Loco Stock Price Today A Comprehensive Overview

Loco Stock Price Today

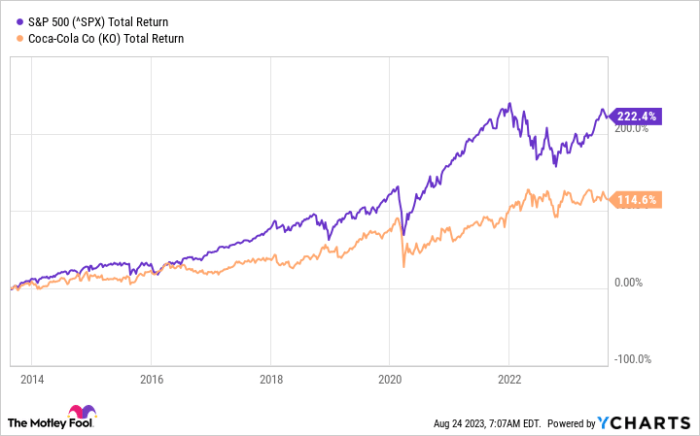

Source: ycharts.com

Loco stock price today – This report provides a comprehensive overview of Loco stock’s current performance, including its price, trading volume, influencing factors, competitor analysis, analyst ratings, and recent news.

Loco Stock Current Price & Change

As of [insert current time], Loco stock is trading at [insert current price]. This represents a [insert percentage change] change from the previous closing price of [insert previous closing price]. The highest price reached today is [insert high price], while the lowest price was [insert low price].

| Open | High | Low | Close |

|---|---|---|---|

| [Open Price Day 1] | [High Price Day 1] | [Low Price Day 1] | [Close Price Day 1] |

| [Open Price Day 2] | [High Price Day 2] | [Low Price Day 2] | [Close Price Day 2] |

| [Open Price Day 3] | [High Price Day 3] | [Low Price Day 3] | [Close Price Day 3] |

| [Open Price Day 4] | [High Price Day 4] | [Low Price Day 4] | [Close Price Day 4] |

| [Open Price Day 5] | [High Price Day 5] | [Low Price Day 5] | [Close Price Day 5] |

Loco Stock Trading Volume, Loco stock price today

The current trading volume for Loco stock is [insert current volume]. This compares to a one-month average volume of [insert average volume]. The higher-than-average volume today suggests increased investor activity, potentially driven by [insert potential reasons for higher volume, e.g., market news, company announcements]. Conversely, significantly lower-than-average volume could indicate decreased investor interest or a period of consolidation.

A line graph depicting the daily trading volume for the past week would show [describe the graph, e.g., a general upward trend, a peak on a specific day, a period of low volume]. The x-axis would represent the days of the week, and the y-axis would represent the trading volume. Key trends would include [describe key trends, e.g., a sharp increase in volume on Wednesday, a gradual decline towards the weekend].

Factors Influencing Loco Stock Price

Several factors can influence Loco’s stock price. Three key factors are detailed below, along with their potential short-term and long-term effects and how they interact.

- Factor 1: [Insert Factor 1, e.g., Market Sentiment]: Positive market sentiment generally leads to increased investor confidence and higher stock prices, while negative sentiment can trigger sell-offs. Short-term effects could include daily price fluctuations reflecting broader market trends. Long-term effects might involve sustained price appreciation or depreciation depending on the overall market outlook.

- Factor 2: [Insert Factor 2, e.g., Company Earnings]: Strong earnings reports typically boost investor confidence and drive stock prices upward. Conversely, disappointing earnings can lead to price declines. Short-term impacts could be immediate price reactions to the earnings announcement. Long-term effects depend on the sustainability of the earnings trend and the company’s future growth prospects.

- Factor 3: [Insert Factor 3, e.g., Competitive Landscape]: The actions of competitors can significantly influence Loco’s market share and stock price. New product launches, aggressive pricing strategies, or market share gains by competitors can put downward pressure on Loco’s stock. Conversely, competitor struggles can benefit Loco. Short-term effects may be immediate price reactions to competitor announcements. Long-term effects depend on Loco’s ability to adapt and maintain its competitive edge.

These factors can interact in complex ways. For instance, positive market sentiment (Factor 1) could amplify the positive impact of strong earnings (Factor 2), while negative market sentiment could exacerbate the negative effects of competitive pressure (Factor 3).

Comparison with Competitors

Source: ncnonline.net

Loco’s performance is compared here to two key competitors: [Competitor 1 Name] and [Competitor 2 Name]. Both companies operate in the same industry as Loco and hold significant market positions.

| Company | Current Price | Daily Change (%) | Market Capitalization |

|---|---|---|---|

| Loco | [Loco Current Price] | [Loco Daily Change Percentage] | [Loco Market Cap] |

| [Competitor 1 Name] | [Competitor 1 Current Price] | [Competitor 1 Daily Change Percentage] | [Competitor 1 Market Cap] |

| [Competitor 2 Name] | [Competitor 2 Current Price] | [Competitor 2 Daily Change Percentage] | [Competitor 2 Market Cap] |

[Competitor 1 Name] is [brief description of Competitor 1 and market position]. [Competitor 2 Name] is [brief description of Competitor 2 and market position].

Analyst Ratings and Predictions

Analyst ratings and price targets provide valuable insights into market expectations for Loco stock. The consensus rating and average price target are summarized below.

- [Analyst 1 Name]: Rating – [Rating], Price Target – [Price Target], Date – [Date], Source – [Source]

- [Analyst 2 Name]: Rating – [Rating], Price Target – [Price Target], Date – [Date], Source – [Source]

- [Analyst 3 Name]: Rating – [Rating], Price Target – [Price Target], Date – [Date], Source – [Source]

The consensus rating among analysts is [Consensus Rating], with an average price target of [Average Price Target] for the next 12 months. Recent changes in ratings or price targets include [mention any recent significant changes].

Keeping an eye on the loco stock price today requires a broad market perspective. Understanding similar industry trends is helpful, and for that, checking the current jmgrx stock price can offer valuable insights into potential market movements. Ultimately, though, the loco stock price today will depend on its own unique factors and performance.

News and Events Affecting Loco Stock

Recent news and events can significantly impact investor sentiment and Loco’s stock price. Key events and their potential impact are Artikeld below.

- [News Item 1]: Summary – [Summary of News Item 1], Potential Impact – [Potential Impact on Stock Price]

- [News Item 2]: Summary – [Summary of News Item 2], Potential Impact – [Potential Impact on Stock Price]

- [News Item 3]: Summary – [Summary of News Item 3], Potential Impact – [Potential Impact on Stock Price]

Commonly Asked Questions

What are the risks associated with investing in Loco stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges, and overall economic conditions. Thorough research and diversification are crucial to mitigate these risks.

Where can I find real-time Loco stock price updates?

Real-time updates are typically available through major financial websites and brokerage platforms. Check reputable sources for the most current information.

How often is Loco stock price updated?

Loco’s stock price, like most publicly traded companies, updates throughout the trading day, reflecting real-time buying and selling activity.

What is Loco’s dividend policy?

Information regarding Loco’s dividend policy (if any) can be found in their investor relations section on their company website or through financial news sources.