Neo Stock Price Prediction A Comprehensive Analysis

Neo Stock Price Prediction: A Comprehensive Analysis

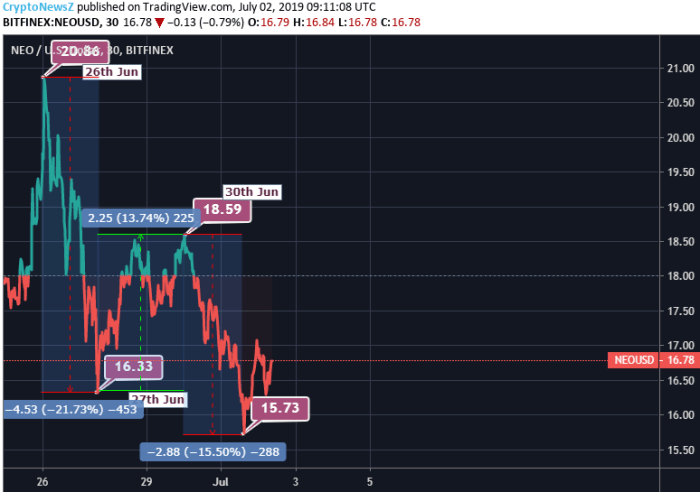

Source: cryptonewsz.com

Neo stock price prediction – Predicting stock prices is inherently complex, involving a multifaceted interplay of market forces, company performance, and external factors. This analysis delves into Neo’s current market position, financial health, and the external influences shaping its stock price. We will explore predictive modeling techniques, visualize historical trends, and assess the risks associated with investing in Neo stock, providing a comprehensive overview for informed decision-making.

Neo’s Market Position and Financial Performance

Neo’s standing in the financial market is currently characterized by [Describe Neo’s current market capitalization and market share relative to competitors. Include specific competitor names if possible, e.g., “compared to competitors like Company X and Company Y, Neo holds a [percentage]% market share.”]. Key factors driving its stock price volatility include [List key factors, such as market sentiment towards the technology sector, regulatory changes impacting the company’s operations, and the company’s own announcements of financial results or new product launches].

Neo’s recent financial performance has [Describe recent financial performance – e.g., “shown strong revenue growth but lower than expected profit margins,” or “experienced a decline in revenue due to [reason],” etc.]. This has impacted investor sentiment [Describe the impact on investor sentiment – e.g., “negatively, leading to a decrease in the stock price,” or “positively, resulting in increased investor confidence,” etc.].

Compared to similar companies, Neo’s valuation metrics, such as [Mention specific metrics like Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), etc.], are [Compare Neo’s metrics to industry averages or competitor metrics. Use specific numbers if possible].

Neo’s Financial Health Breakdown, Neo stock price prediction

Neo’s revenue primarily stems from [List Neo’s main revenue streams, e.g., subscription fees, advertising revenue, etc.]. Profitability is currently [Describe Neo’s profitability – e.g., “strong, with consistent profit margins,” or “under pressure due to increased operating costs,” etc.]. The company’s debt levels are [Describe Neo’s debt levels and the implications for its future growth – e.g., “relatively low, providing financial flexibility,” or “high, potentially limiting future expansion,” etc.].

Neo’s cash flow situation is [Describe Neo’s cash flow situation and its implications for the stock price – e.g., “positive and robust, supporting stock price stability,” or “negative, raising concerns about the company’s financial sustainability,” etc.].

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2018 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

External Factors Influencing Neo’s Stock Price

Macroeconomic factors, such as interest rate changes and inflation rates, can significantly influence Neo’s stock price. For example, rising interest rates could [Explain the impact of rising interest rates on Neo’s stock price, e.g., “increase borrowing costs, impacting profitability and potentially leading to a decrease in stock valuation”]. Geopolitical events, such as [Give examples of geopolitical events that could affect Neo, e.g., “trade wars or international conflicts”], can also create uncertainty in the market and affect investor sentiment towards Neo.

Regulatory changes, particularly those related to [Mention specific regulations impacting Neo’s industry], could [Explain the impact of regulatory changes, e.g., “increase compliance costs or restrict market access, affecting Neo’s financial performance”]. Technological advancements in [Mention specific technologies], could [Explain the impact of technological advancements, e.g., “disrupt Neo’s business model, requiring adaptation and potentially impacting its stock price”].

Predicting the Neo stock price involves analyzing various market factors and trends. Understanding historical performance of similar tech companies can offer valuable insights; for instance, examining the keysight stock price history might reveal patterns relevant to Neo’s potential trajectory. Ultimately, however, accurate Neo stock price prediction requires a multifaceted approach considering numerous variables beyond historical comparisons.

Predictive Modeling Techniques for Neo Stock Price

Source: dart-europe.eu

Several quantitative methods can be employed for stock price prediction. Time series analysis, for instance, uses historical stock price data to identify patterns and forecast future prices. Regression models, on the other hand, incorporate other relevant variables (like economic indicators) to improve prediction accuracy. Each model has its own assumptions and limitations; for example, time series analysis assumes that past patterns will continue, while regression models rely on the accuracy and relevance of the chosen independent variables.

A hypothetical predictive model for Neo could involve a combination of ARIMA (Autoregressive Integrated Moving Average) for time series analysis and multiple linear regression incorporating macroeconomic indicators.

Comparing the accuracy of different models requires evaluating metrics such as Mean Absolute Error (MAE) and Root Mean Squared Error (RMSE). A lower MAE and RMSE indicates better predictive accuracy. However, it’s crucial to remember that no model guarantees perfect accuracy, and unforeseen events can significantly impact actual stock price movements.

Visualizing Neo’s Stock Price Trends

Neo’s historical stock price performance has exhibited [Describe the overall trend – e.g., “a generally upward trend with periods of volatility,” or “a period of growth followed by a correction,” etc.]. Key turning points include [Identify and describe significant events that caused major changes in the stock price, e.g., “the announcement of a new product launch,” or “a major regulatory change,” etc.].

A line graph illustrating the stock price over time would show [Describe the visual representation of the graph, e.g., “the overall trend, significant peaks and troughs, and periods of high volatility”]. Correlation analysis could reveal relationships between external factors and stock price movements; for example, [Describe a potential correlation, e.g., “a positive correlation between positive economic news and an increase in Neo’s stock price,” or “a negative correlation between rising interest rates and Neo’s stock price,” etc.].

Potential future scenarios, based on different predictive models, might include [Describe potential scenarios, e.g., “a continued upward trend under optimistic economic conditions,” or “a period of stagnation or decline under pessimistic economic conditions,” etc.].

Risk Assessment for Neo Stock Investment

Investing in Neo stock carries several risks. Market risk, encompassing broader market fluctuations, is a significant concern. Company-specific risks include [List company-specific risks, e.g., “competition from other companies,” “failure to innovate,” “reputational damage,” etc.]. Strategies for mitigating these risks include diversification (spreading investments across multiple assets), thorough due diligence (researching the company’s financials and prospects), and setting stop-loss orders (automatic sell orders triggered when the stock price falls below a certain level).

Overall, the risk profile of Neo stock is [Describe the overall risk profile – e.g., “moderate to high,” or “low to moderate,” etc.], depending on the investor’s risk tolerance and investment horizon.

| Risk Factor | Potential Impact | Likelihood | Mitigation Strategy |

|---|---|---|---|

| Market Risk | Significant price fluctuations | High | Diversification |

| Competition | Reduced market share | Medium | Monitor competitor activities |

| Regulatory Changes | Increased compliance costs | Medium | Stay informed on regulatory developments |

| Financial Performance | Decreased profitability | Medium | Thorough due diligence |

Common Queries: Neo Stock Price Prediction

What are the major risks associated with investing in Neo stock?

Major risks include market volatility, company-specific performance issues, regulatory changes, and macroeconomic factors like interest rate hikes or recessions.

How accurate are stock price prediction models?

Stock price prediction models are not perfectly accurate. Their accuracy depends on the quality of data, the chosen model, and the inherent unpredictability of the market. They should be viewed as tools to inform, not dictate, investment decisions.

Where can I find reliable data for Neo stock?

Reliable data sources include reputable financial news websites, stock market data providers (e.g., Yahoo Finance, Google Finance), and Neo’s official investor relations materials.

What is Neo’s competitive advantage?

This requires further research into Neo’s specific business and industry. A competitive advantage could stem from factors such as proprietary technology, strong brand recognition, efficient operations, or a unique business model.