Kalvista Stock Price A Comprehensive Analysis

Kalvista Pharmaceuticals: A Stock Price Analysis: Kalvista Stock Price

Kalvista stock price – This analysis delves into the various factors influencing Kalvista Pharmaceuticals’ stock price, providing an overview of the company, its financial performance, investor sentiment, competitive landscape, and associated risks. We will examine historical trends and explore potential future movements based on observable data and industry analysis.

Kalvista Pharmaceuticals Company Overview

Source: stockprice.com

Tracking Kalvista’s stock price requires a keen eye on the biotech market. It’s interesting to compare its performance against established players like Jacobs Engineering Group; you can check the current jacobs engineering group stock price for a benchmark. Ultimately, however, Kalvista’s future hinges on its own pipeline and clinical trial results, irrespective of other company’s stock valuations.

Kalvista Pharmaceuticals is a biopharmaceutical company focused on the development and commercialization of novel therapies. While specific founding dates and detailed early history might require further research from reliable sources, the company’s current focus is clearly defined by its mission and vision.

Kalvista’s mission and vision statements (which would need to be sourced from official company materials) likely Artikel its commitment to addressing unmet medical needs through innovative drug development. Their product pipeline, a key driver of stock price, is crucial to understanding their strategic direction.

| Product Name | Stage of Development | Target Indication | Key Features |

|---|---|---|---|

| [Product Name 1] | [Stage of Development, e.g., Preclinical, Phase 1, etc.] | [Target Indication, e.g., Specific Disease] | [Key Features, e.g., Novel Mechanism of Action] |

| [Product Name 2] | [Stage of Development] | [Target Indication] | [Key Features] |

| [Product Name 3] | [Stage of Development] | [Target Indication] | [Key Features] |

Factors Influencing Kalvista Stock Price

Several macroeconomic factors, clinical trial outcomes, and competitive actions significantly impact Kalvista’s stock price. Understanding these dynamics is vital for investors.

Three major macroeconomic factors that can influence Kalvista’s stock price include overall market sentiment (bullish or bearish trends), interest rate changes (affecting borrowing costs and investment decisions), and fluctuations in the value of the US dollar ( impacting international revenue streams).

Clinical trial results are paramount. Positive data often leads to significant price increases, while negative or inconclusive results can trigger substantial drops. Competitor actions, such as new drug approvals or market entry, can also influence Kalvista’s stock performance through increased or decreased market share.

- Positive News: Increased investor confidence, higher stock price, increased trading volume.

- Negative News: Decreased investor confidence, lower stock price, potentially increased volatility.

Financial Performance of Kalvista, Kalvista stock price

A thorough analysis of Kalvista’s financial reports, including revenue, expenses, and profitability, is necessary to assess its financial health. This would involve reviewing financial statements available through official channels (SEC filings, for example, if Kalvista is a publicly traded company in the US).

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt-to-Equity Ratio | Profit Margin (%) |

|---|---|---|---|---|

| [Year 1] | [Data] | [Data] | [Data] | [Data] |

| [Year 2] | [Data] | [Data] | [Data] | [Data] |

| [Year 3] | [Data] | [Data] | [Data] | [Data] |

Significant changes in Kalvista’s financial position, such as substantial increases or decreases in revenue or net income, can directly impact investor sentiment and, consequently, the stock price. The company’s debt structure, including the amount and type of debt, influences investor perception of risk and financial stability.

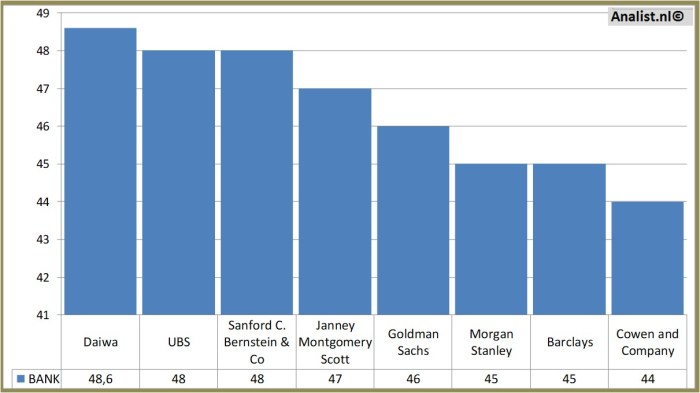

Investor Sentiment and Analyst Ratings

Source: valuespectrum.com

Investor sentiment toward Kalvista Pharmaceuticals reflects the overall market perception of the company’s prospects. This sentiment is influenced by various factors, including clinical trial results, financial performance, and competitive landscape.

Analyst ratings and price targets, gathered from reputable financial news sources, provide insights into professional opinions on Kalvista’s stock valuation. Positive investor sentiment is often driven by successful clinical trials, strong financial results, and positive analyst ratings. Conversely, negative sentiment can result from setbacks in clinical development, disappointing financial performance, or negative analyst revisions.

- [News Article/Press Release 1: Summary and impact on stock price]

- [News Article/Press Release 2: Summary and impact on stock price]

- [News Article/Press Release 3: Summary and impact on stock price]

Comparison with Competitors

A competitive analysis is essential for understanding Kalvista’s position within the pharmaceutical industry. This involves comparing Kalvista’s market capitalization, key products, and competitive advantages against its main competitors.

| Company Name | Market Cap (USD Billions) | Key Products | Competitive Advantage |

|---|---|---|---|

| [Competitor 1] | [Data] | [List of Key Products] | [Description of Competitive Advantage] |

| [Competitor 2] | [Data] | [List of Key Products] | [Description of Competitive Advantage] |

| Kalvista Pharmaceuticals | [Data] | [List of Key Products] | [Description of Competitive Advantage] |

Kalvista’s research and development efforts should be compared to its competitors’ efforts in terms of investment levels, pipeline diversity, and technological advancements. This analysis would provide a deeper understanding of Kalvista’s innovative capabilities and potential for future growth.

Risk Factors Associated with Investing in Kalvista

Source: incomeinvestors.com

Investing in Kalvista Pharmaceuticals involves inherent risks that investors should carefully consider. These risks can significantly impact the stock price and potential returns.

Regulatory hurdles, such as delays or rejections of drug approvals, can negatively impact Kalvista’s stock price. The inherent uncertainties associated with the company’s research and development pipeline also pose significant risk. Failure of clinical trials or unexpected safety concerns could lead to substantial losses.

- Risk of clinical trial failure.

- Risk of regulatory delays or rejection.

- Risk of competition from other pharmaceutical companies.

- Risk of insufficient funding for research and development.

Illustrative Example of Stock Price Movement

Let’s consider a hypothetical scenario. Suppose Kalvista announced unexpectedly positive results from a Phase 3 clinical trial for a key drug candidate. This positive news would likely trigger a surge in investor confidence, leading to a significant increase in the stock price. Trading volume would also likely increase substantially as investors react to the news. The positive market sentiment could persist for some time, depending on the overall market conditions and subsequent developments.

Conversely, if the same trial had yielded negative or inconclusive results, the opposite would occur: a sharp decline in the stock price and increased trading volume, reflecting negative investor sentiment and potential selling pressure.

Answers to Common Questions

What is Kalvista Pharmaceuticals’ primary area of focus?

Kalvista focuses on developing novel therapies for autoimmune and inflammatory diseases.

Where can I find real-time Kalvista stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms.

How frequently does Kalvista release financial reports?

Kalvista typically releases financial reports quarterly and annually, following standard reporting practices.

What are the major risks associated with investing in Kalvista?

Major risks include the failure of clinical trials, intense competition, regulatory delays, and general market volatility.