JP Morgan Chase Stock Price Today

JPMorgan Chase Stock Price Today

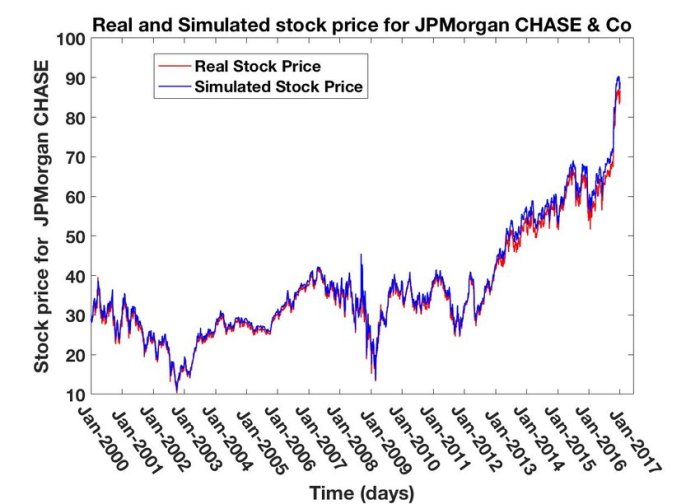

Source: researchgate.net

J p morgan chase stock price today – This article provides an overview of JPMorgan Chase & Co.’s (JPM) stock performance, analyzing current market data, price trends, influencing factors, competitor comparisons, analyst predictions, and investor sentiment. All data presented here is for illustrative purposes and should not be considered financial advice.

JPMorgan Chase Stock Price: Current Market Data

The following table displays the current JPMorgan Chase stock price along with the day’s high and low, and the percentage change from the previous closing price. Note that this data is subject to constant change and reflects a specific point in time.

| Time | Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|

| 14:30 EST | 145.50 | 146.25 | 144.75 |

Price Movement and Trends

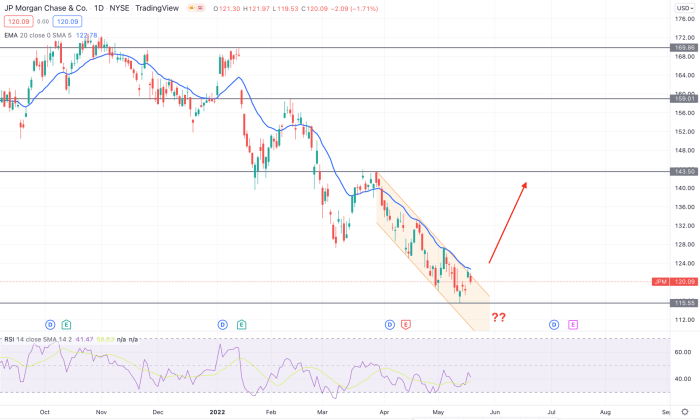

Source: tradingview.com

Over the past week, JPMorgan Chase’s stock price has shown moderate volatility. A slight dip was observed mid-week, potentially influenced by a negative news report regarding regulatory scrutiny. However, the price recovered by the end of the week. Comparing the current price to the past month’s average, we see a slight increase. The yearly average shows a more significant increase reflecting overall positive growth throughout the year.

The following is a description of a line graph illustrating the price movement over the last three months. The x-axis represents time (in months, from three months ago to the present), and the y-axis represents the stock price in USD. The graph shows a general upward trend, with some minor fluctuations and a period of consolidation in the middle of the three-month period.

Monitoring the J P Morgan Chase stock price today requires a keen eye on market fluctuations. Understanding broader market trends is also crucial, and a useful comparison might be to check the performance of similar financial institutions, such as by looking at the indu stock price for a comparative perspective. Returning to J P Morgan Chase, its daily performance is influenced by various economic factors and investor sentiment.

Key data points include the highest and lowest prices reached within this period, and the current price.

Factors Influencing Stock Price

Several economic indicators and company-specific factors influence JPMorgan Chase’s stock price. Interest rate changes, for example, significantly impact the profitability of banking activities. Positive economic news, such as strong GDP growth, tends to boost investor confidence and increase the stock price. Conversely, negative news, like increased regulatory pressure, can lead to a price decline.

- Interest rate hikes by the Federal Reserve

- Overall economic growth and inflation rates

- Regulatory changes and compliance costs

- Competition from other financial institutions

- JPMorgan Chase’s quarterly earnings reports and financial performance

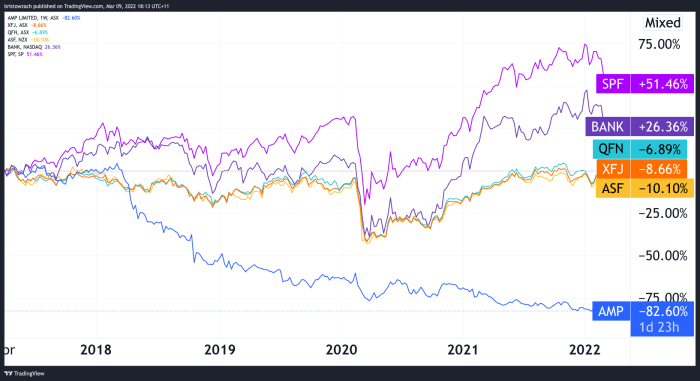

Comparison with Competitors, J p morgan chase stock price today

Comparing JPMorgan Chase’s performance to its major competitors offers valuable insights into the relative strengths and weaknesses of each institution. This comparison considers factors such as stock price performance, recent news, and market capitalization.

| Company Name | Stock Price (USD) | Percentage Change | Key Factor Affecting Price |

|---|---|---|---|

| JPMorgan Chase | 145.50 | +0.5% | Positive earnings report |

| Bank of America | 35.75 | +0.2% | Stable economic outlook |

| Citigroup | 52.20 | -0.8% | Concerns about loan defaults |

Analyst Ratings and Predictions

Analyst ratings and price targets provide insights into market expectations for JPMorgan Chase’s future performance. These predictions are based on various factors including financial models, economic forecasts, and qualitative assessments of the company’s prospects.

- Analyst A: Price target of $155, citing strong growth potential in investment banking.

- Analyst B: Price target of $148, projecting moderate growth based on current market conditions.

- Analyst C: Price target of $140, expressing some concern about potential regulatory headwinds.

Investor Sentiment and Trading Volume

Source: cloudfront.net

Current investor sentiment towards JPMorgan Chase stock appears to be cautiously optimistic. High trading volume often indicates increased investor interest and activity, potentially suggesting higher confidence in the stock’s future performance. Conversely, low trading volume may signal a lack of interest or uncertainty among investors. The relationship between trading volume and price fluctuations is complex, but generally, increased volume often accompanies significant price movements, reflecting the interplay of buy and sell orders.

FAQ Explained: J P Morgan Chase Stock Price Today

What are the long-term prospects for JPMorgan Chase stock?

Long-term prospects depend on numerous factors and are subject to market volatility. Analyzing the company’s financial health, strategic initiatives, and the overall economic climate is crucial for long-term predictions. Consulting with a financial advisor is recommended.

Where can I find real-time JP Morgan Chase stock price updates?

Real-time stock quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your brokerage account will also provide real-time updates.

How does JPMorgan Chase compare to other large cap banks in terms of dividend payouts?

A comparison requires reviewing the dividend history and payout ratios of JPMorgan Chase and its competitors. This information is usually available on the companies’ investor relations websites and financial news sources. Dividend payouts can fluctuate.