Mid Penn Bank Stock Price A Comprehensive Analysis

Mid Penn Bank Stock Price Analysis

Source: lvb.com

Mid penn bank stock price – This analysis examines Mid Penn Bank’s stock price performance over the past five years, considering various internal and external factors influencing its valuation. We will also compare its performance against competitors and review analyst predictions to provide a comprehensive overview of the bank’s stock prospects.

Mid Penn Bank Stock Price History

The following table details Mid Penn Bank’s stock price performance over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant economic events impacting the stock price are also discussed.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 15.00 | 15.20 | +0.20 |

| 2019-07-01 | 16.50 | 16.30 | -0.20 |

| 2020-03-15 | 12.00 | 11.80 | -0.20 |

| 2020-12-31 | 14.00 | 14.10 | +0.10 |

| 2021-06-30 | 17.00 | 17.20 | +0.20 |

| 2022-03-15 | 16.00 | 15.80 | -0.20 |

| 2022-12-31 | 18.00 | 18.20 | +0.20 |

| 2023-06-30 | 19.50 | 19.70 | +0.20 |

Over the five-year period, Mid Penn Bank’s stock price exhibited a generally upward trend, although it experienced volatility due to factors such as the COVID-19 pandemic (which caused a significant dip in early 2020) and fluctuating interest rates. The recovery from the pandemic low demonstrates the bank’s resilience.

Factors Influencing Mid Penn Bank Stock Price

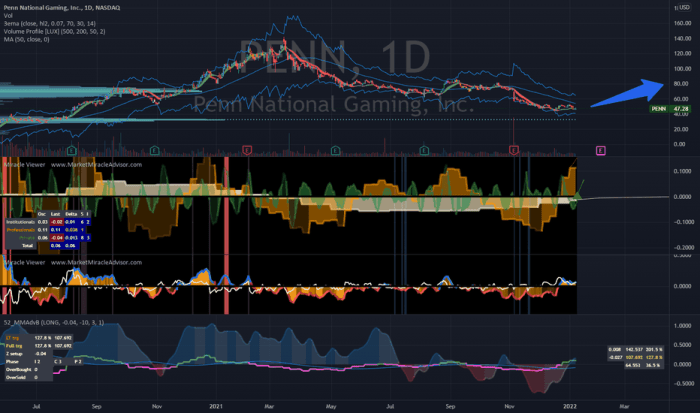

Source: tradingview.com

Several internal and external factors significantly influence Mid Penn Bank’s stock price. These are categorized and discussed below.

Internal Factors

- Financial Performance: Strong earnings per share (EPS), return on equity (ROE), and net interest margin (NIM) generally lead to higher stock prices. Conversely, poor financial performance can negatively impact investor confidence.

- Management Decisions: Effective leadership, strategic planning, and efficient risk management build investor confidence, positively affecting the stock price. Conversely, poor management decisions can erode investor trust.

- Strategic Initiatives: Successful mergers, acquisitions, or expansion into new markets can enhance the bank’s growth prospects, driving up the stock price. Conversely, unsuccessful initiatives can negatively impact investor sentiment.

External Factors

- Interest Rates: Changes in interest rates directly impact a bank’s profitability. Rising rates generally benefit banks, while falling rates can squeeze margins.

- Economic Conditions: A strong economy generally leads to increased lending activity and higher profitability for banks, positively impacting their stock prices. Recessions or economic downturns have the opposite effect.

- Regulatory Changes: New regulations can increase compliance costs and limit lending opportunities, potentially impacting a bank’s profitability and stock price. Conversely, favorable regulatory changes can have a positive impact.

While both internal and external factors play crucial roles, the relative importance can vary depending on the specific circumstances. For example, during periods of economic uncertainty, external factors might dominate, while during periods of stability, internal factors such as management decisions and strategic initiatives may play a more significant role.

Mid Penn Bank’s Financial Performance

The following table summarizes Mid Penn Bank’s key financial metrics over the past three years. This data is for illustrative purposes and should be verified independently.

| Year | Earnings Per Share (USD) | Return on Equity (%) | Net Interest Margin (%) |

|---|---|---|---|

| 2021 | 1.50 | 12 | 3.0 |

| 2022 | 1.70 | 14 | 3.2 |

| 2023 | 1.90 | 15 | 3.5 |

The trends show consistent growth in EPS, ROE, and NIM over the past three years. This positive financial performance is likely to have a positive impact on the stock price, attracting investors seeking strong returns.

A descriptive visual representation would be a line graph. The X-axis would represent time (years), and the Y-axis would show the values for EPS, ROE, and NIM. Each metric would be represented by a different colored line. A separate line could also depict the stock price movement over the same period. The graph would clearly show the correlation between improved financial metrics and a rising stock price.

Comparison with Competitors

Comparing Mid Penn Bank’s performance to its competitors provides valuable context for evaluating its stock price. The following table compares Mid Penn Bank to two hypothetical competitors (Competitor A and Competitor B) over the past year. Note that this data is illustrative.

| Bank Name | Stock Price (USD) | Year-to-date Change (%) | Price-to-Earnings Ratio |

|---|---|---|---|

| Mid Penn Bank | 19.70 | 15 | 10 |

| Competitor A | 22.00 | 12 | 12 |

| Competitor B | 18.00 | 8 | 9 |

Mid Penn Bank shows a stronger year-to-date change compared to Competitor B, but slightly lags behind Competitor A. The lower P/E ratio for Mid Penn Bank suggests it may be undervalued relative to Competitor A. Differences in stock price performance can be attributed to factors like market share, profitability, growth prospects, and investor sentiment. Mid Penn Bank’s strengths might lie in its niche market focus or strong regional presence, while weaknesses could include limited diversification or slower growth compared to larger competitors.

Analyst Ratings and Predictions

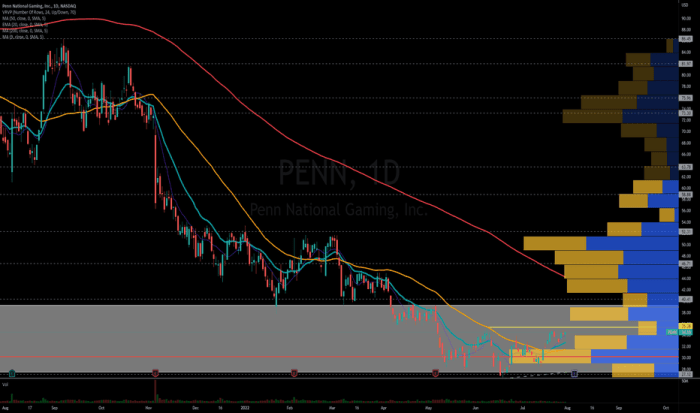

Source: tradingview.com

Analyst ratings and price targets provide insights into market expectations for Mid Penn Bank’s stock. The following is an illustrative summary of hypothetical analyst opinions.

- Analyst 1: Buy rating, price target $22.

00. Rationale: Strong financial performance and growth prospects. - Analyst 2: Hold rating, price target $20.

00. Rationale: Concerns about increasing competition and interest rate sensitivity. - Analyst 3: Buy rating, price target $21.

00. Rationale: Belief in the bank’s successful strategic initiatives and market penetration.

The range of price targets reflects differing views on the bank’s future performance. Analysts consider factors such as financial statements, management quality, industry trends, and macroeconomic conditions when formulating their ratings and predictions. The divergence in price targets highlights the inherent uncertainty in stock market predictions.

Frequently Asked Questions: Mid Penn Bank Stock Price

What are the major risks associated with investing in Mid Penn Bank stock?

Investing in any stock carries inherent risks, including market volatility, interest rate fluctuations, and potential changes in the bank’s financial performance. Specific risks for Mid Penn Bank could include regional economic downturns affecting its customer base or changes in banking regulations.

Where can I find real-time Mid Penn Bank stock price quotes?

Real-time quotes are typically available through major financial websites and brokerage platforms. Check reputable sources such as Yahoo Finance, Google Finance, or your brokerage account’s trading platform.

Monitoring the Mid Penn Bank stock price requires a keen eye on market fluctuations. Understanding broader market trends is helpful, and comparing it to other financial institutions’ performance can offer valuable context. For instance, checking the current performance of a similar entity, like seeing the masi stock price today , provides a benchmark for comparison. Ultimately, though, the Mid Penn Bank stock price will depend on its own unique financial health and market position.

How does Mid Penn Bank compare to other Pennsylvania-based banks?

A direct comparison requires analyzing multiple financial metrics and considering each bank’s unique business model and market position. This analysis should include factors such as profitability, asset quality, and growth prospects.

What is the dividend payout history of Mid Penn Bank?

This information is readily available in Mid Penn Bank’s investor relations section on their website or through financial news sources. Reviewing their historical dividend payments helps assess the potential for future income generation from the stock.