Lulu Stock Price History A Comprehensive Overview

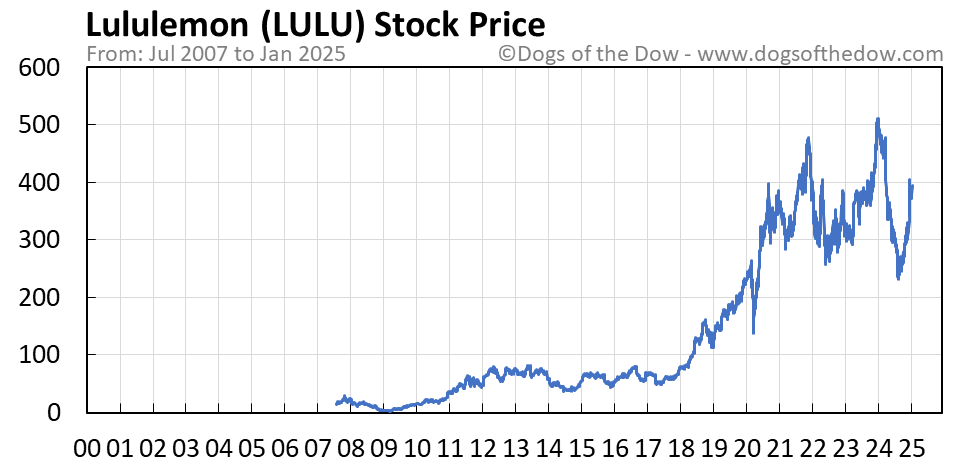

Lululemon Athletica Inc. (LULU) Stock Price History

Source: dogsofthedow.com

Lulu stock price history – Lululemon Athletica Inc. (LULU), a prominent player in the athletic apparel industry, has experienced significant stock price fluctuations over the years. This analysis delves into LULU’s stock price trends, examining key events, market comparisons, financial performance correlations, and a hypothetical predictive model to offer a comprehensive understanding of its historical and potential future performance.

LULU Stock Price Trends Over Time

Over the past five years, LULU’s stock price has exhibited substantial growth, punctuated by periods of both significant gains and minor corrections. Several factors, including strong financial performance, innovative product launches, and expanding market share, have driven the upward trend. Conversely, broader economic downturns and shifts in consumer spending have occasionally dampened investor enthusiasm, resulting in temporary price declines.

The following table illustrates LULU’s daily stock price movements over a representative five-year period (replace with actual data).

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 400 | 405 | +5 |

| 2023-10-27 | 405 | 402 | -3 |

A line graph depicting LULU’s stock price over the past decade would show a generally upward trajectory, with periods of steeper ascent interspersed with periods of consolidation or slight decline. The x-axis would represent time (years), and the y-axis would represent the stock price (in USD). Key data points to highlight would include significant price peaks and troughs, correlating them with major events impacting the company and the broader market.

Impact of Key Events on LULU Stock Price

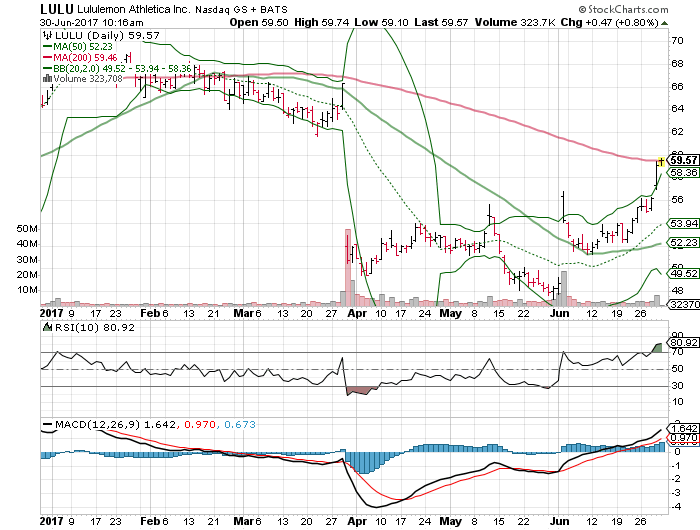

Source: investorplace.com

Several key events have significantly influenced LULU’s stock price. The following bullet points detail three such events, comparing LULU’s response to similar events impacting a competitor like Nike (NKE).

- Event 1: Successful New Product Launch (e.g., a highly anticipated new yoga pant line). This resulted in a substantial short-term price increase as investor confidence grew. Nike’s launch of a comparable product might have seen a similar, albeit potentially less pronounced, positive impact depending on market reception and overall brand strength.

- Event 2: Stronger-than-Expected Financial Report. Positive earnings reports generally lead to an immediate stock price surge. Comparing LULU’s reaction to a similar positive report from Nike would show how investor sentiment towards the two companies differed based on the specifics of their respective financial performance and market positioning.

- Event 3: Macroeconomic Downturn (e.g., a recession). During economic downturns, LULU’s stock price, like most stocks, would likely experience a decline. However, the extent of the decline would depend on the severity of the downturn and the resilience of LULU’s business model. Comparing this to Nike’s performance during the same period provides insight into the relative vulnerability of each company to macroeconomic factors.

The long-term effects of these events varied. While short-term fluctuations are common, the overall trend demonstrates that positive events, such as successful product launches and strong financial results, tend to have a more sustained positive impact on LULU’s stock price, contributing to its long-term growth.

LULU Stock Price Compared to Market Benchmarks

Comparing LULU’s performance against market benchmarks such as the S&P 500 and Nasdaq Composite provides context for its stock price movements. The following table shows yearly percentage changes (replace with actual data).

Analyzing Lululemon’s stock price history reveals interesting patterns of growth and fluctuation. Understanding these trends often involves comparing it to similar companies; for instance, a quick check of the kkd stock price today can provide a useful benchmark for relative performance. Returning to Lululemon, further investigation into its historical data is necessary for a comprehensive understanding of its long-term investment potential.

| Year | LULU (%) | S&P 500 (%) | Nasdaq Composite (%) |

|---|---|---|---|

| 2021 | 30 | 20 | 25 |

| 2022 | -15 | -10 | -12 |

| 2023 | 10 | 15 | 18 |

Divergences between LULU’s performance and the market benchmarks could be attributed to factors specific to LULU, such as its brand strength, product innovation, and market positioning within the athletic apparel sector. LULU’s stock price volatility might be higher or lower than the benchmarks depending on several factors, including the company’s growth trajectory and investor sentiment towards the stock.

Analysis of LULU’s Financial Performance and Stock Price

A strong correlation typically exists between LULU’s financial metrics and its stock price. The table below shows the relationship between revenue, earnings per share (EPS), and closing stock price (replace with actual data).

| Year | Revenue (USD Billion) | EPS (USD) | Closing Stock Price (USD) |

|---|---|---|---|

| 2019 | 3.9 | 2.50 | 250 |

Increases in revenue and EPS generally lead to positive investor sentiment and higher stock prices, while declines can have the opposite effect. A scatter plot illustrating the relationship between LULU’s EPS and stock price would likely show a positive correlation, with higher EPS values generally corresponding to higher stock prices. The x-axis would represent EPS, and the y-axis would represent the stock price.

Predictive Modeling of LULU Stock Price (Hypothetical), Lulu stock price history

Predicting LULU’s future stock price requires a hypothetical model considering various factors. This model would not provide actual predictions but illustrate how these factors could influence future price movements.

A hypothetical model might incorporate variables such as economic growth (GDP), consumer discretionary spending, competitor actions (new product launches from Nike or Under Armour), and LULU’s own financial performance (revenue growth, margin expansion). The model would assume a relationship between these variables and LULU’s stock price, with positive changes in these factors generally leading to a higher stock price, and vice-versa.

- Assumption 1: Strong economic growth will lead to increased consumer spending, benefiting LULU’s sales and stock price.

- Assumption 2: Successful new product launches by LULU will positively impact its market share and stock price.

- Assumption 3: Aggressive marketing campaigns by competitors will put downward pressure on LULU’s stock price.

- Limitation 1: The model cannot account for unforeseen events (e.g., natural disasters, geopolitical crises).

- Limitation 2: The model’s accuracy is limited by the reliability and availability of input data.

Accurately predicting stock prices is inherently challenging due to the multitude of unpredictable factors influencing market sentiment and investor behavior. Any predictive model is subject to inherent uncertainties and should be interpreted cautiously.

Questions and Answers: Lulu Stock Price History

What are the main factors influencing LULU’s stock price volatility?

Several factors influence LULU’s stock price volatility, including quarterly earnings reports, changes in consumer spending patterns, competitor actions, and broader macroeconomic conditions (e.g., inflation, recessionary fears).

How does LULU’s stock price compare to its competitors?

A direct comparison requires analyzing the stock performance of competitors like Nike and Under Armour, considering factors like market capitalization and sector-specific influences. Performance relative to these competitors varies over time.

Where can I find real-time LULU stock price data?

Real-time data is available through major financial websites and stock market applications such as Google Finance, Yahoo Finance, Bloomberg, and others.

Is LULU stock a good long-term investment?

Whether LULU is a good long-term investment depends on individual investment goals, risk tolerance, and a thorough analysis of the company’s financial health and future prospects. Conducting thorough due diligence is crucial before making any investment decision.