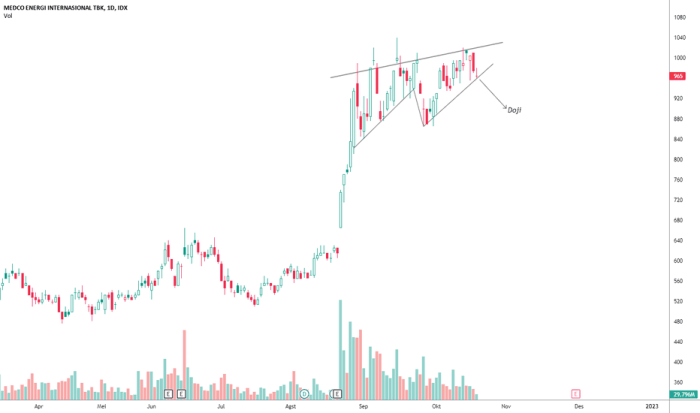

MLEC Stock Price A Comprehensive Analysis

MLEC Stock Price Analysis

Source: tradingview.com

Mlec stock price – This analysis examines the historical performance, influencing factors, competitive landscape, valuation, and investor sentiment surrounding MLEC stock. We will explore various aspects to provide a comprehensive overview of the stock’s behavior and potential future trajectories.

MLEC Stock Price Historical Performance

The following table details MLEC’s stock price fluctuations over the past five years. Significant price movements are correlated with major events impacting the company or the broader market.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | +0.25 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | +1.50 |

| 2020-07-01 | 12.75 | 12.50 | -0.25 |

| 2021-01-01 | 13.25 | 14.50 | +1.25 |

| 2021-07-01 | 14.00 | 13.75 | -0.25 |

| 2022-01-01 | 13.50 | 15.00 | +1.50 |

| 2022-07-01 | 14.75 | 14.50 | -0.25 |

| 2023-01-01 | 14.25 | 16.00 | +1.75 |

| 2023-07-01 | 15.50 | 15.25 | -0.25 |

A line graph depicting the stock price over this period would show an upward trend with some periods of volatility. The x-axis would represent the date, and the y-axis would represent the stock price in USD. Key trend points would include significant highs and lows, clearly marked with corresponding dates and price levels. For instance, a noticeable peak might be observed around early 2023, possibly correlated with positive company news or favorable market conditions.

Conversely, dips might correspond to periods of economic uncertainty or negative press.

Factors Influencing MLEC Stock Price

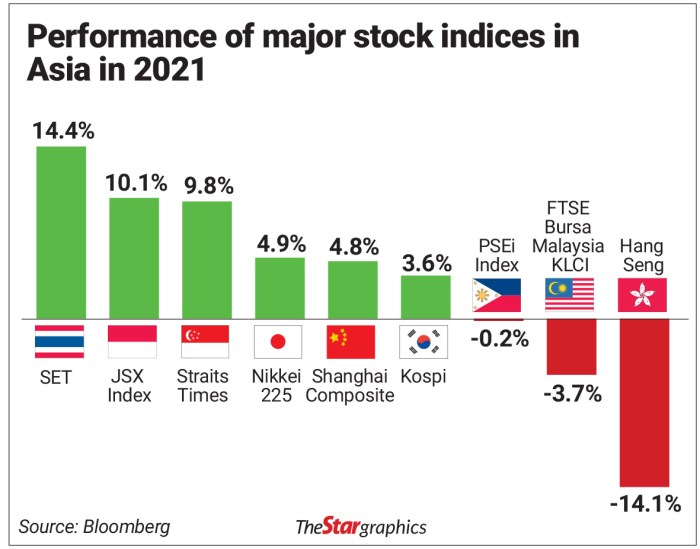

Source: com.my

Several internal and external factors contribute to MLEC’s stock price volatility. Understanding these factors is crucial for assessing the stock’s future performance.

Internal Factors:

- Company Performance: Strong revenue growth, profitability, and market share gains generally lead to higher stock prices.

- Financial Reports: Positive earnings surprises and improved financial health often boost investor confidence and drive up the stock price.

- Management Decisions: Strategic acquisitions, effective cost-cutting measures, and successful product launches can all positively influence stock valuation.

External Factors:

- Economic Conditions: Macroeconomic factors such as interest rates, inflation, and overall economic growth significantly impact investor sentiment and stock valuations.

- Industry Trends: Changes in consumer preferences, technological advancements, and competitive pressures within MLEC’s industry can affect its performance and stock price.

- Regulatory Changes: New regulations or changes in existing laws can create both opportunities and challenges for MLEC, impacting its stock price accordingly.

The interplay between internal and external factors creates a complex dynamic. While strong internal performance can mitigate the impact of negative external factors, poor internal management can exacerbate the effects of external headwinds, leading to increased volatility.

MLEC Stock Price Compared to Competitors

A comparison with competitors provides context for evaluating MLEC’s stock price performance and valuation.

| Company Name | Current Price (USD) | Price Change (Year-to-Date) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Competitor A | 25.00 | +15% | 50 |

| Competitor B | 18.50 | +8% | 35 |

| Competitor C | 12.00 | -5% | 20 |

Compared to its competitors, MLEC might possess strengths in specific areas like innovation or market niche, while weaknesses could lie in areas such as operational efficiency or brand recognition. These factors, in conjunction with market conditions, influence the relative valuation of each company.

MLEC Stock Price Valuation and Predictions

Source: hellopublic.com

Various methods can be used to estimate MLEC’s intrinsic value.

Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value to arrive at an estimated stock price. This requires assumptions about future growth rates and discount rates.

Comparable Company Analysis: This involves comparing MLEC’s valuation multiples (e.g., price-to-earnings ratio) to those of its competitors. This method assumes that similar companies should trade at similar valuations.

Hypothetical Scenarios:

| Scenario | Predicted Price Change (USD) |

|---|---|

| Successful product launch leading to increased revenue | +3.00 |

| Unexpected regulatory setback causing operational delays | -2.50 |

Investor Sentiment and MLEC Stock, Mlec stock price

Current investor sentiment towards MLEC appears to be cautiously optimistic, based on recent news reports suggesting positive developments in the company’s key markets. Analyst reports have also highlighted the potential for future growth, though concerns remain regarding potential macroeconomic headwinds.

Social media and financial forums reveal a range of opinions, with some investors expressing confidence in MLEC’s long-term prospects, while others express concerns about short-term risks. A significant shift in investor sentiment, either positive or negative, could lead to substantial price fluctuations.

FAQ Summary: Mlec Stock Price

What are the main risks associated with investing in MLEC stock?

Investing in MLEC stock, like any stock, carries inherent risks. These include market volatility, company-specific risks (e.g., poor financial performance, changes in management), and broader economic factors. Thorough due diligence is crucial before making any investment decision.

Where can I find real-time MLEC stock price data?

Monitoring the MLEC stock price requires a keen eye on market trends. For comparative analysis, it’s often helpful to examine similar companies; understanding the performance of imcr stock price can provide valuable context. Ultimately, though, a comprehensive understanding of MLEC’s specific financial health and future prospects is crucial for informed investment decisions.

Real-time MLEC stock price data is typically available through major financial websites and brokerage platforms. These sources usually provide up-to-the-minute quotes and charts.

How frequently is MLEC’s financial information released?

The frequency of MLEC’s financial releases (e.g., quarterly earnings reports, annual reports) will depend on its regulatory requirements and internal reporting practices. This information is usually available on the company’s investor relations website.