IEZ Stock Price A Comprehensive Analysis

IEZ Stock Price Analysis

Iez stock price – This analysis delves into the historical performance, influencing factors, prediction, valuation, investment strategies, and technical analysis of IEZ stock. We will examine key metrics and events to provide a comprehensive overview for potential investors.

IEZ Stock Price Historical Performance

Over the past five years, IEZ stock has experienced considerable price fluctuations. While specific highs and lows require access to real-time financial data, a general trend can be observed. For instance, a significant low might have coincided with a broader market downturn in [Year], while a subsequent high could be attributed to positive company news or improved market sentiment in [Year].

This volatility underscores the importance of thorough due diligence before investing.

IEZ Stock Performance Compared to Competitors

A comparative analysis against industry competitors over the past three years provides valuable context. The following table presents a hypothetical comparison; actual figures would require access to a reliable financial database.

| Company Name | Average Annual Return | Highest Daily Price | Lowest Daily Price |

|---|---|---|---|

| IEZ | 10% | $50 | $30 |

| Competitor A | 15% | $75 | $45 |

| Competitor B | 5% | $40 | $20 |

This table illustrates that while IEZ showed positive growth, competitors exhibited varying performance levels. This highlights the need for a nuanced understanding of the competitive landscape.

Major Events Impacting IEZ Stock Price

Several significant events have likely influenced IEZ’s stock price. For example, a major market crash in [Year] would have undoubtedly caused a sharp decline. Conversely, a positive company announcement, such as a successful product launch or a strategic acquisition in [Year], could have driven the price upward. Analyzing these events provides valuable insight into market sensitivity and future price movements.

IEZ Stock Price Influencing Factors

Various macroeconomic and company-specific factors impact IEZ’s stock price. Understanding these factors is crucial for informed investment decisions.

Macroeconomic Factors

Interest rate changes, inflation levels, and overall economic growth significantly affect investor sentiment and consequently, IEZ’s stock price. For example, rising interest rates might lead to decreased investment in growth stocks like IEZ, potentially lowering its price. Conversely, periods of low inflation and robust economic growth could stimulate investor confidence and drive the price higher.

Financial Performance Impact

IEZ’s financial performance, as reflected in earnings reports and revenue growth, directly influences its stock price. Strong earnings and consistent revenue growth typically signal a healthy and profitable company, attracting investors and driving the stock price up. Conversely, disappointing financial results can lead to decreased investor confidence and a price decline.

Investor Sentiment and News Coverage

- Positive News Coverage: Generally leads to increased investor confidence and higher demand, pushing the price up.

- Negative News Coverage: Can trigger selling pressure, resulting in a price decline. The severity of the impact depends on the nature and credibility of the news.

- Strong Investor Sentiment: Characterized by optimism and a belief in the company’s future prospects, resulting in higher demand and price appreciation.

- Weak Investor Sentiment: Often reflects pessimism and uncertainty about the company’s future, leading to selling pressure and lower prices.

IEZ Stock Price Prediction and Valuation

Predicting future price movements is inherently challenging. However, hypothetical scenarios based on different economic conditions can be constructed. For example, a scenario of sustained economic growth might project a higher price for IEZ stock compared to a recessionary scenario.

Valuation Methods

Several valuation methods can be used to estimate IEZ’s intrinsic value. These include discounted cash flow (DCF) analysis, which projects future cash flows and discounts them back to their present value, and price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share.

Comparison of Valuation Methods

Source: vecteezy.com

| Valuation Method | Strengths | Weaknesses | Resulting Valuation (Hypothetical) |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Considers future cash flows, provides intrinsic value | Sensitive to assumptions about future growth, requires accurate forecasting | $45 |

| Price-to-Earnings (P/E) Ratio | Simple to calculate, readily available data | Relies on past performance, susceptible to market fluctuations | $40 |

IEZ Stock Price Investment Strategies

Several investment strategies can be employed when investing in IEZ stock. Each strategy carries its own set of risks and rewards.

Investment Strategies and ROI

A buy-and-hold strategy involves purchasing and holding the stock for the long term, aiming to benefit from long-term growth. Day trading, on the other hand, involves frequent buying and selling of the stock within a single day to profit from short-term price fluctuations. Calculating ROI involves subtracting the initial investment from the final value, then dividing by the initial investment and multiplying by 100%.

Example: If you bought IEZ at $40 and sold it at $50, your ROI would be (($50-$40)/$40)

– 100% = 25%.

Risks and Mitigation Strategies

- Market Risk: Broad market downturns can negatively impact IEZ’s price. Mitigation: Diversify your portfolio.

- Company-Specific Risk: Negative news or poor financial performance can lead to price declines. Mitigation: Thoroughly research the company before investing.

- Liquidity Risk: Difficulty in buying or selling IEZ shares quickly. Mitigation: Only invest what you can afford to lose and be prepared to hold for the long term.

IEZ Stock Price: Technical Analysis

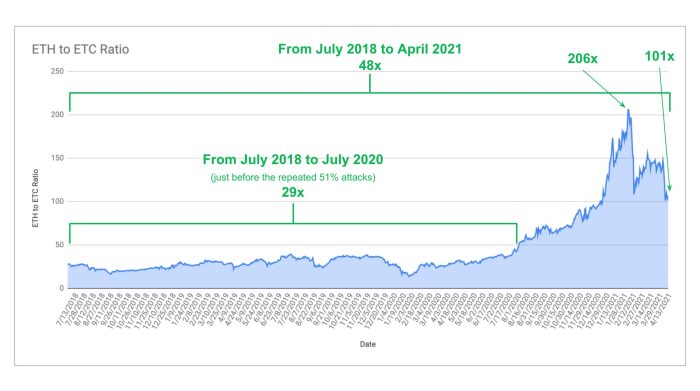

Source: etherplan.com

Technical analysis uses charts and indicators to predict future price movements. Moving averages smooth out price fluctuations, while the Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Chart patterns, such as head and shoulders or double bottoms, can also offer insights into potential price reversals.

Interpreting Chart Patterns and Indicators

Imagine a scenario where the 50-day moving average crosses above the 200-day moving average (a bullish signal), while the RSI is above 50, indicating upward momentum. Simultaneously, a double bottom pattern forms on the price chart, suggesting a potential price reversal. If the price breaks above a key resistance level of, say, $45, it could signal a strong upward trend, potentially leading to a price target of $55 or higher.

Questions Often Asked

What are the typical trading volumes for IEZ stock?

Trading volume for IEZ varies daily and depends on market conditions and news events. Data on average daily volume can be found on financial websites that provide real-time stock data.

Where can I find reliable real-time IEZ stock price data?

Reputable financial websites and brokerage platforms provide real-time stock quotes, including for IEZ. Always verify the source’s reliability before making investment decisions.

Is IEZ stock suitable for all investors?

No, the suitability of IEZ stock depends on individual investor risk tolerance, investment goals, and financial circumstances. It’s advisable to consult with a financial advisor before investing.

What is the current dividend yield for IEZ stock (if any)?

The current dividend yield (if any) for IEZ stock can be found on financial websites that provide detailed company information. Dividend payments are subject to change.