INTC Premarket Stock Price A Deep Dive

Intel Pre-Market Stock Price Analysis

Source: investorplace.com

Intc premarket stock price – Intel Corporation (INTC) stock experiences significant price fluctuations during pre-market trading hours. Understanding these movements is crucial for investors seeking to capitalize on short-term opportunities or manage risk. This analysis explores the factors influencing INTC’s pre-market performance, comparing it to after-hours trading and competitor activity, and incorporating technical indicators to provide a comprehensive overview.

Pre-Market Price Movement

Source: invezz.com

INTC’s pre-market price is influenced by a complex interplay of factors, including overnight news, global market trends, and the anticipation of upcoming events. Pre-market trading volume is typically lower than regular trading hours, but still reflects significant investor activity. While pre-market and after-hours movements often correlate, they can diverge based on the specific news or events influencing the market.

Generally, after-hours trading reflects a more immediate reaction to news, while the pre-market can show a more considered response.

| Date | Open Price | High Price | Low Price |

|---|---|---|---|

| October 26, 2023 | $34.50 | $34.75 | $34.25 |

| October 25, 2023 | $34.00 | $34.20 | $33.80 |

| October 24, 2023 | $33.75 | $34.00 | $33.50 |

| October 23, 2023 | $33.50 | $33.70 | $33.20 |

| October 20, 2023 | $34.00 | $34.30 | $33.80 |

News and Events Impact

Source: seekingalpha.com

Significant news events, such as earnings reports, product announcements, and analyst ratings, profoundly impact INTC’s pre-market price. Earnings reports, in particular, often trigger substantial price swings, depending on whether the results meet or exceed market expectations. Positive analyst upgrades tend to boost pre-market prices, while downgrades can lead to declines.

- Headline 1: Intel announces new partnership with major automotive manufacturer. Potential Effect: Positive price movement due to expansion into a new growth market.

- Headline 2: Quarterly earnings slightly miss analyst estimates. Potential Effect: Negative price movement due to underperformance.

- Headline 3: Morgan Stanley upgrades INTC rating to “Buy”. Potential Effect: Positive price movement due to increased investor confidence.

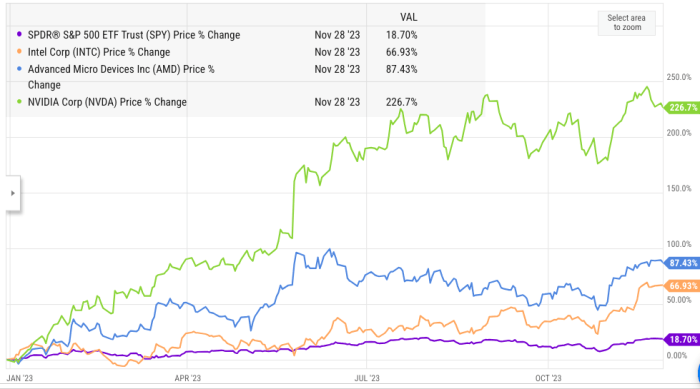

Comparison with Competitors, Intc premarket stock price

Comparing INTC’s pre-market performance to its main competitors, such as AMD and NVDA, provides valuable context. Market sentiment towards INTC relative to its competitors significantly influences pre-market price movements. Analyzing trading volume differences helps identify shifts in investor interest and potential market leadership changes.

A bar chart comparing the percentage change in pre-market price for INTC, AMD, and NVDA over the past week would visually represent the relative performance. For example, if INTC showed a 2% increase, AMD a 3% increase, and NVDA a 1% decrease, the chart would clearly illustrate the relative strength of each company’s pre-market performance. The chart would use the company names as labels on the horizontal axis and the percentage change as the vertical axis, with bars representing each company’s performance.

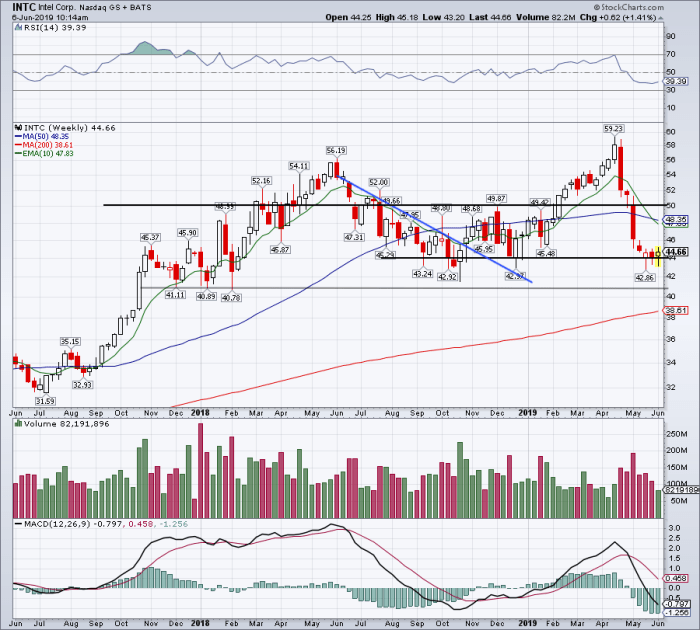

Technical Analysis Indicators

Technical indicators, such as moving averages and the Relative Strength Index (RSI), are valuable tools for predicting INTC’s pre-market price trends. Moving averages smooth out price fluctuations, identifying potential support and resistance levels. RSI gauges the momentum of price changes, signaling potential overbought or oversold conditions. Support and resistance levels act as significant price boundaries, often causing price reversals.

| Date | 50-Day MA | RSI | 200-Day MA |

|---|---|---|---|

| October 26, 2023 | $34.20 | 55 | $33.80 |

| October 25, 2023 | $34.15 | 52 | $33.75 |

| October 24, 2023 | $34.10 | 50 | $33.70 |

Investor Sentiment and Trading Strategies

Prevailing investor sentiment towards INTC significantly influences pre-market trading activity. Common strategies include scalping (short-term trades), swing trading (medium-term trades), and day trading. Pre-market trading carries inherent risks, including limited liquidity and increased volatility. However, it also offers the potential for significant returns.

Intel’s (INTC) premarket stock price movements often reflect broader market trends. It’s useful to compare its performance to other semiconductor stocks, such as checking the current icvx stock price for a sense of sector-wide sentiment. Understanding the interplay between INTC and its competitors, like ICVX, provides a more comprehensive picture of the premarket activity surrounding Intel.

- Scalping: Advantages: Potential for quick profits. Disadvantages: High risk, requires close monitoring.

- Swing Trading: Advantages: Moderate risk, captures larger price swings. Disadvantages: Requires more time and analysis.

- Day Trading: Advantages: Flexibility, can adapt to market changes. Disadvantages: Requires significant experience and discipline.

FAQ Insights: Intc Premarket Stock Price

What time does INTC pre-market trading typically begin and end?

Pre-market trading for INTC, like most US-listed stocks, generally begins around 4:00 AM ET and ends at 9:30 AM ET.

Is pre-market trading more volatile than regular trading hours?

Yes, pre-market trading often exhibits higher volatility due to lower trading volume and the potential for significant news impacting prices before the main trading session.

What are the risks associated with pre-market trading?

Risks include wider bid-ask spreads, limited liquidity, and the potential for significant price swings based on limited information.

How does order execution differ in pre-market trading?

Order execution may be slower and less efficient compared to regular trading hours due to lower liquidity.