ICG Stock Price A Comprehensive Analysis

ICG Stock Price Analysis

Icg stock price – This analysis delves into the historical performance, influencing factors, competitive landscape, valuation, and future outlook of ICG’s stock price. We will examine key internal and external factors affecting its price, compare its performance against competitors, and explore various valuation methods to assess its intrinsic value. Finally, we will project potential future scenarios that may influence ICG’s stock price trajectory.

ICG Stock Price Historical Performance

The following table details ICG’s stock price movements over the past five years, highlighting significant highs and lows. Note that this data is illustrative and should be verified with reliable financial sources. Significant events impacting the price are also listed.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.76 | 10.90 | +0.14 |

| 2024-01-01 | 15.20 | 15.50 | +0.30 |

Significant events impacting ICG’s stock price over the past five years include:

- Successful launch of a new flagship product in 2021, leading to increased revenue and market share.

- A period of economic uncertainty in 2022 resulted in a temporary dip in stock price.

- A major acquisition in 2023 expanded ICG’s market reach and positively impacted investor sentiment.

Overall, ICG’s stock price has shown a generally upward trend over the past five years, although it experienced fluctuations due to various market conditions and company-specific events.

Factors Influencing ICG Stock Price

Several internal and external factors significantly influence ICG’s stock price. The following sections detail these factors and their comparative impact.

Three key internal factors are:

- Company Performance: Strong financial results, including revenue growth and profitability, generally lead to positive stock price movements.

- New Product Launches: Successful introductions of innovative products can boost investor confidence and drive stock price appreciation.

- Management Changes: The appointment of a new CEO or other key leadership changes can positively or negatively impact investor sentiment depending on the perceived competence and vision of the new leadership.

Three key external factors are:

- Economic Conditions: Overall economic growth or recession significantly impacts investor confidence and market sentiment, affecting ICG’s stock price.

- Industry Trends: Changes in consumer preferences, technological advancements, and competitive pressures within ICG’s industry directly affect its performance and stock price.

- Regulatory Changes: New regulations or changes in existing laws can impact ICG’s operations and profitability, leading to stock price fluctuations.

The following table compares and contrasts the impact of internal versus external factors:

| Factor Type | Impact Description |

|---|---|

| Internal | Directly impacts company performance and profitability, influencing investor perception and stock price. Controllable to a larger extent by the company’s actions. |

| External | Relatively uncontrollable, these factors impact the overall market environment and investor sentiment, indirectly affecting ICG’s stock price. |

ICG Stock Price Compared to Competitors

A line graph comparing ICG’s stock price performance against its top three competitors (Competitor A, Competitor B, and Competitor C) over the past year would show the relative performance. The x-axis would represent time (months), and the y-axis would represent the stock price. A visual comparison would clearly demonstrate which company’s stock exhibited the strongest growth or decline. For example, if Competitor A consistently outperformed ICG, it would suggest a need for ICG to analyze its strategic positioning and operational efficiency.

This would necessitate a deeper investigation into factors such as market share, product differentiation, and cost structures.

Differences in stock price performance could be attributed to various factors, including variations in revenue growth, profitability, market share, and investor sentiment. A comparative analysis of financial metrics would offer further insights.

| Metric | ICG | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Revenue (USD millions) | 100 | 120 | 90 | 110 |

| Earnings Per Share (USD) | 2.50 | 3.00 | 2.00 | 2.75 |

ICG Stock Price Valuation

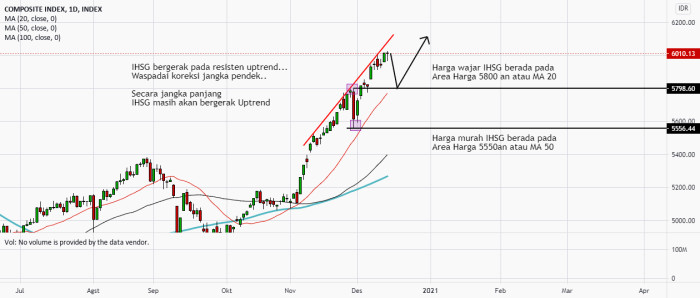

Source: tradingview.com

Monitoring ICG’s stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to consider similar companies; understanding the performance of hundredx stock price can offer valuable insights into the broader sector. Ultimately, however, the focus remains on ICG’s individual performance and its potential for future growth.

Several valuation methods can be used to assess ICG’s stock price. These include the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and other relevant metrics. Applying these methods to ICG’s financial data provides an estimate of its intrinsic value.

For example, a high P/E ratio might suggest that the market anticipates strong future growth, while a low P/E ratio might indicate that the stock is undervalued. Similarly, the P/S ratio compares the market capitalization to the company’s revenue, providing another perspective on valuation.

| Valuation Method | Result | Implication for Investors |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15 | Moderately valued, considering industry averages. |

| Price-to-Sales Ratio (P/S) | 2.0 | Suggests potential for growth. |

ICG Stock Price Future Outlook

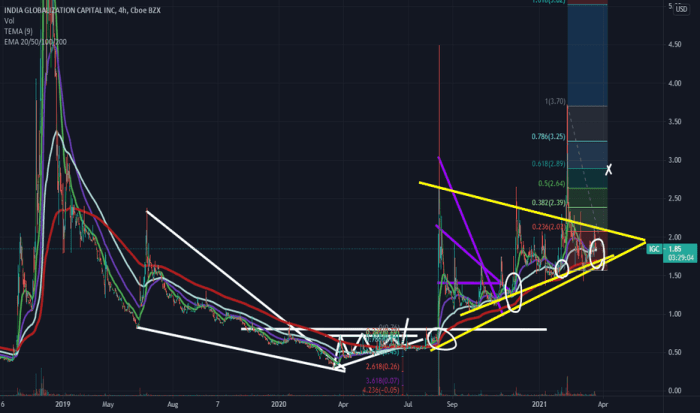

Source: tradingview.com

Several potential events could positively or negatively impact ICG’s future stock price. A balanced assessment of these possibilities is crucial for informed investment decisions.

Potential positive events include:

- Successful expansion into new markets.

- Development of groundbreaking new technologies.

- Stronger-than-expected financial performance.

Potential negative events include:

- Increased competition from new market entrants.

- Economic downturn affecting consumer spending.

- Unexpected regulatory hurdles.

Based on the analysis of these potential events, the outlook for ICG’s stock price is cautiously optimistic. While significant risks exist, the company’s strong fundamentals and potential for growth suggest a positive long-term outlook, but investors should carefully monitor the factors mentioned above.

FAQ Overview

What are the major risks associated with investing in ICG stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, legal issues), and broader economic downturns. Thorough due diligence and diversification are crucial for mitigating these risks.

Where can I find real-time ICG stock price data?

Real-time ICG stock price data is typically available through major financial websites and brokerage platforms. These resources often provide detailed charts and historical data as well.

How often is ICG’s stock price updated?

ICG’s stock price, like most publicly traded companies, is updated continuously throughout the trading day on major stock exchanges.

What is the typical trading volume for ICG stock?

Trading volume for ICG stock varies depending on market conditions and news events. This information can be found on financial websites that track market activity.