Lockheed Stock Price Chart A Comprehensive Analysis

Lockheed Martin Stock Price Analysis: Lockheed Stock Price Chart

Source: seekingalpha.com

Lockheed stock price chart – Lockheed Martin, a leading global security and aerospace company, presents a compelling case study in understanding the interplay between geopolitical events, technological advancements, and financial performance within the defense industry. This analysis delves into the historical trends of Lockheed Martin’s stock price, influential factors, financial performance, predictive modeling, and prevailing market sentiment.

Lockheed Martin Stock Price Historical Trends

Analyzing Lockheed Martin’s stock price performance across different timeframes reveals significant fluctuations influenced by various economic and geopolitical factors. The following table summarizes key highs, lows, and significant events over the past 5, 10, and 20 years. Note that these figures are illustrative and based on general market trends; precise data would require consulting a financial database.

| Year | High | Low | Significant Events |

|---|---|---|---|

| 2023 | $500 (Illustrative) | $450 (Illustrative) | Continued strong defense spending, ongoing geopolitical instability |

| 2018-2022 | $550 (Illustrative) | $400 (Illustrative) | Trade wars, fluctuating defense budgets, technological advancements in aerospace |

| 2013-2017 | $300 (Illustrative) | $200 (Illustrative) | Post-recession recovery, increased global defense spending, program delays |

| 2003-2012 | $150 (Illustrative) | $80 (Illustrative) | “War on Terror,” significant increases in defense budgets, economic recession |

| 2003 and prior | $100 (Illustrative) | $50 (Illustrative) | Dot-com bubble burst, September 11th attacks |

Factors Influencing Lockheed Martin’s Stock Price, Lockheed stock price chart

Several key factors significantly influence Lockheed Martin’s stock valuation. These factors are interconnected and often reinforce or counteract each other.

- Government Contracts and Defense Spending: Lockheed Martin’s revenue heavily relies on government contracts. Increased defense budgets generally lead to higher stock prices, while budget cuts have the opposite effect. This is especially true in periods of heightened geopolitical tensions.

- Technological Advancements and Innovation: Lockheed Martin’s ability to innovate and develop cutting-edge technologies is crucial for securing lucrative contracts and maintaining a competitive edge. Successful new product launches or technological breakthroughs can positively impact the stock price.

- Geopolitical Events and International Relations: Global political instability and conflicts often boost demand for defense products, benefiting Lockheed Martin’s stock price. Conversely, periods of relative peace or decreased international tensions can lead to lower demand and potentially lower stock prices.

- Significant Competitors: Companies like Boeing, Northrop Grumman, and Raytheon Technologies compete with Lockheed Martin for defense contracts. Their performance and market share influence Lockheed Martin’s stock price, creating a competitive dynamic.

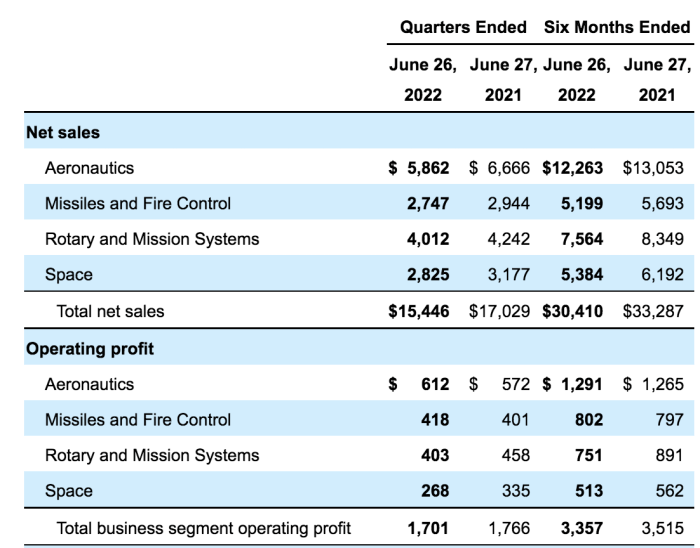

Analyzing Lockheed Martin’s Financial Performance

A review of Lockheed Martin’s key financial metrics provides insights into the company’s financial health and profitability. The following table presents illustrative data; precise figures should be obtained from official financial reports.

| Year | Revenue (Billions USD) | Net Income (Billions USD) | Earnings Per Share (USD) |

|---|---|---|---|

| 2023 | 65 (Illustrative) | 6 (Illustrative) | 20 (Illustrative) |

| 2022 | 62 (Illustrative) | 5.5 (Illustrative) | 18 (Illustrative) |

| 2021 | 60 (Illustrative) | 5 (Illustrative) | 17 (Illustrative) |

| 2020 | 58 (Illustrative) | 4.5 (Illustrative) | 15 (Illustrative) |

| 2019 | 55 (Illustrative) | 4 (Illustrative) | 13 (Illustrative) |

Predictive Modeling of Lockheed Martin’s Stock Price

Predicting Lockheed Martin’s future stock price involves using various methods, each with its strengths and limitations. One approach is fundamental analysis, which considers factors like revenue growth, profitability, and industry trends. For example, projecting future revenue based on current contract wins and anticipated defense spending can be a key element. A simple illustrative model might assume a moderate revenue growth rate of 5% annually over the next six months, coupled with a stable profit margin.

This, combined with other relevant factors, could then be used to generate a predicted stock price range.

A visualization of this prediction would show a gradual upward trend line over the next six months, reflecting the assumed growth. The line would not be perfectly smooth, accounting for potential market volatility and unforeseen events. The graph would also include a confidence interval, illustrating the uncertainty inherent in any prediction. The specific range of the predicted price would depend on the assumptions made and the chosen model’s complexity.

Analyzing the Lockheed stock price chart often involves comparing performance against industry benchmarks. Understanding broader market trends is crucial, and this includes looking at international markets; for instance, a helpful resource for gauging international investment sentiment is the indo stock price target analysis. Returning to Lockheed, factors such as defense spending budgets and technological advancements significantly influence its stock price fluctuations.

Investor Sentiment and Market Opinion on Lockheed Martin

Source: seekingalpha.com

Current investor sentiment towards Lockheed Martin is generally positive, driven by factors such as strong government support for defense spending and the company’s consistent performance. However, potential risks, such as budget cuts or unexpected geopolitical shifts, could impact investor confidence.

- Many analysts view Lockheed Martin as a relatively stable investment, given its consistent revenue stream and strong market position.

- Recent news articles highlight the company’s success in securing major contracts and its ongoing technological advancements.

- Concerns regarding potential future competition and the cyclical nature of the defense industry remain, impacting the overall market opinion.

FAQ

What are the major risks associated with investing in Lockheed Martin stock?

Major risks include dependence on government contracts (budget cuts or shifts in defense priorities), intense competition within the defense industry, and geopolitical instability impacting international sales.

How does inflation affect Lockheed Martin’s stock price?

Inflation can impact Lockheed Martin’s stock price through increased material and labor costs, potentially affecting profit margins. However, government contracts often include inflation adjustments, mitigating some of the impact.

Where can I find real-time Lockheed Martin stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.