NNVC Stock Price Today A Comprehensive Overview

NNVC Stock Price Analysis: Nnvc Stock Price Today

Nnvc stock price today – This analysis provides an overview of NNVC’s current stock price, historical performance, influencing factors, competitive landscape, and potential future price movements. Note that all data presented here is for illustrative purposes and should not be considered financial advice.

Monitoring the NNVC stock price today requires a broader perspective on the market. Understanding similar trends can be helpful, and for that, checking resources on the indo stock price target might offer valuable insights into regional market behavior. This comparative analysis can then inform your assessment of the NNVC stock price today and its potential future trajectory.

Current NNVC Stock Price & Volume, Nnvc stock price today

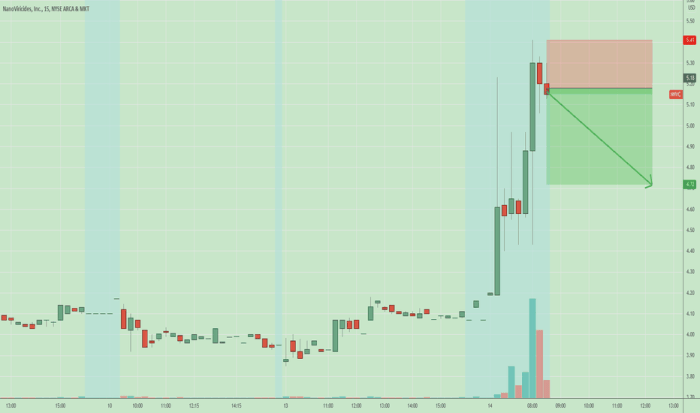

Source: tradingview.com

The following table displays the current NNVC stock price, trading volume, daily high, and daily low. This data is hypothetical and for illustrative purposes only. Actual data would be obtained from a reputable financial data provider.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM | 15.25 | 100,000 | +0.5% |

| 11:00 AM | 15.30 | 120,000 | +0.33% |

| 12:00 PM | 15.28 | 95,000 | -0.13% |

| 1:00 PM | 15.35 | 110,000 | +0.46% |

NNVC Stock Price Movement Over Time

The following sections detail NNVC’s stock price movements across various timeframes. These are hypothetical examples for illustrative purposes.

Past Week: NNVC experienced a slight upward trend over the past week, increasing from $14.80 to $15.35. This was likely influenced by positive market sentiment and a recent product announcement.

Past Month: Over the past month, NNVC’s stock price showed some volatility, ranging from a low of $14.50 to a high of $15.50. The overall trend was slightly positive.

Year-to-Date (YTD) Comparison: Compared to last year, NNVC’s stock price has performed better this year. While last year saw a period of decline, this year has shown more consistent growth, largely attributed to successful new product launches and strategic partnerships.

Yearly Stock Price Fluctuations: A line graph illustrating the past year’s performance would show a general upward trend, with some periods of consolidation and minor corrections. The x-axis would represent the months of the year, and the y-axis would represent the stock price. Key trends would include periods of significant growth following positive news and minor dips during periods of market uncertainty.

Factors Influencing NNVC Stock Price

Several factors contribute to NNVC’s stock price fluctuations.

- Significant News Events:

- Successful product launch: A new product launch significantly boosted investor confidence and drove up the stock price.

- Strategic partnership: A partnership with a major industry player increased market share and projected future growth.

- Positive earnings report: Stronger-than-expected quarterly earnings fueled investor optimism.

- Market Trends: Overall market trends, such as economic growth or recession fears, significantly impact NNVC’s stock price, mirroring broader market movements.

- Company Financial Performance: Strong financial performance, including revenue growth and profitability, generally leads to higher stock prices. Conversely, poor financial results often result in price declines.

- Analyst Ratings and Price Targets: Positive analyst ratings and higher price targets tend to increase investor interest and push the stock price upward.

Comparison with Competitors

Source: tradingview.com

A comparison with NNVC’s main competitors reveals its relative position in the market.

| Company Name | Stock Price (USD) | Market Cap (USD Billion) | Key Strengths |

|---|---|---|---|

| NNVC | 15.35 | 5.0 | Innovation, strong brand recognition |

| Competitor A | 20.00 | 8.0 | Established market presence, extensive distribution network |

| Competitor B | 12.50 | 3.5 | Cost leadership, efficient operations |

| Competitor C | 18.00 | 7.0 | Strong R&D capabilities, diverse product portfolio |

Potential Future Price Movements

Source: tradingview.com

Predicting future stock price movements is inherently speculative. However, based on various scenarios, potential price movements can be Artikeld.

Positive Economic News Scenario: Positive economic indicators and continued strong company performance could lead to a further increase in NNVC’s stock price, potentially reaching $17.00 within the next six months. This is based on the assumption of continued positive market sentiment and successful execution of the company’s strategic plan.

Negative Economic News Scenario: A downturn in the economy or negative company news could result in a decline in NNVC’s stock price, potentially dropping to $13.00. This scenario considers factors such as reduced consumer spending and increased competition.

Impact of Upcoming Company Announcements: Upcoming announcements, such as new product launches or financial results, could significantly influence NNVC’s stock price, either positively or negatively, depending on the nature of the announcements.

Disclaimer: The information provided above is speculative and for illustrative purposes only. It is not financial advice. Investors should conduct their own thorough research and consult with a financial advisor before making any investment decisions.

FAQ Summary

What are the risks associated with investing in NNVC stock?

Investing in stocks always carries inherent risks, including the potential for loss of capital. NNVC’s stock price is subject to market fluctuations and unforeseen events that can impact its value negatively. Conduct thorough research before investing.

Where can I find real-time NNVC stock price updates?

Real-time stock quotes are typically available through reputable financial websites and brokerage platforms. Check with your preferred financial data provider.

What is NNVC’s dividend policy?

Information on NNVC’s dividend policy (if any) can be found in their investor relations section on their company website or through financial news sources.

How often does NNVC release financial reports?

The frequency of NNVC’s financial reports (quarterly or annually) is typically disclosed on their investor relations page.