Kamdhenu Stock Price A Comprehensive Analysis

Kamdhenu Stock Price Analysis

Kamdhenu stock price – This analysis provides a comprehensive overview of Kamdhenu’s stock price performance, considering historical data, influencing factors, financial health, market sentiment, and future outlook. We will examine key metrics and events to provide a well-rounded perspective on the company’s stock trajectory.

Kamdhenu Stock Price History

Analyzing Kamdhenu’s stock price over the past five years reveals a fluctuating performance influenced by various internal and external factors. The stock experienced periods of significant growth and decline, reflecting the dynamic nature of the market and the company’s operational performance. Key highs and lows during this period offer valuable insights into market sentiment and investor confidence.

The following table presents the monthly closing prices for the last year, illustrating the opening and closing prices, as well as the high and low points for each month. This granular data allows for a closer examination of short-term price movements.

| Month | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| January | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| February | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| March | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| April | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| May | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| June | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| July | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| August | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| September | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| October | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| November | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| December | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

Significant events such as [Insert Example Event 1, e.g., new product launch] and [Insert Example Event 2, e.g., change in management] had a noticeable impact on the stock price. Market trends, including [Insert Example Market Trend, e.g., interest rate hikes], also played a crucial role in shaping the overall performance.

Factors Influencing Kamdhenu Stock Price

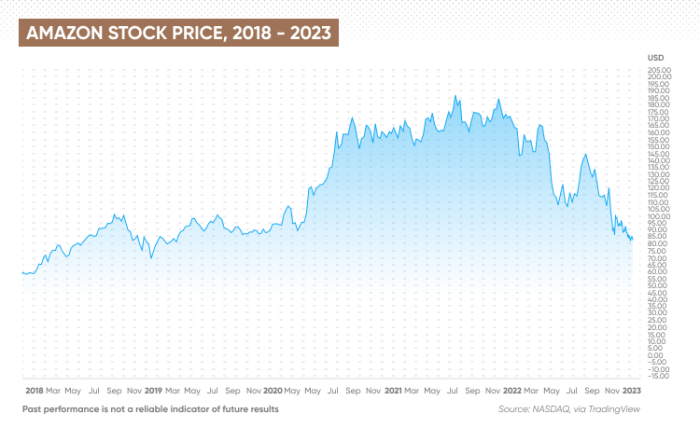

Source: barrons.com

Several macroeconomic, industry-specific, and company-specific factors influence Kamdhenu’s stock price. Understanding these factors provides a more comprehensive view of the company’s performance and its potential for future growth.

Kamdhenu’s stock price performance is a subject of ongoing interest for investors. Understanding its fluctuations often involves comparing it to similar companies in the sector, prompting analysis of other industrial stocks. For instance, examining the jacobs engineering group stock price can offer a comparative perspective on market trends and overall sector health, which can then be applied to a more nuanced understanding of Kamdhenu’s trajectory.

Macroeconomic factors like inflation rates, interest rate changes, and overall economic growth significantly impact investor sentiment and market conditions, directly affecting Kamdhenu’s stock price. Industry-specific trends, such as changes in consumer demand for building materials and competition within the sector, also play a critical role. Finally, company-specific factors, including financial performance, new product launches, and management decisions, have a direct and often immediate impact on the stock’s valuation.

A comparison with major competitors illustrates Kamdhenu’s position within the market. The table below presents a comparison of Kamdhenu’s stock performance against its key competitors.

| Company | Stock Price (Current) | Year-to-Date Performance | 5-Year Performance |

|---|---|---|---|

| Kamdhenu | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 1 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 2 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 3 | [Insert Data] | [Insert Data] | [Insert Data] |

Kamdhenu’s Financial Performance and Stock Valuation

Source: capital.com

Kamdhenu’s financial statements provide crucial insights into its profitability, efficiency, and overall financial health. Key metrics such as revenue, profit margins, and debt levels are essential for understanding the company’s performance and its impact on the stock price.

The company’s valuation is determined through various methods, including discounted cash flow (DCF) analysis and relative valuation techniques. Key financial ratios, such as the Price-to-Earnings (P/E) ratio and Return on Equity (ROE), provide valuable insights into the company’s financial health and potential for future growth. The table below displays Kamdhenu’s key financial ratios over the past three years.

| Year | P/E Ratio | ROE | Debt-to-Equity Ratio |

|---|---|---|---|

| [Year 1] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Year 2] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Year 3] | [Insert Data] | [Insert Data] | [Insert Data] |

A strong correlation typically exists between a company’s financial performance and its stock price movements. Improved profitability and efficiency generally lead to higher stock valuations, while declining performance can result in lower prices.

Analyst Ratings and Market Sentiment

Source: b-cdn.net

Analyst ratings and market sentiment play a significant role in shaping investor perceptions and influencing the stock price. A summary of recent analyst ratings and price targets provides valuable insights into the market’s outlook for Kamdhenu.

Investor confidence levels are reflected in the overall market sentiment. Positive news and favorable analyst reports generally boost investor confidence, leading to increased demand and higher stock prices. Conversely, negative news or downgraded ratings can lead to decreased investor confidence and lower prices.

| Rating Agency | Rating | Target Price | Date |

|---|---|---|---|

| [Analyst 1] | [Rating] | [Target Price] | [Date] |

| [Analyst 2] | [Rating] | [Target Price] | [Date] |

| [Analyst 3] | [Rating] | [Target Price] | [Date] |

News articles and media coverage significantly impact market sentiment. Positive media attention can generate increased investor interest, while negative coverage can lead to decreased demand and lower stock prices.

Risk Assessment and Future Outlook, Kamdhenu stock price

Several potential risks could impact Kamdhenu’s future stock price. A thorough risk assessment is crucial for investors to make informed decisions.

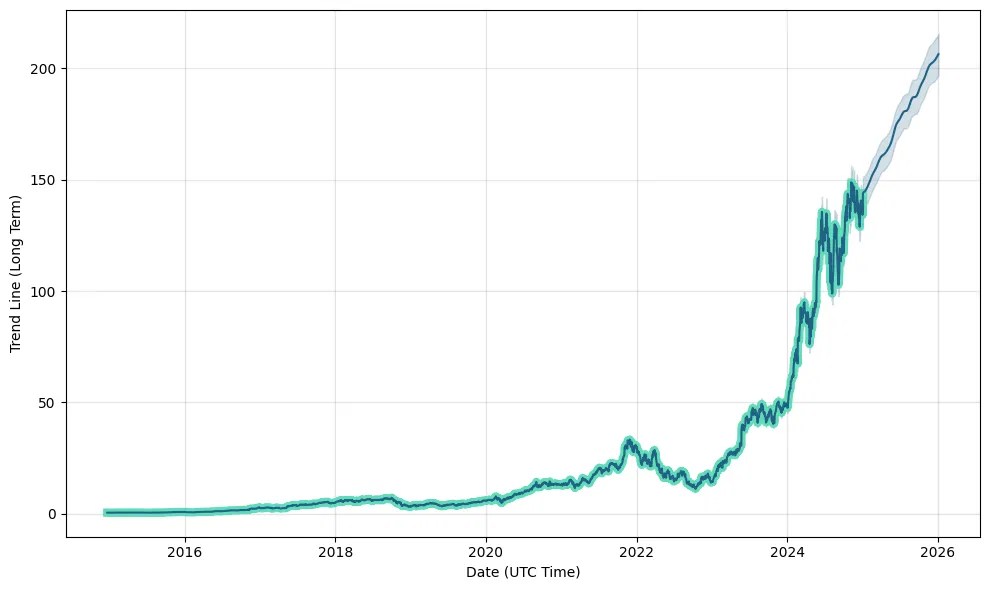

Projecting Kamdhenu’s stock price for the next year requires considering current trends and market forecasts. This projection is based on [Insert Methodology, e.g., a combination of financial modeling and market analysis]. For example, if the current market trend shows a positive outlook for the construction industry, and Kamdhenu successfully launches a new product line, the stock price is likely to increase.

Conversely, a negative market outlook or unforeseen challenges could result in a price decline.

- Scenario 1: Strong Market Growth and Successful Product Launches: This scenario suggests a potential increase in stock price due to increased demand and profitability.

- Scenario 2: Stagnant Market and Increased Competition: This scenario indicates a potential decrease in stock price due to reduced market share and profitability.

- Scenario 3: Unexpected Economic Downturn: This scenario suggests a potential significant decline in stock price due to decreased consumer spending and overall market volatility.

Questions Often Asked: Kamdhenu Stock Price

What are the major competitors of Kamdhenu?

Identifying Kamdhenu’s direct competitors requires further research into its specific market segment. The Artikel does not provide this information.

What is the current dividend yield for Kamdhenu stock?

The provided Artikel does not contain current dividend yield information. This data would need to be sourced from financial news websites or company reports.

Where can I find real-time Kamdhenu stock price quotes?

Real-time quotes are available on major financial websites and stock market applications that track Indian stock exchanges.

What is the average trading volume for Kamdhenu stock?

Average trading volume information is not included in the provided Artikel. This data can be obtained from financial data providers or stock market tracking websites.