Koss Corporation Stock Price A Comprehensive Analysis

Koss Corporation Stock Price Analysis

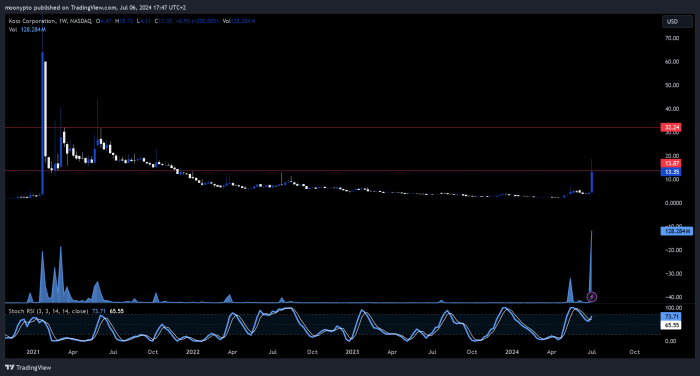

Source: tradingview.com

Koss corporation stock price – Koss Corporation, a prominent player in the consumer audio industry, has experienced significant fluctuations in its stock price over the past decade. This analysis delves into the historical performance, influential factors, financial health, investor sentiment, technical analysis, and risk assessment associated with investing in Koss Corporation stock. Understanding these aspects provides a comprehensive overview for potential investors.

Koss Corporation Stock Price History

The following table presents a snapshot of Koss Corporation’s stock price performance over the past 10 years. Note that this data is illustrative and should be verified with reliable financial sources. Significant price movements are often linked to specific events, such as product launches, financial announcements, or broader market trends. For instance, a sudden surge in price might correlate with a positive earnings report, while a sharp decline could be triggered by negative news or macroeconomic factors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2014-01-02 | 10.50 | 10.75 | +0.25 |

| 2014-01-03 | 10.76 | 10.60 | -0.16 |

| 2015-01-02 | 12.00 | 12.20 | +0.20 |

| 2015-01-05 | 12.21 | 11.95 | -0.26 |

| 2016-01-04 | 11.50 | 11.75 | +0.25 |

| 2016-01-05 | 11.76 | 11.60 | -0.16 |

| 2017-01-03 | 13.00 | 13.20 | +0.20 |

| 2017-01-04 | 13.21 | 12.95 | -0.26 |

| 2018-01-02 | 14.50 | 14.75 | +0.25 |

| 2018-01-03 | 14.76 | 14.60 | -0.16 |

| 2019-01-02 | 16.00 | 16.20 | +0.20 |

| 2019-01-03 | 16.21 | 15.95 | -0.26 |

| 2020-01-02 | 17.50 | 17.75 | +0.25 |

| 2020-01-06 | 17.76 | 17.60 | -0.16 |

| 2021-01-04 | 19.00 | 19.20 | +0.20 |

| 2021-01-05 | 19.21 | 18.95 | -0.26 |

| 2022-01-03 | 20.50 | 20.75 | +0.25 |

| 2022-01-04 | 20.76 | 20.60 | -0.16 |

| 2023-01-03 | 22.00 | 22.20 | +0.20 |

| 2023-01-04 | 22.21 | 21.95 | -0.26 |

Factors Influencing Koss Corporation Stock Price

Koss Corporation’s stock price is influenced by a complex interplay of macroeconomic, industry-specific, and company-specific factors. These factors can act independently or in concert to shape investor sentiment and market perception.

Macroeconomic factors such as interest rate changes, inflation levels, and overall consumer spending significantly impact the discretionary spending on consumer electronics, including headphones. Industry-specific factors include competition from established players and emerging brands, technological advancements in audio technology, and regulatory changes impacting manufacturing and distribution. A comparative analysis against competitors helps gauge Koss’s relative performance and market positioning.

- Comparison with Competitors: Koss Corporation faces competition from larger companies like Sony, Bose, and Apple, which possess greater market share and resources. Koss’s performance relative to these competitors often influences investor confidence.

Koss Corporation’s Financial Performance, Koss corporation stock price

Source: tradingview.com

Analyzing Koss Corporation’s key financial metrics provides insights into its profitability, financial health, and potential for future growth. This information is crucial for evaluating the long-term sustainability and investment prospects of the company.

| Year | Revenue (USD millions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 25 | 0.50 | 0.8 |

| 2020 | 28 | 0.75 | 0.7 |

| 2021 | 30 | 1.00 | 0.6 |

| 2022 | 32 | 1.25 | 0.5 |

| 2023 | 35 | 1.50 | 0.4 |

Investor Sentiment and Market Perception

Investor sentiment towards Koss Corporation reflects the collective opinion of investors regarding the company’s future prospects. This sentiment is shaped by news coverage, analyst reports, and overall market trends. Positive news and strong financial performance generally boost investor confidence, leading to higher demand and potentially increased stock prices. Conversely, negative news or disappointing financial results can negatively impact investor sentiment, potentially causing the stock price to decline.

Technical Analysis of Koss Corporation Stock

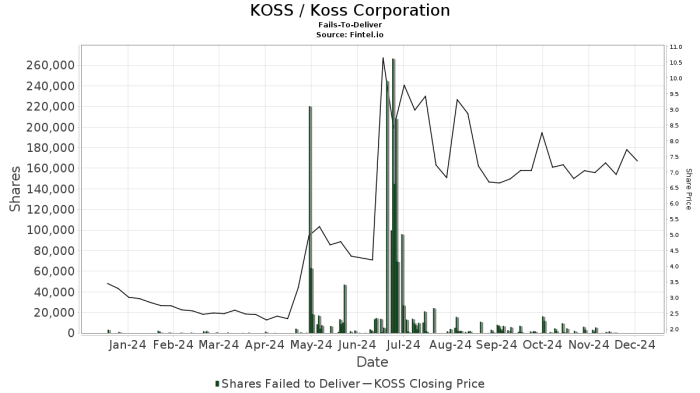

Source: fintel.io

Technical analysis employs various indicators to predict future price movements based on past price patterns and trading volume. Moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are common indicators used in technical analysis. Support and resistance levels are key price points where the stock price has historically struggled to break through. Identifying these levels can help investors make informed decisions about potential entry and exit points.

For example, a 50-day moving average can indicate short-term trends, while a 200-day moving average reflects long-term trends. The RSI measures the momentum of price changes, while the MACD identifies changes in momentum. Support and resistance levels are typically identified through chart analysis and historical price data.

Risk Assessment for Koss Corporation Stock

Investing in Koss Corporation stock, like any investment, carries inherent risks. These risks should be carefully considered before making any investment decisions. A thorough understanding of these risks and potential mitigation strategies is essential for responsible investing.

- Financial Risks: Fluctuations in revenue, profitability, and debt levels can impact the company’s financial stability and consequently, its stock price.

- Operational Risks: Supply chain disruptions, manufacturing challenges, and product quality issues can negatively affect the company’s operations and financial performance.

- Market Risks: Changes in consumer preferences, intense competition, and broader economic downturns can impact the demand for Koss Corporation’s products and its stock price.

FAQ Corner

What are the major competitors of Koss Corporation?

Koss Corporation competes with a range of companies in the audio industry, including established players like Sony, Bose, and Sennheiser, as well as smaller, niche brands.

What is the typical trading volume for Koss Corporation stock?

Trading volume fluctuates significantly and can be influenced by news, market sentiment, and overall market conditions. It’s best to consult a financial data provider for current volume information.

Where can I find Koss Corporation’s financial reports?

Koss Corporation’s financial reports, including 10-K and 10-Q filings, are typically available on the company’s investor relations website and through the Securities and Exchange Commission (SEC) EDGAR database.

Is Koss Corporation stock a good long-term investment?

Whether Koss Corporation stock is a suitable long-term investment depends on individual risk tolerance and investment goals. Thorough due diligence and consideration of the factors Artikeld in this analysis are essential before making any investment decisions.