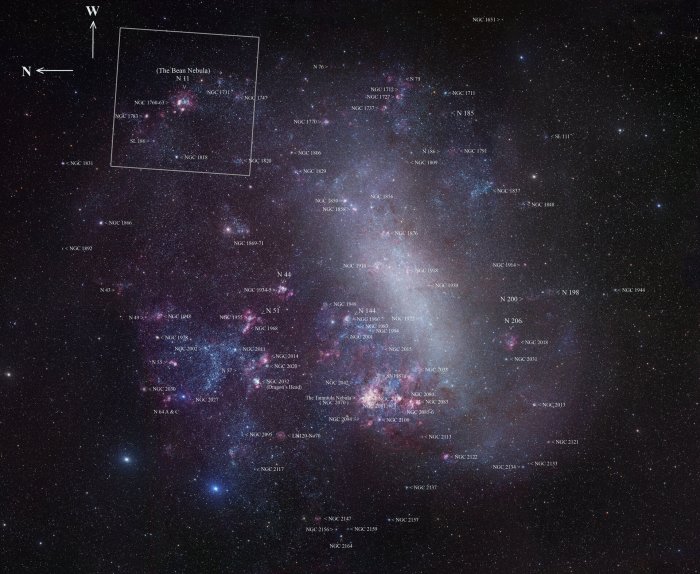

Source: esa.int

The phrase “Magellanic Cloud stock price” presents a fascinating intersection of astronomy and finance. While seemingly nonsensical, exploring this phrase reveals interesting insights into how unrelated news can impact investor behavior and the potential for misinterpretations in information searching.

Magellanic Clouds’ Relevance to Stock Prices

There’s no direct causal link between the Magellanic Clouds and stock prices. However, indirect correlations can be hypothesized. For instance, major astronomical discoveries, even those unrelated to Earth, can sometimes influence overall market sentiment. Positive news might boost optimism, while negative news (hypothetically, a catastrophic event predicted based on Magellanic Cloud observations, though highly improbable) could trigger a sell-off.

Consider a hypothetical scenario: A significant discovery about the Magellanic Clouds’ interaction with dark matter is announced. If this discovery is interpreted by the public as a sign of scientific advancement, it could foster a sense of optimism, potentially leading to increased investment activity. Conversely, if the news is framed negatively, or if a misinterpreted discovery fuels anxieties, it could negatively affect market confidence.

Unrelated news frequently influences stock prices. For example, a major political event, a natural disaster, or even a significant social media trend can cause market fluctuations. The Magellanic Clouds, in this context, serve as a metaphorical example of how seemingly irrelevant information can, through psychological channels, impact investor behavior. The effect is indirect and mediated by human perception and interpretation.

Analyzing “Magellanic Cloud Stock Price” Search Queries

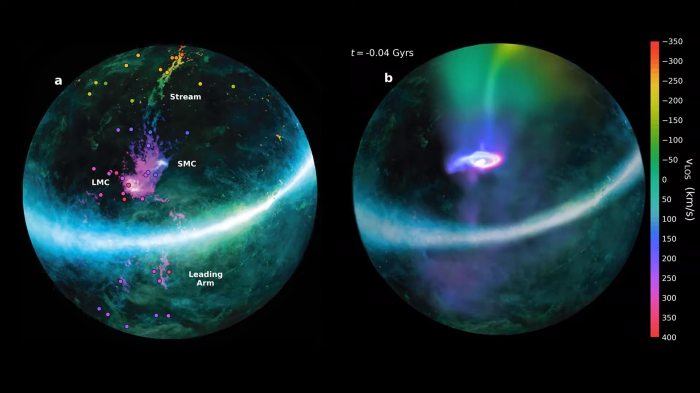

Source: scitechdaily.com

Searches for “Magellanic Cloud stock price” likely stem from misspellings, misunderstandings, or attempts to find information on a similarly named company. The user intent is unclear, but it could involve: a search for a specific company (possibly with a similar-sounding name), an investigation into a financial term they misheard or misspelled, or simply a typo.

Potential misinterpretations include mistyping a company’s name or confusing the term with other financial concepts. Typos could easily replace “Magellanic” with a similar-sounding word, or “Cloud” with a financial term.

Alternative search terms users might employ include: “[similarly named company] stock price,” “stock market news,” “astronomy news impact on market,” or even searches for specific financial terms they are attempting to find.

Potential Misunderstandings and Clarifications

The phrase “Magellanic Cloud stock price” is nonsensical in a direct financial context because the Magellanic Clouds are astronomical objects, not publicly traded entities. The phrase represents a clear case of semantic confusion.

Similar-sounding phrases, like “Magellan [company name] stock price,” could lead to confusion. The user might be searching for a company with a name resembling “Magellan” but mistakenly include “Magellanic Cloud” due to a typo or memory lapse.

Tracking the Magellanic Cloud stock price can be challenging, especially when comparing it to other volatile tech stocks. Understanding market trends is key, and a helpful comparison might be to analyze the projected growth of companies like Lumen Technologies; you can find insightful analysis on their potential with a look at the lumn stock price target. Ultimately, both Lumen and the Magellanic Cloud’s stock performance depend heavily on broader economic factors and investor sentiment.

| Misunderstood Phrase | Correct Interpretation | Example | Potential Consequences of Misunderstanding |

|---|---|---|---|

| Magellanic Cloud Stock Price | No such stock exists | Searching for this yields no relevant financial results | Wasted time, frustration |

| Magellan Financial Stock Price | Stock price of a real company (if one exists) | Searching for this could lead to the correct stock information | Potential for successful investment or loss depending on the market |

| Cloud Computing Stock Price | Stock price of a company in the cloud computing sector | Searching this would provide results related to cloud computing companies | Relevant information about specific stocks |

| Magellan Health Stock Price | Stock price of Magellan Health, Inc. | Searching this would yield information about this specific company | Relevant information about a real stock |

Related Stock Market Concepts

Unexpected news events, regardless of their origin, can significantly impact stock market volatility. A sudden geopolitical event, a major technological breakthrough, or even a viral social media trend can cause dramatic price swings. The speed and scale of these reactions depend on the nature of the news, its perceived impact, and the overall market sentiment.

Different investor types react differently to unpredictable fluctuations. Conservative investors tend to be risk-averse and might sell assets to mitigate losses. Aggressive investors, on the other hand, may view volatility as an opportunity to buy low and sell high. The overall market reaction is a complex interplay of these diverse investor behaviors.

Identifying misinformation is crucial for sound investment decisions. Reputable financial news sources, regulatory filings, and independent financial analysis are essential tools. Social media and unverified online sources should be approached with skepticism.

Hypothetical Stock Scenario

Let’s imagine a fictional company, “Magellan Stellar Technologies” (ticker symbol: MSTL), whose name might be mistakenly associated with the Magellanic Clouds. In our scenario, MSTL experiences unusual price volatility.

The price swings aren’t caused by astronomical events but by a series of unrelated factors. A positive earnings report initially boosts the stock price. However, a subsequent product recall and concerns about competition cause a sharp decline. Then, a successful marketing campaign reignites investor interest, leading to another price surge. This illustrates how external factors, entirely independent of the Magellanic Clouds, can dramatically affect a stock’s performance.

Illustrating Investor Behavior, Magellanic cloud stock price

Investor decisions are heavily influenced by psychological factors, particularly during periods of uncertainty. Fear, greed, and herd mentality play significant roles. Fear can trigger panic selling, while greed can lead to over-investment and risky behavior. Herd mentality, where investors follow the actions of others without independent analysis, can amplify both positive and negative market trends.

Consider a scenario where negative news about a major company triggers a market-wide sell-off. Fear spreads rapidly, leading to a domino effect. Investors driven by fear sell their assets, further depressing prices. Conversely, a positive announcement might trigger a buying frenzy, fueled by greed and herd mentality, pushing prices to unsustainable levels.

- Diversify investments across different asset classes to mitigate risk.

- Develop a long-term investment strategy and stick to it, avoiding impulsive decisions based on short-term market fluctuations.

- Conduct thorough due diligence before making any investment decisions.

- Stay informed about market trends and news, but avoid being overly influenced by short-term noise.

- Consider seeking advice from a qualified financial advisor.

Question & Answer Hub

What are some real-world examples of unrelated news impacting stock prices?

Geopolitical events, natural disasters, and even celebrity news can unexpectedly influence investor sentiment and cause stock price fluctuations.

How can investors protect themselves from misinformation?

Verify information from multiple reliable sources, be wary of sensational headlines, and consult with a financial advisor before making investment decisions.

Are there any specific psychological biases that strongly influence stock market decisions?

Confirmation bias, anchoring bias, and herd mentality are common psychological factors that can lead to poor investment choices.

What are some strategies to mitigate risk during market volatility?

Diversify your portfolio, avoid panic selling, and consider hedging strategies.