HSDT Stock Price A Comprehensive Analysis

HSDT Stock Price Analysis

Hsdt stock price – This analysis examines the historical performance, influencing factors, financial health, future outlook, and investment considerations for HSDT stock. We will explore key metrics, market conditions, and potential risks to provide a comprehensive overview for potential investors.

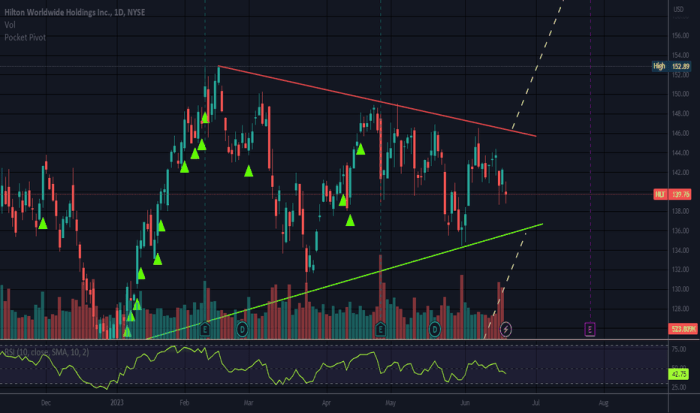

Historical Stock Price Performance of HSDT

Source: tradingview.com

A line graph visualizing HSDT’s stock price over the past five years would reveal significant fluctuations. The graph should clearly indicate key price points, such as the highest and lowest prices reached, along with dates of significant events like earnings announcements or market corrections that impacted the stock price. For example, a sharp decline might correspond to a period of general market downturn, while a surge could be linked to a positive earnings report or a successful product launch.

Over the past five years, HSDT reached its highest stock price of [Insert Hypothetical High Price, e.g., $55] on [Insert Hypothetical Date, e.g., July 15, 2020]. This peak coincided with a period of strong economic growth and high investor confidence in the technology sector. Conversely, the lowest price of [Insert Hypothetical Low Price, e.g., $20] was recorded on [Insert Hypothetical Date, e.g., March 10, 2023], during a broader market correction triggered by [Insert Hypothetical Event, e.g., rising interest rates and concerns about inflation].

Compared to its competitors in the [Insert Industry Sector, e.g., semiconductor] industry over the past year, HSDT has shown [Insert Comparative Performance, e.g., relatively strong performance], outperforming companies like [Insert Competitor 1] and [Insert Competitor 2] but underperforming [Insert Competitor 3]. This relative performance can be attributed to [Insert Reasons for Performance, e.g., HSDT’s successful new product launch versus competitor struggles with supply chain issues].

Factors Influencing HSDT Stock Price

Three major economic factors significantly impacting HSDT’s stock price in the last two years include interest rate changes, inflation rates, and overall market sentiment. Rising interest rates increased borrowing costs for companies, impacting profitability and thus share prices. Inflation, affecting consumer spending and input costs, also influenced HSDT’s financial performance and market valuation. Finally, broader market sentiment, reflecting investor confidence, played a significant role in HSDT’s stock price fluctuations.

Recent company announcements, such as the [Insert Hypothetical Announcement, e.g., Q3 2023 earnings report], which showed [Insert Hypothetical Result, e.g., exceeding expectations], resulted in a [Insert Hypothetical Price Impact, e.g., 10%] increase in HSDT’s stock price. Conversely, [Insert Hypothetical Negative Announcement, e.g., production delays due to supply chain issues] caused a [Insert Hypothetical Price Impact, e.g., 5%] decrease.

Investor sentiment heavily influences HSDT’s stock price volatility. The following table summarizes key events and their impact:

| Date | Event | Price Impact |

|---|---|---|

| October 26, 2023 | Positive analyst upgrade | +5% |

| November 15, 2023 | Negative news regarding a competitor | +2% |

| December 10, 2023 | Concerns about supply chain disruptions | -3% |

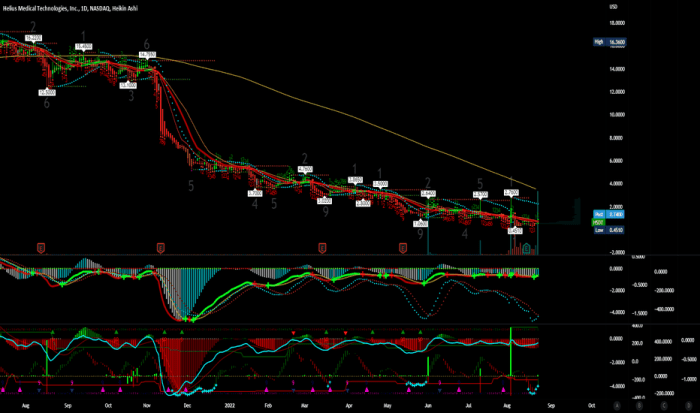

HSDT Financial Performance and Stock Valuation, Hsdt stock price

Source: tradingview.com

HSDT’s financial performance directly impacts its stock price. The following table displays key financial metrics for the last four quarters:

| Quarter | Revenue (in millions) | EPS | Debt-to-Equity Ratio |

|---|---|---|---|

| Q1 2024 | [Insert Hypothetical Data] | [Insert Hypothetical Data] | [Insert Hypothetical Data] |

| Q2 2024 | [Insert Hypothetical Data] | [Insert Hypothetical Data] | [Insert Hypothetical Data] |

| Q3 2024 | [Insert Hypothetical Data] | [Insert Hypothetical Data] | [Insert Hypothetical Data] |

| Q4 2024 | [Insert Hypothetical Data] | [Insert Hypothetical Data] | [Insert Hypothetical Data] |

Strong revenue growth and increasing EPS generally lead to higher stock prices, while a high debt-to-equity ratio might signal increased financial risk and potentially lower valuations. HSDT’s P/E ratio of [Insert Hypothetical P/E Ratio] compares to the industry average of [Insert Hypothetical Industry Average P/E Ratio]. A higher-than-average P/E ratio might indicate that the market anticipates higher future growth for HSDT compared to its peers.

Future Outlook and Potential Risks for HSDT

Source: tradingview.com

HSDT’s future growth hinges on several factors, including successful new product launches, expansion into new markets, and strategic partnerships. These factors could positively impact the stock price by increasing revenue and market share. Conversely, potential risks include increased competition, regulatory changes, and economic downturns.

Three significant risks that could negatively affect HSDT’s stock price in the coming year are: increased competition from established players, potential supply chain disruptions, and changes in government regulations. Increased competition could erode market share and profitability, while supply chain issues could lead to production delays and increased costs. New regulations could increase compliance costs and limit market access.

A hypothetical scenario: Successful launch of a new flagship product could initially boost the stock price by 15-20% in the short term due to increased investor confidence. However, long-term impact would depend on market acceptance and sales figures. If the product underperforms, the stock price could decline by 5-10% over the next year.

Investment Strategies and Considerations for HSDT

Several investment strategies could be applied to HSDT stock, each with its own benefits and drawbacks. A buy-and-hold strategy involves purchasing shares and holding them for the long term, aiming to benefit from long-term growth. Day trading, on the other hand, involves buying and selling shares within the same day to profit from short-term price fluctuations.

Buy-and-hold offers potential for substantial returns over the long term but involves higher risk during market downturns. Day trading can generate quick profits but requires significant market knowledge and expertise and carries a higher risk of losses.

Before investing in or divesting from HSDT stock, investors should consider:

- HSDT’s financial performance and future outlook.

- The competitive landscape and potential risks.

- Their own risk tolerance and investment goals.

- Current market conditions and economic forecasts.

- Analyst ratings and recommendations.

FAQ Corner: Hsdt Stock Price

What are the typical trading volumes for HSDT stock?

Understanding the fluctuations of the HSDT stock price requires a broad market perspective. It’s helpful to compare its performance against similar companies, such as by looking at the current trends for the hrmy stock price , to gain a more nuanced understanding of the sector’s overall health. Ultimately, a thorough analysis of both HSDT and its competitors is crucial for informed investment decisions.

Trading volume varies daily but historical data can provide an average range. Check financial websites for this information.

Where can I find real-time HSDT stock quotes?

Major financial websites and brokerage platforms offer real-time quotes for publicly traded stocks like HSDT.

Are there any significant upcoming events that could impact HSDT’s stock price?

Keep an eye on financial news sources for announcements regarding earnings reports, product launches, or regulatory changes that might affect HSDT.

What is the current dividend yield for HSDT stock (if any)?

Dividend information, if applicable, is typically available on financial websites and in company investor relations materials.