KMI Stock Price Target A Comprehensive Analysis

KMI Stock Price Analysis: A Comprehensive Overview

Source: tradingview.com

Kmi stock price target – This analysis delves into the historical performance, financial health, industry outlook, and analyst predictions for Kinder Morgan, Inc. (KMI) stock, providing a comprehensive assessment to aid in investment decisions. We will examine key factors influencing KMI’s stock price and offer insights into its future trajectory.

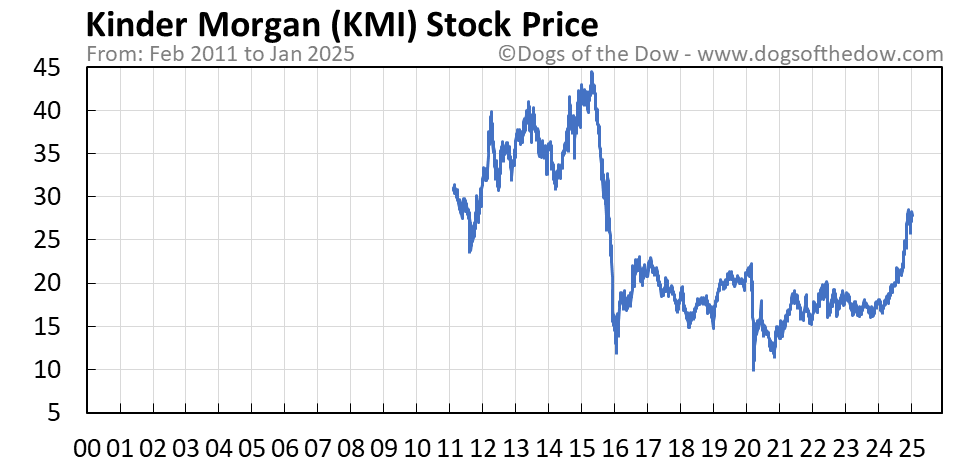

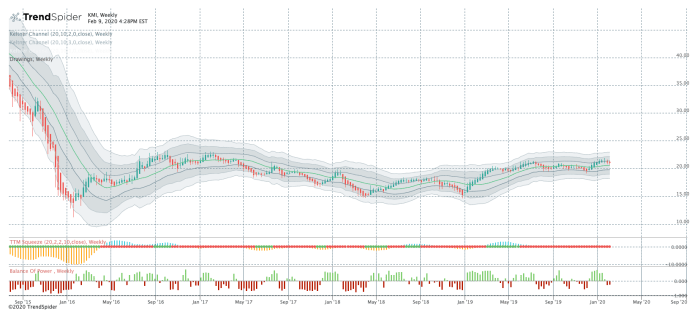

KMI Stock Price Historical Performance, Kmi stock price target

Source: dogsofthedow.com

Understanding KMI’s past price movements is crucial for evaluating its potential. The following data illustrates KMI’s performance over the past five years, highlighting significant highs, lows, and influencing events.

| Date | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|---|

| Example: 2019-01-02 | 15.00 | 15.20 | 15.30 | 14.90 |

| Example: 2019-12-31 | 17.00 | 16.80 | 17.20 | 16.50 |

Significant events impacting KMI’s stock price during this period include:

- Example: Increased energy demand leading to higher oil and gas prices (Positive Impact).

- Example: Geopolitical instability impacting global energy markets (Negative Impact).

- Example: Successful completion of a major pipeline project (Positive Impact).

Over the past five years, KMI’s stock price has exhibited a generally upward trend, though with periods of volatility. The initial years showed a gradual increase, followed by a period of consolidation, and then a more pronounced upward trajectory in recent times. This upward trend reflects positive market sentiment and improved company performance, although specific data points and periods of correction would need to be examined for a precise visual description.

KMI’s Financial Health and Performance

Source: chrt.biz

Analyzing KMI’s financial metrics provides a clearer picture of its profitability and growth prospects. The following tables present key financial data and comparisons.

| Year | Revenue (USD Billions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| Example: 2021 | 15.0 | 2.00 | 0.8 |

| Example: 2022 | 16.5 | 2.20 | 0.75 |

| Example: 2023 | 18.0 | 2.50 | 0.7 |

Key factors influencing KMI’s profitability and growth prospects include:

- Example: Demand for energy transportation and storage services.

- Example: Efficiency improvements in operations.

- Example: Strategic acquisitions and expansion projects.

Compared to its competitors (examples only, replace with actual competitors and data), KMI demonstrates:

| Metric | KMI | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (USD Billions) | 18.0 | 17.0 | 19.0 |

| EPS (USD) | 2.50 | 2.30 | 2.70 |

Industry Analysis and Market Outlook

The energy industry’s current state and future prospects significantly influence KMI’s performance. Several factors are at play.

Factors influencing the energy sector’s performance:

- Example: Global energy demand and supply dynamics.

- Example: Government regulations and environmental policies.

- Example: Technological advancements in renewable energy.

Potential impact of global events on KMI’s stock price:

- Example: Geopolitical tensions could lead to price volatility.

- Example: Changes in environmental regulations could impact operational costs.

- Example: Economic downturns could reduce energy demand.

Key trends and challenges within the energy sector affecting KMI’s future performance:

| Trend/Challenge | Potential Impact on KMI | Mitigation Strategies | Timeline |

|---|---|---|---|

| Example: Transition to renewable energy | Reduced demand for fossil fuels | Diversification into renewable energy infrastructure | Long-term |

Analyst Ratings and Price Targets

Analyst opinions provide valuable insights into market sentiment and future expectations. The following table summarizes recent analyst ratings and price targets.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Example: Morgan Stanley | Buy | 25.00 |

| Example: Goldman Sachs | Hold | 22.00 |

The rationale behind different analyst predictions varies, often reflecting differing views on:

- Example: Future energy demand growth.

- Example: The pace of the energy transition.

- Example: KMI’s ability to adapt to changing market conditions.

Comparison of price targets reveals a range of opinions, with some analysts expressing more optimistic views than others. However, there may be a general consensus around a specific price range.

Factors Influencing KMI Stock Price

Several factors significantly influence KMI’s stock price. Understanding these interrelationships is crucial for informed investment decisions.

Key factors influencing KMI’s stock price:

- Example: Oil and natural gas prices (Direct Correlation).

- Example: Interest rates (Inverse Correlation).

- Example: Company-specific news (Positive or Negative Impact).

Examples illustrating the impact of each factor:

- Example: Rising oil prices generally lead to higher KMI stock prices due to increased revenue.

- Example: Higher interest rates can increase KMI’s borrowing costs, potentially impacting profitability and lowering stock prices.

- Example: Announcements of new pipeline projects or successful acquisitions typically boost investor confidence and the stock price.

A visual representation would show a positive correlation between oil prices and KMI’s stock price, an inverse correlation between interest rates and KMI’s stock price, and distinct price spikes or dips following significant company-specific news. The overall trend would reflect the combined influence of these factors, with periods of high volatility during times of significant geopolitical events or market fluctuations.

Determining a KMI stock price target requires careful consideration of various market factors. For comparative analysis, it’s helpful to examine the performance of similar companies, such as checking the current market value by looking at the inogen stock price today. Understanding Inogen’s trajectory can offer insights into potential future trends and inform predictions regarding the KMI stock price target.

Questions and Answers: Kmi Stock Price Target

What are the major risks associated with investing in KMI?

Investing in KMI, like any stock, carries inherent risks. These include fluctuations in oil prices, geopolitical instability affecting energy markets, regulatory changes, and the company’s own operational performance.

How does KMI compare to its competitors in terms of dividend payouts?

A comparison of KMI’s dividend payout ratio and yield against its competitors requires reviewing their respective financial statements and investor relations materials. This information is readily available on their corporate websites.

What is the typical trading volume for KMI stock?

Trading volume for KMI stock varies daily and can be easily found on major financial websites providing real-time stock market data.

Where can I find more detailed financial information about KMI?

Detailed financial information for KMI can be found on the company’s investor relations website, SEC filings (EDGAR database), and major financial data providers.