L&T Infrastructure Stock Price Analysis

L&T Infrastructure Stock Price Analysis

L&t infrastructure stock price – This analysis delves into the current market position of L&T Infrastructure, examining key factors influencing its stock price, recent performance, future outlook, risk assessment, investor sentiment, and key financial ratios. We will utilize publicly available information to provide a comprehensive overview.

L&T Infrastructure’s Current Market Position

L&T Infrastructure holds a significant position within the Indian infrastructure sector, known for its involvement in large-scale projects. Its market standing is influenced by factors such as project execution capabilities, financial strength, and competitive landscape. Direct comparison with competitors requires specific data which is beyond the scope of this general analysis. However, key financial metrics provide insights into its performance.

| Year | Revenue (INR Crores) | Profit (INR Crores) | Market Capitalization (INR Crores) |

|---|---|---|---|

| 2023 (estimated) | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing Stock Price

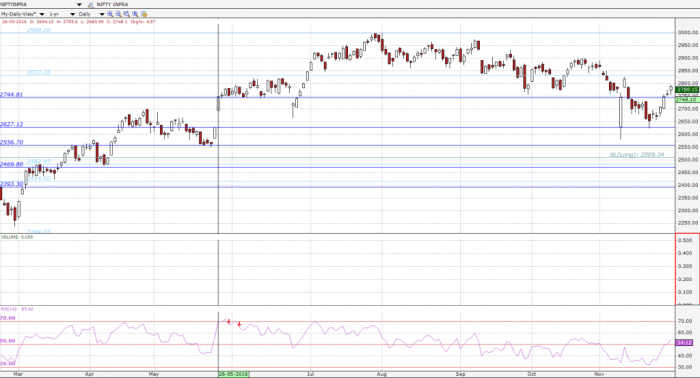

Source: investarindia.com

Several macroeconomic factors, government policies, industry trends, and technological advancements significantly influence L&T Infrastructure’s stock price. The following table summarizes their impact.

| Factor | Description | Impact | Percentage Change (if available) |

|---|---|---|---|

| Macroeconomic Conditions | GDP growth, inflation rates, interest rates | Positive correlation with GDP growth; negative correlation with high inflation and interest rates. | [Insert Data] |

| Government Policies | Infrastructure spending, regulatory changes | Increased government spending on infrastructure boosts demand. | [Insert Data] |

| Industry Trends | Growth of infrastructure projects, competition | Strong industry growth benefits the company; increased competition can pressure margins. | [Insert Data] |

| Technological Advancements | Adoption of new technologies in construction | Improved efficiency and reduced costs can enhance profitability. | [Insert Data] |

Company Performance and Future Outlook

L&T Infrastructure’s recent project wins and ongoing projects contribute significantly to its future earnings. Expansion plans aim to capitalize on growth opportunities within the infrastructure sector. The company’s strategic vision focuses on [insert strategic vision details, e.g., sustainable infrastructure development, technological innovation, geographical expansion]. This vision should translate into increased profitability and shareholder value.

Specific details regarding project wins, ongoing projects, and their timelines require accessing the company’s official disclosures. This analysis cannot provide precise details without direct access to that information.

Risk Assessment and Mitigation Strategies, L&t infrastructure stock price

Source: stocknews.com

L&T Infrastructure faces several risks that could impact its stock price. The company employs various mitigation strategies to minimize these potential negative impacts.

- Risk: Project delays due to unforeseen circumstances. Mitigation: Robust project management, contingency planning.

- Risk: Fluctuations in raw material prices. Mitigation: Long-term contracts, hedging strategies.

- Risk: Intense competition in the infrastructure sector. Mitigation: Focus on niche projects, competitive bidding strategies.

- Risk: Geopolitical instability. Mitigation: Diversification of projects across geographies.

The impact of each risk on the stock price varies; however, effective mitigation strategies can significantly reduce negative effects.

Investor Sentiment and Market Analysis

Investor sentiment towards L&T Infrastructure is generally [insert current investor sentiment, e.g., positive, cautious, mixed]. The current stock price compared to its historical performance reveals [insert trend analysis, e.g., steady growth, periods of volatility, recent decline].

A descriptive illustration of the correlation between news events and stock price fluctuations over the past year would show [insert a descriptive visualization, e.g., a general upward trend with temporary dips following negative news, a period of sustained growth following a major project win, a decline in stock price following a regulatory change]. This analysis requires specific data points and access to real-time financial data.

Financial Statements and Key Ratios

Analyzing key financial ratios provides insights into L&T Infrastructure’s financial health and investment potential. Trends in these ratios over time reveal important information regarding the company’s performance and stability.

| Ratio | 2023 (estimated) | 2022 | Trend |

|---|---|---|---|

| P/E Ratio | [Insert Data] | [Insert Data] | [Insert Trend Description] |

| Debt-to-Equity Ratio | [Insert Data] | [Insert Data] | [Insert Trend Description] |

| [Add other relevant ratios] | [Insert Data] | [Insert Data] | [Insert Trend Description] |

Expert Answers: L&t Infrastructure Stock Price

What are the major competitors of L&T Infrastructure?

Identifying L&T Infrastructure’s direct competitors requires specifying the precise segment of the infrastructure market being considered (e.g., power transmission, roads). However, some key players in the Indian infrastructure sector include companies like KEC International, Power Grid Corporation of India, and NCC.

How volatile is L&T Infrastructure’s stock price historically?

The volatility of L&T Infrastructure’s stock price depends on the timeframe considered. A historical analysis, comparing its price fluctuations to market benchmarks, would be needed to quantify this volatility accurately. External factors like economic downturns can significantly impact the stock’s price movements.

L&T Infrastructure’s stock price performance often reflects broader market trends. However, comparing its trajectory with that of other companies offers valuable insights. For instance, a look at the current kraig biocraft stock price reveals a different growth pattern, highlighting the diverse investment landscape. Understanding these contrasting performances helps investors make more informed decisions regarding L&T Infrastructure’s future potential.

What is the dividend payout history of L&T Infrastructure?

The dividend payout history of L&T Infrastructure should be readily available in its annual reports and financial statements. Investors should consult these official sources for accurate and detailed information on dividend payments over time.

Where can I find real-time L&T Infrastructure stock price data?

Real-time stock price data for L&T Infrastructure is available through major financial websites and stock market data providers, such as the National Stock Exchange of India (NSE) website or reputable financial news sources.