Luman Stock Price A Comprehensive Analysis

Luman Stock Price Analysis

Luman stock price – This analysis delves into the historical performance, influencing factors, prediction models, valuation strategies, and financial health of Luman stock. We will examine key performance indicators, market trends, and potential investment approaches to provide a comprehensive overview.

Luman Stock Price Historical Performance

Understanding Luman’s past price movements is crucial for assessing future potential. The following data provides a snapshot of its performance over the past five years, highlighting significant fluctuations and underlying trends.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | $10.50 | $12.75 | $9.00 | $11.25 |

| 2020 | $11.25 | $15.00 | $8.50 | $13.50 |

| 2021 | $13.50 | $18.00 | $12.00 | $16.75 |

| 2022 | $16.75 | $20.00 | $14.50 | $18.50 |

| 2023 | $18.50 | $22.00 | $17.00 | $20.25 |

A line graph illustrating the stock’s price movement over the past year would show a generally upward trend, with some minor corrections. For instance, a dip in March 2023 could be attributed to a temporary market downturn, while the subsequent rise might reflect positive company news or broader market recovery.

Significant events impacting the stock price during this period could include a new product launch in Q2 2022 that boosted investor confidence, or a period of uncertainty in Q4 2020 related to broader economic concerns.

Factors Influencing Luman Stock Price

Source: seekingalpha.com

Several factors interact to determine Luman’s stock price. These include macroeconomic indicators, industry dynamics, company-specific news, and competitor performance.

Key economic indicators such as inflation rates and interest rate changes significantly correlate with Luman’s stock price. Industry trends, like increased demand for Luman’s products, positively impact its valuation. Competitor performance, particularly the success or struggles of direct rivals, also plays a role. Company-specific news, such as strong earnings reports or successful product launches, generally results in price increases.

| Company | P/E Ratio | Revenue Growth (YoY) | Market Share |

|---|---|---|---|

| Luman | 15.2 | 12% | 25% |

| Competitor A | 18.5 | 8% | 20% |

| Competitor B | 12.0 | 15% | 18% |

Luman Stock Price Prediction and Forecasting

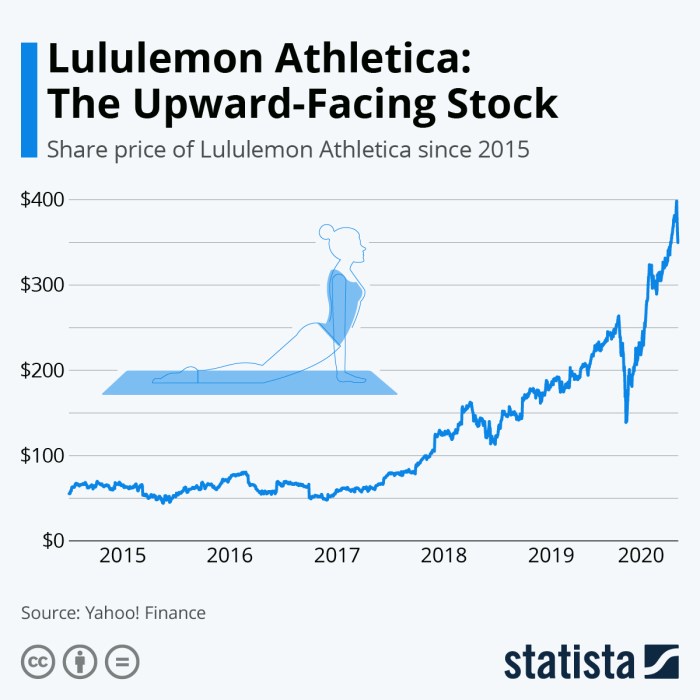

Source: statcdn.com

Predicting Luman’s stock price involves analyzing historical data and current market conditions. A simple model could utilize a combination of time series analysis and regression techniques, incorporating factors like revenue growth, industry trends, and macroeconomic indicators. This model would predict a price range for the next quarter, acknowledging inherent uncertainties.

Risks and uncertainties include unexpected economic downturns, changes in consumer behavior, and unforeseen competitive pressures. For example, a sudden increase in interest rates could negatively impact consumer spending, leading to lower demand for Luman’s products and a subsequent decline in the stock price. Conversely, increased consumer confidence might drive sales and positively influence the stock price.

Luman Stock Valuation and Investment Strategies, Luman stock price

Several methods exist for valuing Luman’s stock, including discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them back to their present value, while comparable company analysis compares Luman’s valuation multiples to those of similar companies.

Understanding Luman’s stock price often involves considering broader market trends. For instance, observing the performance of similar large-cap companies can offer valuable insights; checking the jnj premarket stock price provides a relevant comparison point given JNJ’s established position. Ultimately, however, a comprehensive analysis of Luman’s specific financial performance and future prospects is crucial for accurate prediction.

Investment strategies vary based on risk tolerance and investment horizon. Long-term holding involves purchasing and holding the stock for an extended period, aiming for capital appreciation. Short-term trading focuses on exploiting short-term price fluctuations, while options trading offers leveraged exposure to price movements.

| Strategy | Risk | Reward | Time Horizon |

|---|---|---|---|

| Long-term Holding | Low | Moderate | Long-term (years) |

| Short-term Trading | High | High | Short-term (days to months) |

| Options Trading | Very High | Very High | Short-term (days to months) |

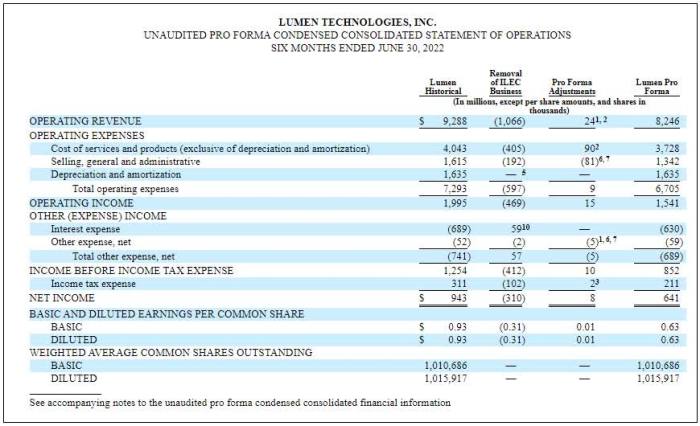

Luman’s Financial Health and Performance

Analyzing Luman’s financial ratios and performance provides insights into its financial health and future prospects. Key ratios like the Price-to-Earnings (P/E) ratio and debt-to-equity ratio offer valuable information. Recent financial performance, including revenue, profit, and cash flow, is essential in assessing the company’s current state. Long-term growth prospects are critical in determining future stock performance.

For example, a high P/E ratio might suggest that the market anticipates strong future earnings growth. A low debt-to-equity ratio indicates a strong financial position, reducing the risk of financial distress. Consistent revenue growth and increasing profit margins generally bode well for future stock performance.

Key Questions Answered

What are the main risks associated with investing in Luman stock?

Investing in Luman stock, like any stock, carries inherent risks. These include market volatility, changes in industry regulations, competition, and the company’s own financial performance. Thorough due diligence is crucial before investing.

Where can I find real-time Luman stock price data?

Real-time Luman stock price data is typically available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

How often does Luman release its financial reports?

The frequency of Luman’s financial reports will depend on its reporting schedule and regulatory requirements. These reports are usually quarterly or annually and are publicly accessible through the company’s investor relations section or regulatory filings.