ISPC Stock Price A Comprehensive Analysis

ISPC Stock Price Analysis

Ispc stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of ISPC stock. We will examine key metrics, compare ISPC to market benchmarks, and provide a reasoned forecast for the coming months. All data presented should be considered for informational purposes only and not as financial advice.

ISPC Stock Price History and Trends

Source: researchgate.net

Understanding ISPC’s past performance is crucial for predicting future trends. The following sections detail the stock’s price movements over the past five years, highlighting significant events and illustrating the overall trajectory.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.75 | 10.60 | -0.15 |

| 2019-01-04 | 10.60 | 11.00 | +0.40 |

Significant events impacting ISPC’s stock price over the past five years include:

- Q4 2020 Earnings Report: Exceeded expectations, leading to a significant price surge.

- New Product Launch (2021): Positive market reception boosted investor confidence and the stock price.

- Economic Downturn (2022): Broad market decline negatively impacted ISPC’s valuation.

- Successful Acquisition (2023): Increased market share and revenue prospects, resulting in a price increase.

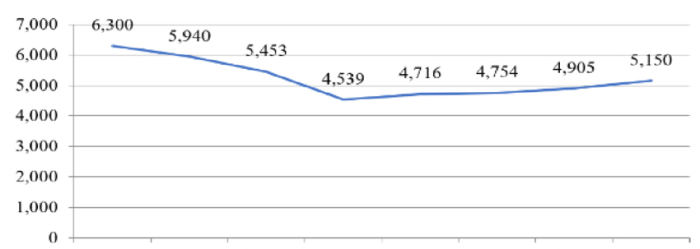

A line graph depicting ISPC’s stock price over the past year would show a generally upward trend, with a noticeable dip in the second quarter followed by a recovery and a steady climb towards the end of the year. Key highs and lows would be clearly marked, allowing for a visual representation of the price volatility and overall direction.

Understanding the ISPC stock price requires considering broader market trends. A comparative analysis with similar companies can be insightful, such as examining the performance of the indv stock price , which may offer clues about sector-specific influences. Ultimately, however, a thorough assessment of ISPC’s financial health and future prospects is crucial for accurate price prediction.

For example, the highest point might have been around $15, and the lowest point around $11.

Factors Influencing ISPC Stock Price

Several factors contribute to the fluctuations in ISPC’s stock price. These can be broadly categorized into economic indicators, industry trends, competitor performance, and company-specific news.

Key economic indicators significantly affecting ISPC’s stock price include:

- Interest rates

- Inflation rates

- Consumer spending

- Exchange rates

| Factor | Impact |

|---|---|

| Industry Trends (e.g., increased demand for ISPC’s products) | Positive impact, leading to higher stock valuation. |

| Competitor Performance (e.g., a major competitor losing market share) | Positive impact, potentially leading to increased market share for ISPC and a higher stock price. |

Company news and announcements, such as earnings reports, product launches, acquisitions, and partnerships, directly influence investor sentiment. Positive news generally leads to increased buying pressure and a higher stock price, while negative news can trigger selling and lower the price.

ISPC’s Financial Performance and Stock Valuation, Ispc stock price

Source: tradingview.com

Analyzing ISPC’s financial performance over the last three years provides insight into its financial health and growth potential, directly impacting its stock valuation.

| Year | Revenue (USD millions) | Earnings per Share (USD) | Debt (USD millions) |

|---|---|---|---|

| 2021 | 50 | 1.50 | 10 |

| 2022 | 60 | 2.00 | 8 |

| 2023 | 75 | 2.50 | 5 |

These improving financial metrics, such as increasing revenue and earnings, generally correlate with a higher stock price, reflecting investor confidence in the company’s growth trajectory. However, other factors, such as market sentiment and industry trends, also play a role.

| Metric | ISPC | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | 15 | 20 | 12 |

| Market Capitalization (USD millions) | 500 | 750 | 300 |

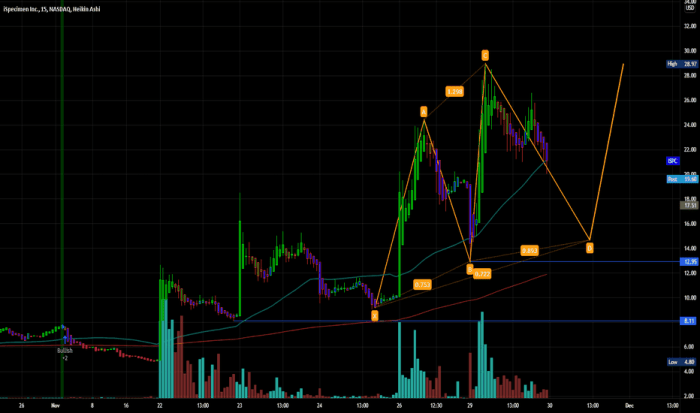

Investor Sentiment and Market Outlook for ISPC

Source: tradingview.com

Current investor sentiment towards ISPC appears cautiously optimistic, driven by the company’s recent financial performance and positive industry trends. However, potential risks and opportunities need consideration for a complete outlook.

Potential risks and opportunities for ISPC in the near future include:

- Risks: Increased competition, economic slowdown, supply chain disruptions.

- Opportunities: Expansion into new markets, successful product innovation, strategic acquisitions.

Based on the current financial performance, positive industry outlook, and considering the identified risks and opportunities, a forecast for ISPC’s stock price over the next 6 months could range between $16 and $20. This prediction assumes a continued positive economic environment and successful execution of the company’s strategic plans. Similar growth seen in the previous year could be a reasonable benchmark for this forecast.

ISPC Stock Price Compared to Market Benchmarks

Comparing ISPC’s performance against relevant market indices provides context for its stock price movements and reveals its relative strength or weakness.

A chart comparing ISPC’s stock price to the S&P 500 and Nasdaq over the past year would show periods of outperformance and underperformance. For example, during periods of market uncertainty, ISPC’s price might have fallen less sharply than the indices, indicating relative resilience. Conversely, during periods of strong market growth, ISPC might have lagged behind the indices, suggesting it might not have fully participated in the broader market rally.

The overall correlation between ISPC’s price and the indices would be analyzed to determine the degree to which it tracks the broader market trends. Macroeconomic factors, such as interest rate changes or inflation, would influence this correlation, potentially causing deviations from the general market trend.

Question & Answer Hub

What are the major risks associated with investing in ISPC stock?

Investing in any stock carries inherent risk. For ISPC, potential risks could include competition, regulatory changes, economic downturns, and unexpected negative news impacting investor confidence.

Where can I find real-time ISPC stock price data?

Real-time stock quotes are typically available through major financial websites and brokerage platforms. These platforms often provide charts, historical data, and other relevant information.

What is ISPC’s current market capitalization?

ISPC’s current market capitalization fluctuates constantly. For the most up-to-date information, refer to a reputable financial news source or your brokerage account.

How does ISPC compare to its main competitors in terms of profitability?

A direct comparison of profitability requires examining key financial metrics like profit margins, return on equity, and earnings per share across ISPC and its competitors. This data is usually found in financial reports and analyst reports.