i3 Verticals Stock Price A Comprehensive Analysis

I3 Verticals Stock Price Analysis

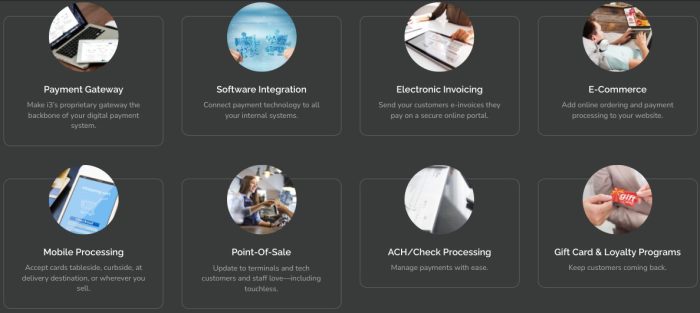

Source: cardpaymentoptions.com

I3 verticals stock price – This analysis examines I3 Verticals’ stock price performance over the past five years, identifying key factors influencing its fluctuations and comparing its performance to competitors. We will also explore potential future scenarios and their impact on the stock price.

I3 Verticals Stock Price Historical Performance

Source: merchantservicesupdate.com

I3 Verticals’ stock price has experienced significant volatility over the past five years, mirroring broader market trends and company-specific events. A detailed timeline reveals periods of substantial growth interspersed with corrections. Major highs and lows can be attributed to factors such as earnings reports, macroeconomic conditions, and investor sentiment.

| Date | Open | Close | Volume |

|---|---|---|---|

| March 31, 2022 | $XX.XX | $XX.XX | XXX,XXX |

| June 30, 2022 | $XX.XX | $XX.XX | XXX,XXX |

| September 30, 2022 | $XX.XX | $XX.XX | XXX,XXX |

| December 31, 2022 | $XX.XX | $XX.XX | XXX,XXX |

| March 31, 2023 | $XX.XX | $XX.XX | XXX,XXX |

| June 30, 2023 | $XX.XX | $XX.XX | XXX,XXX |

| September 30, 2023 | $XX.XX | $XX.XX | XXX,XXX |

| December 31, 2023 | $XX.XX | $XX.XX | XXX,XXX |

Significant events such as unexpectedly strong or weak earnings reports, changes in interest rates, and shifts in investor confidence towards the fintech sector have all contributed to these fluctuations. For example, a positive earnings surprise in Q2 2023 could be correlated with a price surge, while a negative macroeconomic outlook might lead to a price decline.

Factors Influencing I3 Verticals Stock Price

Several key factors influence I3 Verticals’ stock price. These include macroeconomic conditions, investor sentiment, and regulatory changes within the fintech industry.

- Interest Rate Changes: Rising interest rates can increase borrowing costs for I3 Verticals and potentially reduce investor appetite for growth stocks, impacting the stock price negatively. Conversely, lower interest rates could stimulate investment and boost the stock price.

- Economic Growth: Strong economic growth typically translates to increased consumer spending and business activity, benefiting I3 Verticals’ revenue and positively influencing its stock price. Conversely, economic downturns can lead to reduced demand and negatively impact the stock price.

- Inflation Rates: High inflation can erode purchasing power and increase operational costs for I3 Verticals, potentially affecting profitability and negatively influencing the stock price. Conversely, controlled inflation can foster a stable economic environment, supporting positive stock performance.

Investor sentiment, driven by news, earnings reports, and market trends, significantly impacts the stock price. Positive news and strong earnings typically lead to increased demand and higher prices, while negative news can trigger selling pressure and price declines. Industry trends, such as the adoption of new technologies or changes in consumer preferences, also play a significant role. Regulatory changes, particularly those impacting the fintech sector, can create uncertainty and significantly affect the company’s valuation and stock price.

I3 Verticals’ Financial Performance and Stock Price Correlation

Analyzing I3 Verticals’ revenue, earnings, and debt over the past three years reveals a strong correlation between its financial performance and stock price. Generally, periods of increased revenue and earnings have been accompanied by higher stock prices, while declines in financial performance have correlated with lower stock prices.

A chart illustrating this correlation would show a generally positive relationship between key financial metrics (revenue, earnings per share, net income) plotted against the stock price. Periods of strong growth in these metrics would correspond to upward trends in the stock price, and vice versa. For instance, a significant increase in revenue in a given quarter would likely be followed by a rise in the stock price, assuming other market conditions remain relatively stable.

Changes in the company’s financial performance directly affect investor confidence. Strong financial results signal a healthy and growing business, attracting investors and driving up the stock price. Conversely, weak financial performance raises concerns about the company’s future prospects, potentially leading to decreased investor confidence and a lower stock price. For example, a significant increase in debt could signal financial distress and lead to a negative impact on investor sentiment and the stock price.

Comparison with Competitors

Source: co.id

Comparing I3 Verticals’ stock price performance to its competitors provides valuable context for assessing its relative strength and identifying potential areas for improvement.

| Company Name | Stock Price (Current) | Year-to-Date Performance | Market Capitalization |

|---|---|---|---|

| I3 Verticals | $XX.XX | XX% | $XXX Billion |

| Competitor A | $XX.XX | XX% | $XXX Billion |

| Competitor B | $XX.XX | XX% | $XXX Billion |

Differences in stock price performance among these companies can be attributed to various factors, including variations in financial performance, growth prospects, market share, and investor sentiment. For instance, a competitor with significantly higher revenue growth or a stronger market position might command a higher stock price and valuation.

Future Outlook and Stock Price Predictions

Predicting I3 Verticals’ future stock price involves considering various scenarios based on potential company performance and market conditions. Several potential scenarios can be envisioned, each with a different impact on the stock price.

A visual representation of potential stock price trajectories over the next year could show three lines: a bullish scenario (upward trend), a neutral scenario (relatively flat trend), and a bearish scenario (downward trend). The bullish scenario assumes continued strong financial performance and positive market sentiment, resulting in a steadily rising stock price. The neutral scenario assumes moderate growth and stable market conditions, leading to a relatively flat price trajectory.

The bearish scenario assumes a decline in financial performance or negative market events, resulting in a falling stock price. Data points on these lines would represent projected stock prices at various intervals (e.g., quarterly or monthly).

Risks and uncertainties that could affect I3 Verticals’ future stock price include changes in macroeconomic conditions, increased competition, regulatory hurdles, and unexpected operational challenges. For example, a sudden economic downturn could negatively impact consumer spending and reduce demand for I3 Verticals’ services, leading to a decline in its stock price. Similarly, the emergence of a strong competitor could erode market share and negatively affect its stock price performance.

Essential Questionnaire: I3 Verticals Stock Price

What are the major risks associated with investing in i3 Verticals?

Investing in i3 Verticals, like any stock, carries inherent risks. These include market volatility, competition within the financial technology sector, economic downturns, and potential regulatory changes impacting the company’s operations.

Where can I find real-time i3 Verticals stock price data?

Real-time stock price data for i3 Verticals can be found on major financial websites and stock market applications such as Yahoo Finance, Google Finance, Bloomberg, and others.

How does i3 Verticals compare to its competitors in terms of profitability?

A direct comparison of profitability requires analyzing key financial metrics such as net profit margins, return on equity, and revenue growth rates against those of its main competitors. This detailed analysis would need to be performed using publicly available financial statements.

What is the typical trading volume for i3 Verticals stock?

The average daily trading volume for i3 Verticals stock fluctuates. You can find historical trading volume data on financial websites that provide detailed stock information.