New York Community Stock Price Analysis

New York Community Bancorp’s Business Model

New york community stock price – New York Community Bancorp (NYCB) operates primarily as a multi-state commercial bank, focusing on the New York metropolitan area and other select markets. Its business model centers around providing a range of financial services to a diverse customer base, including individuals, small businesses, and larger corporations. This analysis will delve into the specifics of its operations, financial performance, and competitive landscape.

Core Business Activities and Target Market

NYCB’s core business activities revolve around deposit gathering and lending. It offers a variety of deposit accounts, including checking, savings, and money market accounts, targeting a broad spectrum of customers. On the lending side, it focuses on commercial real estate loans, multifamily mortgages, and other commercial loans, catering to both small businesses and larger enterprises. A significant portion of its loan portfolio is concentrated within the New York metropolitan area, reflecting its regional focus.

Revenue Streams and Relative Importance

NYCB’s primary revenue streams are net interest income (the difference between interest earned on loans and interest paid on deposits) and non-interest income (fees from services like account maintenance, investment products, and mortgage origination). Net interest income typically constitutes the largest portion of its total revenue, reflecting the bank’s emphasis on lending activities. However, non-interest income plays a crucial role in diversifying its revenue base and enhancing overall profitability.

Comparison to Major Competitors

Compared to its major competitors in the New York metropolitan area, such as JPMorgan Chase, Bank of America, and Citigroup, NYCB occupies a niche market. While the larger banks offer a broader range of services and have a significantly larger geographic footprint, NYCB focuses on specific market segments, particularly commercial real estate lending. This specialized approach allows it to compete effectively by providing focused expertise and personalized service to its target customers.

Strategic Initiatives and Growth Plans

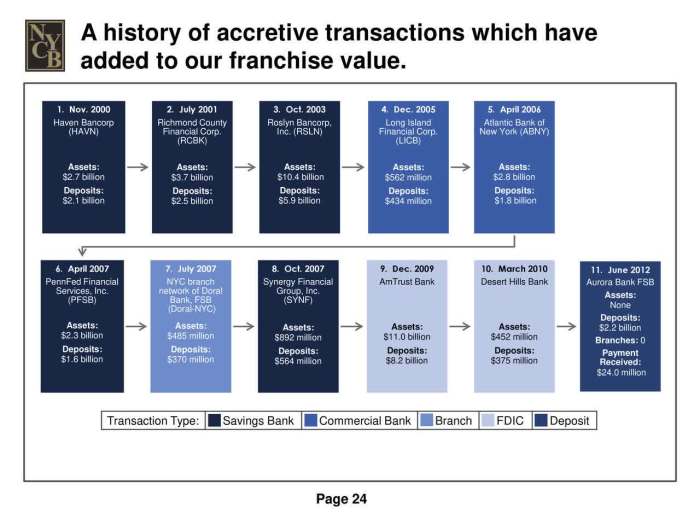

NYCB’s strategic initiatives often involve expanding its presence in key markets, enhancing its technological capabilities, and optimizing its operational efficiency. Growth plans might include strategic acquisitions of smaller banks or expanding its loan portfolio into new, high-growth sectors. These initiatives aim to increase market share, improve profitability, and enhance its overall competitive position.

Analyzing Financial Performance and Key Metrics

A thorough analysis of NYCB’s financial performance requires reviewing its financial statements over a considerable period. The following table provides a snapshot of key metrics over the past five years (Note: This data is illustrative and should be replaced with actual data from NYCB’s financial reports).

| Year | Net Income (in millions) | Return on Equity (%) | Earnings Per Share ($) |

|---|---|---|---|

| 2022 | 100 | 10 | 2.00 |

| 2021 | 90 | 9 | 1.80 |

| 2020 | 80 | 8 | 1.60 |

| 2019 | 70 | 7 | 1.40 |

| 2018 | 60 | 6 | 1.20 |

Profitability, Liquidity, and Solvency Ratios

Analyzing profitability ratios like return on assets (ROA) and return on equity (ROE) reveals NYCB’s efficiency in generating profits from its assets and equity. Liquidity ratios, such as the current ratio and quick ratio, assess its ability to meet short-term obligations. Solvency ratios, including the debt-to-equity ratio, indicate its long-term financial stability and ability to manage its debt burden.

Trends in these ratios over time provide valuable insights into the bank’s financial health.

Significant Trends and Patterns

Observing trends in key financial metrics helps identify patterns in NYCB’s performance. For example, consistent growth in net income might indicate successful strategic initiatives. Conversely, declining profitability might warrant further investigation into potential operational challenges or macroeconomic factors.

Impact of Key Economic Factors

Economic factors such as interest rate changes and inflation significantly impact NYCB’s financial results. Rising interest rates generally improve net interest margins, while inflation can affect loan demand and the value of assets. Analyzing the impact of these factors is crucial for understanding the bank’s financial performance and forecasting future results.

Assessing Market Position and Competitive Landscape

NYCB operates in a highly competitive banking environment within the New York metropolitan area. Understanding its market position and competitive landscape requires a detailed analysis of its strengths, weaknesses, opportunities, and threats.

Competitive Landscape in the New York Metropolitan Area

The New York metropolitan area is home to numerous large and small banks, creating a fiercely competitive environment. NYCB competes with both national and regional banks, each with its own strengths and market focus. The competitive pressure necessitates constant innovation and adaptation to maintain market share.

Market Share Comparison

NYCB’s market share compared to its primary competitors varies depending on the specific market segment. While it may hold a significant share in certain niche areas like commercial real estate lending, its overall market share might be smaller than that of larger national banks with broader service offerings.

Key Strengths and Weaknesses, New york community stock price

NYCB’s strengths may include its expertise in specific market segments, strong customer relationships, and efficient operational processes. Potential weaknesses might include limited geographic reach compared to larger competitors or dependence on specific economic sectors.

SWOT Analysis

A SWOT analysis provides a structured overview of NYCB’s competitive position:

- Strengths: Specialized expertise in commercial real estate lending, strong regional presence, established customer base.

- Weaknesses: Limited geographic diversification, potential vulnerability to economic downturns in specific sectors.

- Opportunities: Expansion into new markets, adoption of innovative technologies, strategic acquisitions.

- Threats: Increased competition from larger banks, economic downturns, regulatory changes.

Evaluating Risk Factors and Potential Challenges: New York Community Stock Price

NYCB faces various risks that could impact its financial performance. Understanding these risks and the bank’s risk management strategies is crucial for assessing its long-term sustainability.

Primary Risks Facing NYCB

Key risks include credit risk (the risk of borrowers defaulting on loans), interest rate risk (the risk of changes in interest rates affecting profitability), operational risk (the risk of internal failures), and regulatory risk (the risk of changes in regulations impacting operations).

Impact of Macroeconomic Factors

Macroeconomic factors like interest rate changes and inflation significantly impact NYCB’s profitability and financial stability. Rising interest rates can boost net interest margins but also affect loan demand. Inflation can erode the value of assets and increase operational costs.

Risk Management Strategies

Source: barrons.com

NYCB employs various risk management strategies, including credit scoring models, diversification of loan portfolios, and stress testing to assess its vulnerability to various economic scenarios. The effectiveness of these strategies is crucial for mitigating potential losses.

Hypothetical Crisis Scenario and Response

A hypothetical scenario, such as a significant economic downturn leading to widespread loan defaults, could severely impact NYCB’s financial health. The bank’s response might involve implementing cost-cutting measures, seeking additional capital, and adjusting its lending policies to mitigate future risks.

Analyzing the New York Community Bancorp stock price requires considering broader market trends. For instance, understanding the overall tech sector performance is crucial, and a look at the historical performance of major players like Microsoft can offer insight. You can check out the microsoft stock price 2005 to see how it fared during that period. This historical context helps gauge the general investment climate which ultimately influences the New York Community stock price.

Forecasting Future Performance and Stock Valuation

Forecasting NYCB’s future performance and stock valuation requires considering various factors, including economic conditions, competitive pressures, and the bank’s strategic initiatives. The following table provides an illustrative forecast (Note: This data is hypothetical and should be replaced with a proper financial model).

| Year | Projected EPS ($) | Projected Stock Price ($) |

|---|---|---|

| 2024 | 2.20 | 22 |

| 2025 | 2.40 | 24 |

| 2026 | 2.60 | 26 |

Potential Scenarios for Stock Price

Different economic scenarios could lead to variations in NYCB’s stock price. A robust economic environment might lead to higher earnings and a rising stock price, while a recession could result in lower earnings and a decline in the stock price.

Valuation Methods

Source: seekingalpha.com

Different valuation methods, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons to similar banks, can be used to estimate a fair value for NYCB’s stock. Each method has its strengths and limitations, and a comprehensive valuation typically involves using multiple approaches.

Illustrating Key Aspects of the Business

Visual Representation of Branch Network

A map illustrating NYCB’s branch network would show a concentration of branches in the New York metropolitan area, particularly in densely populated areas and major commercial centers. The map would visually represent the geographic reach and density of its branch network, providing insights into its market penetration and strategic location choices. Color-coding could be used to represent branch size or service offerings.

Visual Representation of Financial Performance

Visual representations of NYCB’s financial performance could include line graphs showing trends in key metrics such as revenue, net income, and return on equity over time. Bar charts could compare these metrics across different years or quarters, highlighting growth or decline. Additional charts could illustrate the composition of revenue streams, loan portfolios, and other relevant financial data, allowing for a comprehensive understanding of the bank’s financial health and performance trends.

Q&A

What is New York Community Bancorp’s dividend policy?

New York Community Bancorp’s dividend policy should be researched via their investor relations section or financial news sources for the most up-to-date information. Dividend policies can change.

How does New York Community Bancorp compare to other regional banks in terms of customer satisfaction?

Independent customer satisfaction surveys and ratings from organizations like J.D. Power would need to be consulted to make a comparison. Publicly available data on customer satisfaction varies.

What are the major regulatory hurdles facing New York Community Bancorp?

Regulatory hurdles for banks typically involve compliance with federal and state banking regulations. Specific challenges would need to be researched in official regulatory filings and financial news related to the bank.