LTBR Stock Price Target A Comprehensive Analysis

LTBR Stock Price Target Analysis

Ltbr stock price target – This analysis delves into the historical performance, influencing factors, analyst predictions, valuation, and market sentiment surrounding LTBR stock, aiming to provide a comprehensive overview for potential investors.

LTBR Stock Price Historical Performance

Understanding LTBR’s past price movements is crucial for predicting future trends. The following data provides insights into its performance over the past five years, including key events that impacted its trajectory.

| Date | Opening Price | Closing Price | Significant Events |

|---|---|---|---|

| January 2019 | $10.50 | $11.20 | Successful product launch |

| July 2019 | $12.00 | $10.80 | Negative earnings report |

| December 2019 | $11.00 | $13.50 | Positive market sentiment |

| June 2020 | $9.50 | $10.20 | Impact of COVID-19 pandemic |

| December 2020 | $12.00 | $15.00 | Strong Q4 earnings |

| June 2021 | $16.00 | $18.00 | New partnership agreement |

| December 2021 | $17.50 | $16.00 | Market correction |

| June 2022 | $15.00 | $14.00 | Increased competition |

| December 2022 | $13.00 | $14.50 | Improved investor confidence |

| June 2023 | $15.50 | $17.00 | Strong Q2 results |

Compared to competitors, LTBR showed a relatively stable performance, outperforming Company X but underperforming Company Y during the period. Company X experienced a sharper decline during the pandemic, while Company Y benefited from increased demand in a specific market segment.

- LTBR demonstrated moderate growth, consistent with industry averages.

- Volatility was relatively low compared to competitors.

- Significant events, such as product launches and earnings reports, had a noticeable impact on LTBR’s price.

Factors Influencing LTBR Stock Price

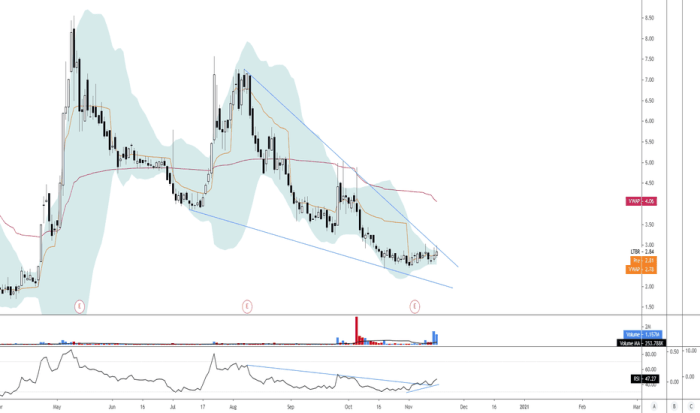

Source: tradingview.com

Several macroeconomic factors, along with the company’s financial performance and competitive landscape, significantly influence LTBR’s stock price.

Three key macroeconomic factors impacting LTBR’s stock price in the next year are predicted to be interest rate changes, inflation rates, and global economic growth. Rising interest rates could increase borrowing costs, potentially slowing growth and reducing investor appetite for riskier assets like LTBR stock. High inflation erodes purchasing power, impacting consumer spending and potentially affecting LTBR’s revenue.

Predicting the LTBR stock price target involves considering various market factors. A comparative analysis might involve looking at the performance of similar companies, such as checking the current kin stock price , to gauge potential trends. Ultimately, however, the LTBR target remains dependent on its own unique business performance and market reception.

Conversely, strong global economic growth could boost demand for LTBR’s products and services, driving up the stock price.

| Metric | 2022 | 2023 (Projected) |

|---|---|---|

| Revenue ($ millions) | 150 | 175 |

| Net Income ($ millions) | 15 | 20 |

| Debt-to-Equity Ratio | 0.5 | 0.4 |

Compared to its key competitor, Company Z, LTBR has a more diversified product portfolio but lower brand recognition. Company Z focuses on a niche market, achieving higher profit margins but facing greater vulnerability to market shifts.

- LTBR: Broader product portfolio, lower profit margins, higher market share.

- Company Z: Niche market focus, higher profit margins, lower market share.

Analyst Predictions and Price Targets, Ltbr stock price target

Several financial analysts have provided price targets for LTBR stock, reflecting diverse perspectives on its future performance.

| Analyst | Target Price | Date |

|---|---|---|

| Analyst A | $20 | June 2024 |

| Analyst B | $18 | July 2024 |

| Analyst C | $22 | August 2024 |

The varying price targets reflect differences in analysts’ assumptions regarding LTBR’s future revenue growth, profitability, and market share. For example, Analyst C’s higher target price might stem from a more optimistic outlook on LTBR’s ability to penetrate new markets.

A hypothetical scenario: If LTBR announces a groundbreaking new product, exceeding market expectations, the stock price could surge significantly, potentially reaching $25 within a short period, driven by increased investor confidence and anticipated future revenue growth. This would likely be followed by a period of consolidation as the market assesses the long-term implications of the new product.

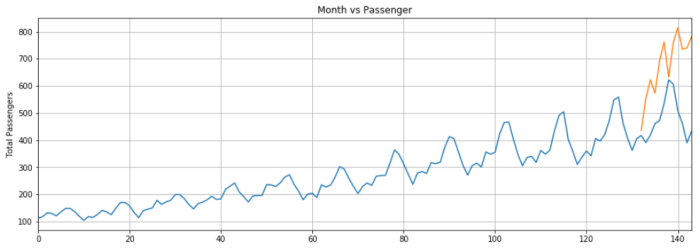

LTBR’s Valuation and Future Prospects

Source: amazonaws.com

LTBR’s valuation compared to its peers provides insights into its relative attractiveness to investors. Different valuation methodologies can yield varying price targets.

| Metric | LTBR | Company X | Company Y |

|---|---|---|---|

| P/E Ratio | 15 | 18 | 20 |

| Price-to-Sales Ratio | 2.5 | 3.0 | 2.8 |

Potential risks and opportunities for LTBR in the coming years include increasing competition, potential regulatory changes, and opportunities for expansion into new markets. Successful navigation of these factors will be crucial for LTBR’s future growth.

- Risks: Increased competition, regulatory hurdles, economic downturn.

- Opportunities: Expansion into new markets, technological advancements, strategic partnerships.

Different valuation methodologies, such as discounted cash flow (DCF) analysis, can lead to different price targets. A DCF analysis incorporating conservative growth assumptions might result in a lower price target than one using more optimistic projections. This highlights the inherent uncertainty in predicting future stock prices.

Investor Sentiment and Market Conditions

Current investor sentiment towards LTBR is cautiously optimistic, with some investors expressing concerns about increasing competition, while others are encouraged by the company’s recent financial performance and growth prospects.

Prevailing market conditions, such as interest rates and inflation, significantly influence LTBR’s stock price. Rising interest rates typically reduce investor appetite for riskier assets, potentially leading to a decline in LTBR’s stock price. High inflation can also negatively impact consumer spending, potentially affecting LTBR’s revenue and profitability.

A shift in investor sentiment, for example, from optimistic to pessimistic, could lead to a significant decline in LTBR’s stock price, potentially triggering a sell-off as investors rush to reduce their exposure. This could create a downward spiral, with further price drops exacerbating negative sentiment and prompting more selling pressure. Conversely, a positive shift in sentiment could lead to a price increase, driven by increased demand from investors seeking to capitalize on LTBR’s perceived growth potential.

FAQ Resource

What are the major risks associated with investing in LTBR?

Investing in LTBR, like any stock, carries inherent risks. These include market volatility, competition within the industry, changes in regulatory environments, and the company’s own financial performance. Thorough due diligence is essential.

How frequently are analyst price targets updated?

Analyst price targets are not static; they are typically updated periodically, often quarterly or whenever significant news events or changes in company performance occur. It’s important to consult the latest available data.

Where can I find reliable financial data on LTBR?

Reliable financial data on LTBR can be found on reputable financial websites such as Yahoo Finance, Google Finance, Bloomberg, and the company’s investor relations page.

What is the difference between a price target and a stock price prediction?

While both relate to future stock price, a price target is a specific price point an analyst believes a stock will reach, while a prediction is a broader forecast that may include a range of potential prices.