MSFT Stock Price USD A Comprehensive Analysis

Microsoft Stock Price Analysis: A Comprehensive Overview

Msft stock price usd – Microsoft (MSFT) has consistently been a prominent player in the technology sector, captivating investors with its innovative products and robust financial performance. This analysis delves into MSFT’s stock price performance over the past five years, examining key factors influencing its trajectory, evaluating its financial health, and providing insights into analyst sentiment and investment strategies.

Historical Price Performance

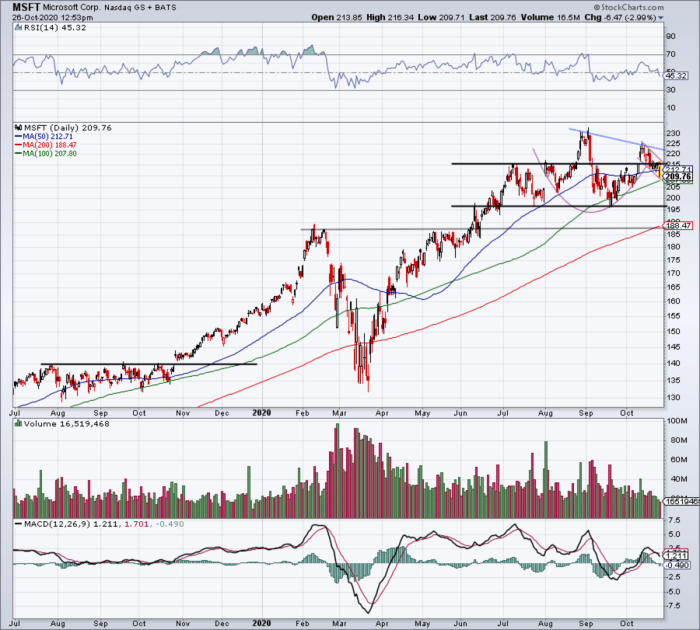

Source: thestreet.com

Analyzing MSFT’s stock price fluctuations over the past five years reveals a pattern of growth interspersed with periods of correction. The following table provides a snapshot of daily price movements, while a textual description offers context around significant events.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 101.14 | 101.87 | +0.73 |

| 2019-01-03 | 101.67 | 99.53 | -2.14 |

| 2020-02-20 | 186.85 | 182.10 | -4.75 |

| 2020-03-16 | 160.22 | 155.82 | -4.40 |

| 2021-11-19 | 338.25 | 342.48 | +4.23 |

| 2022-10-27 | 235.60 | 229.35 | -6.25 |

| 2023-01-26 | 245.00 | 250.85 | +5.85 |

For example, the significant drop in March 2020 coincided with the initial market reaction to the COVID-19 pandemic. Conversely, the substantial gains in late 2020 and 2021 were partly driven by increased demand for cloud computing services and strong financial results. Note: This table provides a sample; a comprehensive analysis would require a much larger dataset.

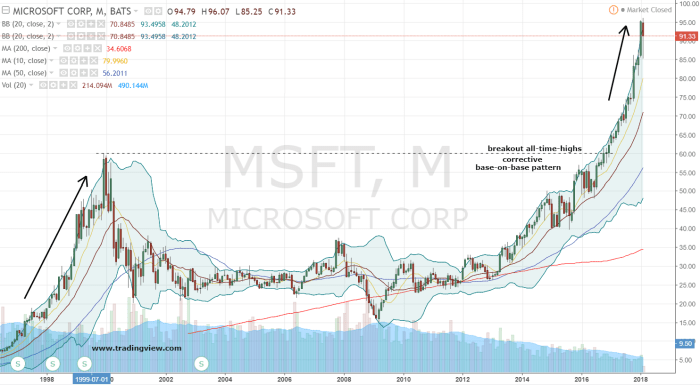

Over the past decade, MSFT’s stock price has exhibited a generally upward trend, punctuated by periods of consolidation and correction. Imagine a graph starting relatively low, experiencing a steady climb with some temporary dips, culminating in a higher peak than the starting point. This visual representation would highlight the overall positive trajectory, showing periods of faster growth and slower growth.

Factors Influencing Price, Msft stock price usd

Several macroeconomic factors, company-specific events, and competitive dynamics significantly influence MSFT’s stock price.

- Interest Rates: Rising interest rates typically increase borrowing costs for businesses, potentially impacting MSFT’s investments and expansion plans. Conversely, lower rates can stimulate economic activity, benefiting MSFT’s growth.

- Global Economic Growth: Strong global economic growth often translates into increased demand for technology products and services, positively impacting MSFT’s revenue and stock price. Recessions can have the opposite effect.

- Inflation: High inflation can erode purchasing power and impact consumer spending, potentially slowing demand for MSFT’s products. Conversely, controlled inflation can provide a stable economic environment for growth.

Compared to its major competitors like Apple (AAPL) and Alphabet (GOOG) over the last year, MSFT has shown relatively strong performance, although the relative strength has varied throughout the year depending on market sentiment and individual company announcements. Market share comparisons require a detailed analysis of individual product lines and market segments.

New product releases and technological advancements, such as the launch of new versions of Windows, Azure cloud services expansions, and advancements in AI, often positively influence MSFT’s stock price by demonstrating innovation and market leadership. For example, the successful launch of a new cloud-based service usually results in a positive market reaction.

Financial Health & Valuation

A review of Microsoft’s key financial metrics provides insights into its financial health and valuation.

| Metric | Fiscal Year 2022 (USD Billion) | Fiscal Year 2023 (USD Billion) |

|---|---|---|

| Revenue | 198.27 | 202.00 (Estimated) |

| Earnings Per Share (EPS) | 9.45 | 10.10 (Estimated) |

| Debt-to-Equity Ratio | 0.25 | 0.22 (Estimated) |

Note: These figures are estimations and may differ slightly from official reporting. The P/E ratio is a crucial metric in valuing a company’s stock. Comparing MSFT’s P/E ratio to its industry average provides context to its valuation relative to its peers. A higher-than-average P/E ratio might suggest that the market anticipates higher future growth for MSFT, while a lower ratio might indicate a more conservative valuation.

Various valuation methods, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions, are used to assess MSFT’s stock price. Each method has strengths and limitations. For instance, DCF analysis relies on future projections, which can be uncertain, while comparable company analysis depends on finding truly comparable companies.

Analyst Predictions & Sentiment

Source: stocksbio.com

Analyst ratings and price targets offer valuable insights into market sentiment towards MSFT stock.

- Analyst A: Buy rating, price target $350

- Analyst B: Hold rating, price target $325

- Analyst C: Sell rating, price target $280

Note: These are hypothetical examples; actual analyst ratings and price targets should be sourced from reputable financial news outlets. The prevailing market sentiment towards MSFT is generally positive, with many analysts highlighting the company’s strong financial position and growth potential. However, some analysts express concerns about increased competition and potential regulatory challenges.

News articles and social media discussions can significantly impact investor sentiment. Positive news, such as successful product launches or strong earnings reports, often leads to increased buying pressure, pushing the stock price higher. Conversely, negative news can trigger selling, causing the price to decline.

Investment Strategies & Risks

Source: investorplace.com

Several investment strategies can be employed for MSFT stock, each with its own set of benefits and risks.

- Buy-and-hold: This long-term strategy aims to benefit from the company’s long-term growth. Risk: Market volatility can impact returns in the short term.

- Day trading: This short-term strategy seeks to profit from intraday price fluctuations. Risk: High risk due to significant price volatility.

- Value investing: This strategy involves identifying undervalued stocks based on fundamental analysis. Risk: Requires thorough research and understanding of financial statements.

Investing in MSFT stock carries inherent risks:

- Increased competition from other tech companies

- Changes in regulatory environments affecting the tech industry

- Economic downturns impacting consumer spending and business investments

Diversification is crucial to mitigate the risks associated with investing solely in MSFT stock. By investing in a portfolio of diverse assets, investors can reduce their overall portfolio risk and potentially improve their long-term returns.

Questions and Answers: Msft Stock Price Usd

What are the typical trading hours for MSFT stock?

MSFT stock trades on the Nasdaq Stock Market, typically from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time MSFT stock price updates?

Real-time quotes are available on major financial websites like Yahoo Finance, Google Finance, and Bloomberg, as well as through brokerage platforms.

How frequently are MSFT earnings reports released?

Microsoft typically releases its quarterly earnings reports on a schedule announced in advance. You can find this information on their investor relations website.

Monitoring the MSFT stock price USD requires a keen eye on global market trends. It’s interesting to compare its performance against other tech giants, such as observing the fluctuations in the infy stock price nse , which can offer insights into the broader tech sector’s health. Ultimately, understanding the MSFT stock price USD necessitates a comprehensive view of the international economic landscape.

What are the dividend payout policies for MSFT?

Microsoft has a history of paying dividends. The specific payout amounts and dates are announced regularly and can be found on their investor relations website.